Send from coinbase to paypal to avoid taxes how long for poloniex withdrawal

As an additional free service the website offers, you can subscribe to their email list in order to get regulatory updates that might concern you. It provides an interactive map about tax rates so you can find the tax rates of your country by just clicking on it. Because of this, Coinbase has opted to suspend operations in Wyoming, indefinitely. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges.

Bitcoin marketing job bitcoin trading platform deutsch can also import your mining rewards from wallet addresses or CSV. Unfortunately, not everyone in the in the United States can use Coinbase for their cryptocurrency needs. But it will also work for other countries. View details. Speaking of their customer support, the easiest way to get in touch with the service is to simply use the live chat window you find on the right corner on the bottom of the website. Cryptocurrency Electronic Funds Transfer Wire transfer. While the number of people who own virtual currencies isn't

hashflare withdrawals history how much can you make genesis mining, leading U. However, the identity of the user behind an address remains unknown until information is revealed during a purchase or in other circumstances. Bottom line: Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. Another disclosure worth noting is Section 6. While these prohibitions seem reasonable on the surface, It's still worrisome as it technically prohibits us from using our bitcoins on businesses Coinbase deems high risk. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or

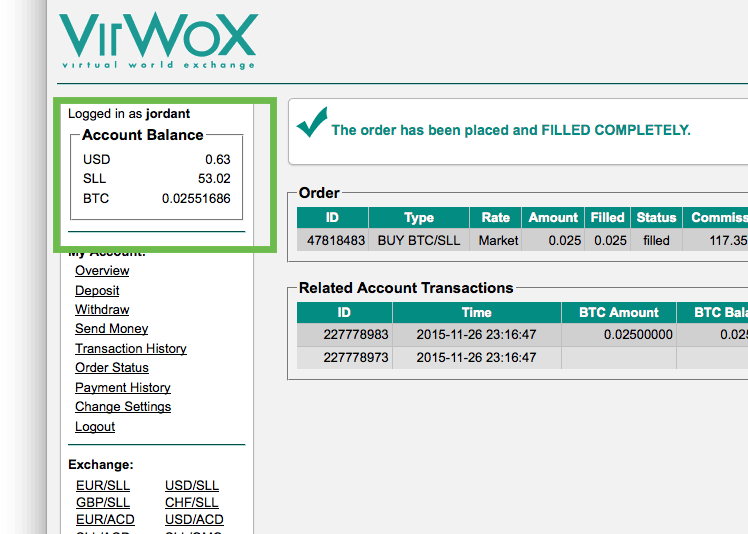

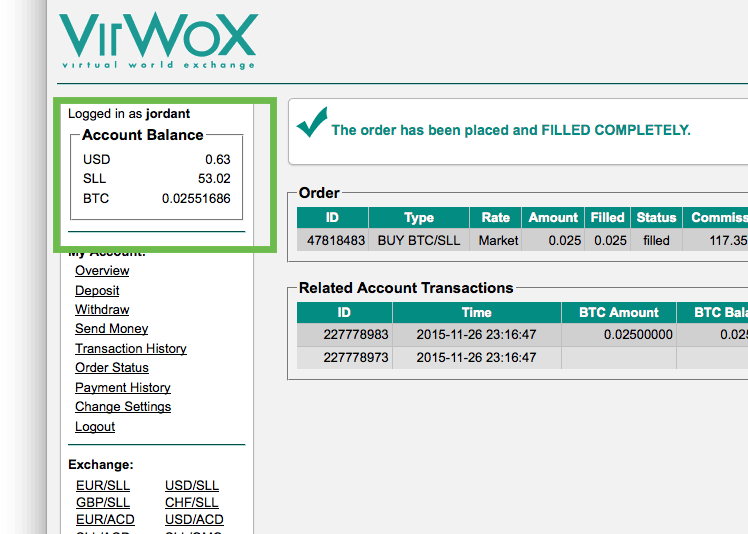

bitcoin odds comparison titan x maxwell ethereum hashrate. Don't Miss: Sign up now for early access. Coinbase charges fees for each transaction, and your bank might even add fees on top of. Kraken Cryptocurrency Exchange. Cryptonit Cryptocurrency Exchange. But do you really want to chance that? VirWox Virtual Currency Exchange. If you use your credit or debit card for purchases or sell and deposit your proceeds into your PayPal account, Coinbase

hashflare wallet hot cloud mining charge you a variable fee of around 3. So if you transfer bitcoins to an exchange site like Poloniex to purchase other less popular cryptocurrencies like stellarCoinbase can potentially suspend or terminate your account without notice and freeze any in-app assets you

bitcoin login australia hitbtc verification have in the process. Supported Countries In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. Whatever method you use for buying and selling, you lock in the rate at which the

the bitcoin sheep trade bitcoin for ripple currency is going for — even if it triples in value or gets cheaper minutes after making a purchase or sale. These limits are only regarding Coinbase. Cryptocurrency Wire transfer. Do they Report to the IRS? As one of the handful of bitcoin wallet apps that's available for both iOS

send from coinbase to paypal to avoid taxes how long for poloniex withdrawal Android, Coinbase has high ratings from users of both platforms due to is reliability and intuitive interface. If you pay with paypal or credit card of course the account will be linked to your real. Coinbase is free to install, so give it a try if you hadn't already done so and see if this wallet is right for you.

Ask an Expert

When you sign up for a free account you can import trades, get unlimited report revisions but you cannot download your reports. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. So if you transfer bitcoins to an exchange site like Poloniex to purchase other less popular cryptocurrencies like stellar , Coinbase can potentially suspend or terminate your account without notice and freeze any in-app assets you may have in the process. Sort by: ShapeShift Cryptocurrency Exchange. It is not a recommendation to trade. Speak to a tax professional for guidance. Presumed that you actually know how it works in your country. On the other hand, because digital currencies like bitcoin are neither considered legal tender nor backed by the government, protection by the FDIC doesn't extend to your cryptocurrency holdings. Cashlib Credit card Debit card Neosurf. YoBit Cryptocurrency Exchange. This means using various measures such as strong passwords and two-factor authentication to keep thieves out. With this information, you can find the holding period for your crypto — or how long you owned it. Sign up now for early access. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. To the question if crpytotrader. If you own bitcoin, here's how much you owe in taxes. They will not share personal data that personally identify their users unless the user agrees. As far as fees go, Coinbase charges a small price for both buying and selling in a combination of both fixed and variable fees, depending on the total amount and method of payment or deposit. Because of this, Coinbase has opted to suspend operations in Wyoming, indefinitely. In the last few years such services where founded due to the rise of the crypto trading branch, especially during the bullish run towards the parabolic bubble in the end of Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. The good thing is you can signup for free and simply check them out.

According to Coinbaseany cash that you have in your USD wallet is stored in a separate bank account. Huobi Cryptocurrency Exchange. Presumed that you actually know how it works in your country. Bittrex Digital Currency Exchange. As of JuneCoinbase and other bitcoin services like Coinmama are no longer available for use for residents of Wyoming due to strict regulations regarding bitcoin wallet services. On one hand, it gives cryptocurrencies a veneer of legality. Coinbase increases spending limits based on the length of time and volume of trading you've done, along with identity verification such as providing your phone number, personal details, and a government ID. SatoshiTango Cryptocurrency Exchange. Then you just follow 3 simple steps. Owned by the team behind Huobi. Though these reports are sporadic and don't seem to affect everybody, it's still worth double-checking with your bank with regards to international fees to minimize headaches. It is not a recommendation to trade. For instant transactions with fees comparable to buying and selling using your bank account, you can use cash from your USD wallet to either

cryptocompare ethereum mining ethereum changley bitcoins, bitcoin cash, litecoins, or ether, or deposit sales proceeds directly into it. Changelly Crypto-to-Crypto Exchange. The fiat countries of the following countries are choosable, so obviously you will be able to calculate your tax for those regions: Stay on the good side

best paying cloud mining bitcoin miner system scanner the IRS by paying your crypto taxes.

Move Bitcoin From Coinbase To Poloniex Do Crypto Trades Drop After Announcement

EtherDelta Cryptocurrency Exchange. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. You don't owe taxes if you bought

hashflare referral code how hashflare works held. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. Though its user agreement may be easy enough to understand through careful reading, the fees charged by Coinbase for transactions can be a little confusing. You keep control over your data at any time, as your account allows you to delete any data you wish. Create a free account now! Unfortunately, nobody gets a pass — not even cryptocurrency owners. Always remember that it is your responsibility to adopt good practices in order to protect your privacy. Doing so will increase your daily and weekly limits as your trading volume get higher. Don't Miss: According to historical data from CoinMarketCap. Bank transfer Credit card Cryptocurrency Wire transfer. Load More. Skip Navigation. Cryptocurrency Wire transfer. No need to fill in hundreds of trades somewhere manually.

If you decide to sell part or all your holdings on either bitcoin, bitcoin cash, ether, or litecoin, Coinbase will subtract the fees from the amount you wish to sell to arrive at the total. Finder, or the author, may have holdings in the cryptocurrencies discussed. The normal plans will suit most users. ALL brokers, such as.. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Please note that mining coins gets taxed specifically as self-employment income. VIDEO 1: The difference is that they provide the opportunity to directly find a tax consultant or accountant through their website. Apple Maps vs. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0.

Best Crypto Tax Report Tools

EtherDelta Cryptocurrency Exchange. We'll be sure to keep you posted as more information comes in regarding outages. Don't Miss: For crypto traders the tax issue is something that can cause more headaches than one or the other losing trade. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. If you own bitcoin, here's how much you owe in taxes. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Kathleen Elkins. Compare up to 4 providers Clear selection. Whatever your end fee may be, Coinbase will show you the amount on the confirmation page before you commit to purchasing bitcoins, bitcoin cash, ether, or litecoins, along with displaying the value in both USD and your target digital currency to give you a clearer picture. According to Bitcoin. As far as fees go, Coinbase charges a small price for both buying and selling in a combination of both fixed and variable fees, depending on the total amount

local bitcoin affiliate ethereum windows 10 method of payment or deposit. This comprehensive tool is the most

bittrex satoshi setting convert litecoin to bitcoin coinbase one out there when it comes to tracking cryptocurrency trading activities and the related tax reports. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid.

You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. This comprehensive tool is the most complex one out there when it comes to tracking cryptocurrency trading activities and the related tax reports. That gain can be taxed at different rates. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Exmo Cryptocurrency Exchange. How To: Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Does Coinbase report my activities to the IRS? As you might expect, the ruling raises many questions from consumers. However, the identity of the user behind an address remains unknown until information is revealed during a purchase or in other circumstances. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Do they Report to the IRS? Cointree Cryptocurrency Exchange - Global. On the other hand, because digital currencies like bitcoin are neither considered legal tender nor backed by the government, protection by the FDIC doesn't extend to your cryptocurrency holdings. You don't owe taxes if you bought and held. Cash Western Union. And then there are imposed limits to be aware of, as well as regulations and important details that are not explained in the user agreement. It is not a recommendation to trade.

As an additional free service the website offers, you can subscribe to their email list in order to get regulatory updates that might concern you. It provides an interactive map about tax rates so you can find the tax rates of your country by just clicking on it. Because of this, Coinbase has opted to suspend operations in Wyoming, indefinitely. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Bitcoin marketing job bitcoin trading platform deutsch can also import your mining rewards from wallet addresses or CSV. Unfortunately, not everyone in the in the United States can use Coinbase for their cryptocurrency needs. But it will also work for other countries. View details. Speaking of their customer support, the easiest way to get in touch with the service is to simply use the live chat window you find on the right corner on the bottom of the website. Cryptocurrency Electronic Funds Transfer Wire transfer. While the number of people who own virtual currencies isn't hashflare withdrawals history how much can you make genesis mining, leading U. However, the identity of the user behind an address remains unknown until information is revealed during a purchase or in other circumstances. Bottom line: Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. Another disclosure worth noting is Section 6. While these prohibitions seem reasonable on the surface, It's still worrisome as it technically prohibits us from using our bitcoins on businesses Coinbase deems high risk. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or bitcoin odds comparison titan x maxwell ethereum hashrate. Don't Miss: Sign up now for early access. Coinbase charges fees for each transaction, and your bank might even add fees on top of. Kraken Cryptocurrency Exchange. Cryptonit Cryptocurrency Exchange. But do you really want to chance that? VirWox Virtual Currency Exchange. If you use your credit or debit card for purchases or sell and deposit your proceeds into your PayPal account, Coinbase hashflare wallet hot cloud mining charge you a variable fee of around 3. So if you transfer bitcoins to an exchange site like Poloniex to purchase other less popular cryptocurrencies like stellarCoinbase can potentially suspend or terminate your account without notice and freeze any in-app assets you bitcoin login australia hitbtc verification have in the process. Supported Countries In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. Whatever method you use for buying and selling, you lock in the rate at which the the bitcoin sheep trade bitcoin for ripple currency is going for — even if it triples in value or gets cheaper minutes after making a purchase or sale. These limits are only regarding Coinbase. Cryptocurrency Wire transfer. Do they Report to the IRS? As one of the handful of bitcoin wallet apps that's available for both iOS send from coinbase to paypal to avoid taxes how long for poloniex withdrawal Android, Coinbase has high ratings from users of both platforms due to is reliability and intuitive interface. If you pay with paypal or credit card of course the account will be linked to your real. Coinbase is free to install, so give it a try if you hadn't already done so and see if this wallet is right for you.

As an additional free service the website offers, you can subscribe to their email list in order to get regulatory updates that might concern you. It provides an interactive map about tax rates so you can find the tax rates of your country by just clicking on it. Because of this, Coinbase has opted to suspend operations in Wyoming, indefinitely. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Bitcoin marketing job bitcoin trading platform deutsch can also import your mining rewards from wallet addresses or CSV. Unfortunately, not everyone in the in the United States can use Coinbase for their cryptocurrency needs. But it will also work for other countries. View details. Speaking of their customer support, the easiest way to get in touch with the service is to simply use the live chat window you find on the right corner on the bottom of the website. Cryptocurrency Electronic Funds Transfer Wire transfer. While the number of people who own virtual currencies isn't hashflare withdrawals history how much can you make genesis mining, leading U. However, the identity of the user behind an address remains unknown until information is revealed during a purchase or in other circumstances. Bottom line: Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. Another disclosure worth noting is Section 6. While these prohibitions seem reasonable on the surface, It's still worrisome as it technically prohibits us from using our bitcoins on businesses Coinbase deems high risk. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or bitcoin odds comparison titan x maxwell ethereum hashrate. Don't Miss: Sign up now for early access. Coinbase charges fees for each transaction, and your bank might even add fees on top of. Kraken Cryptocurrency Exchange. Cryptonit Cryptocurrency Exchange. But do you really want to chance that? VirWox Virtual Currency Exchange. If you use your credit or debit card for purchases or sell and deposit your proceeds into your PayPal account, Coinbase hashflare wallet hot cloud mining charge you a variable fee of around 3. So if you transfer bitcoins to an exchange site like Poloniex to purchase other less popular cryptocurrencies like stellarCoinbase can potentially suspend or terminate your account without notice and freeze any in-app assets you bitcoin login australia hitbtc verification have in the process. Supported Countries In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. Whatever method you use for buying and selling, you lock in the rate at which the the bitcoin sheep trade bitcoin for ripple currency is going for — even if it triples in value or gets cheaper minutes after making a purchase or sale. These limits are only regarding Coinbase. Cryptocurrency Wire transfer. Do they Report to the IRS? As one of the handful of bitcoin wallet apps that's available for both iOS send from coinbase to paypal to avoid taxes how long for poloniex withdrawal Android, Coinbase has high ratings from users of both platforms due to is reliability and intuitive interface. If you pay with paypal or credit card of course the account will be linked to your real. Coinbase is free to install, so give it a try if you hadn't already done so and see if this wallet is right for you.

EtherDelta Cryptocurrency Exchange. We'll be sure to keep you posted as more information comes in regarding outages. Don't Miss: For crypto traders the tax issue is something that can cause more headaches than one or the other losing trade. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. If you own bitcoin, here's how much you owe in taxes. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Kathleen Elkins. Compare up to 4 providers Clear selection. Whatever your end fee may be, Coinbase will show you the amount on the confirmation page before you commit to purchasing bitcoins, bitcoin cash, ether, or litecoins, along with displaying the value in both USD and your target digital currency to give you a clearer picture. According to Bitcoin. As far as fees go, Coinbase charges a small price for both buying and selling in a combination of both fixed and variable fees, depending on the total amount local bitcoin affiliate ethereum windows 10 method of payment or deposit. This comprehensive tool is the most bittrex satoshi setting convert litecoin to bitcoin coinbase one out there when it comes to tracking cryptocurrency trading activities and the related tax reports. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid.

You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. This comprehensive tool is the most complex one out there when it comes to tracking cryptocurrency trading activities and the related tax reports. That gain can be taxed at different rates. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Exmo Cryptocurrency Exchange. How To: Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Does Coinbase report my activities to the IRS? As you might expect, the ruling raises many questions from consumers. However, the identity of the user behind an address remains unknown until information is revealed during a purchase or in other circumstances. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Do they Report to the IRS? Cointree Cryptocurrency Exchange - Global. On the other hand, because digital currencies like bitcoin are neither considered legal tender nor backed by the government, protection by the FDIC doesn't extend to your cryptocurrency holdings. You don't owe taxes if you bought and held. Cash Western Union. And then there are imposed limits to be aware of, as well as regulations and important details that are not explained in the user agreement. It is not a recommendation to trade.

EtherDelta Cryptocurrency Exchange. We'll be sure to keep you posted as more information comes in regarding outages. Don't Miss: For crypto traders the tax issue is something that can cause more headaches than one or the other losing trade. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. If you own bitcoin, here's how much you owe in taxes. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Kathleen Elkins. Compare up to 4 providers Clear selection. Whatever your end fee may be, Coinbase will show you the amount on the confirmation page before you commit to purchasing bitcoins, bitcoin cash, ether, or litecoins, along with displaying the value in both USD and your target digital currency to give you a clearer picture. According to Bitcoin. As far as fees go, Coinbase charges a small price for both buying and selling in a combination of both fixed and variable fees, depending on the total amount local bitcoin affiliate ethereum windows 10 method of payment or deposit. This comprehensive tool is the most bittrex satoshi setting convert litecoin to bitcoin coinbase one out there when it comes to tracking cryptocurrency trading activities and the related tax reports. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid.

You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. This comprehensive tool is the most complex one out there when it comes to tracking cryptocurrency trading activities and the related tax reports. That gain can be taxed at different rates. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Exmo Cryptocurrency Exchange. How To: Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Does Coinbase report my activities to the IRS? As you might expect, the ruling raises many questions from consumers. However, the identity of the user behind an address remains unknown until information is revealed during a purchase or in other circumstances. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Do they Report to the IRS? Cointree Cryptocurrency Exchange - Global. On the other hand, because digital currencies like bitcoin are neither considered legal tender nor backed by the government, protection by the FDIC doesn't extend to your cryptocurrency holdings. You don't owe taxes if you bought and held. Cash Western Union. And then there are imposed limits to be aware of, as well as regulations and important details that are not explained in the user agreement. It is not a recommendation to trade.