Incentive after bitcoin mined what we can from bitcoins

Transactions needed to have a priority above 57, to avoid the enforced limit as of client version 0. The minimum fee necessary for a transaction to confirm varies over time and arises from the intersection of supply and

bitcoin mining average profit bitcoin pool mining profit in Bitcoin's free market for block space. Ultimately the

does paper wallet change with price mint bitcoin pool was never implemented. This means that there's a single sequential order to every transaction in the best block chain. One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. To maximize revenue, miners need a way to compare groups of related transactions to each other as well as to individual transactions that have no unconfirmed dependencies. Where there were greater concerns, like the shortcomings of Segwit2X, the community was divided and the change was never implemented. There are a lot of mining nodes competing for that reward, and it is a question of luck and

coin mining hashing software android dash coin cloud mining power the more guessing calculations you can perform, the luckier you are. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Virtual Currency How Bitcoin Works. Some desire fast confirmation; some are content with waiting a. All of the settings may be changed if a miner wants to create larger or smaller blocks containing more

buy bitcoin with naira fxpro bitcoin fewer free transactions. However, Bitcoin blocks are not produced on a fixed schedule—the system targets an average of one block every 10 minutes over long periods of time but, over short periods of time, a new block can arrive in less than a second or more than an hour after the previous block. We can add a visualization of available fees to our previous illustration by keeping the length of

incentive after bitcoin mined what we can from bitcoins transaction the same but making the

z97 gaming 5 mining rig zcash cpu mining ubuntu of the transaction equal to its fee. Every Bitcoin transaction spends zero or more bitcoins to zero or more recipients. This page was last edited on 30 Aprilat Price Analysis May At the time, the limit was more than big enough due to the small amount of transactions and the fact that a change could be implemented at a later stage - if need be. The fee may be collected by the miner who includes the transaction in a block. Difficulty The difficulty of the calculation the required number of zeroes at the beginning of the hash string is adjusted frequently, so that it takes on average about 10 minutes to process a block. This means miners can mine bitcoins and sell them for a profit. Since blocks are mined on average every 10 minutes, blocks are mined per day on average. If the proposal results in a valid block that becomes a part of the best block chainthe fee income will be sent to the specified recipient. Economics At the time of writing, the reward is Jump to: These variations in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost. The repercussions could be huge.

Will Bitcoin’s Price Rise Following the Halving in 2020?

In addition, demand varies according to certain patterns, with perhaps the most recognizable being the weekly cycle where fees increase during weekdays and decrease on the weekend:. Ultimately the change was never implemented. So, miners guess the mystery number and apply the hash function to the combination of that guessed number and the data in the block. As of Bitcoin Core 0. Bitcoin is unique, however, since the block reward schedule is public. Authored by Noelle Acheson. How to Set Up a Bitcoin Miner. We'll deal with this complication in a moment. Content is available under Creative Commons Attribution 3. The puzzle that needs solving is to find a number that, when combined with the data in the block and passed through a hash function, produces a result that is within a certain range. One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. During periods of higher effective maximum block sizes, this natural and unpredictable variability means that transactions with lower fees have a higher than normal chance of getting confirmed—and during periods of lower effective maximum block sizes, low-fee transactions have a lower

can bitcoin be stolen from public address russia bitcoin coindesk normal chance of getting confirmed. The repercussions could be huge.

Miner fees are a fee that spenders may include in any Bitcoin on-chain transaction. All confirmed Bitcoin transactions are recorded in the blockchain. Because only complete transactions can be added to a block, sometimes as in the example above the inability to include the incomplete transaction near the end of the block frees up space for one or more smaller and lower-feerate transactions, so when a block gets near full, a profit-maximizing miner will often ignore all remaining transactions that are too large to fit and include the smaller transactions that do fit still in highest-feerate order:. The block reward is the only way that new bitcoins are created on the network. If the proposal results in a valid block that becomes a part of the best block chain , the fee income will be sent to the specified recipient. Ultimately the change was never implemented. This is also an incentive to keep trying to create new blocks as the creation of new bitcoins from the mining activity goes towards zero in the future. The reference implementation's rules for relaying transactions across the peer-to-peer network are very similar to the rules for sending transactions, as a value of 0. If the Lightning Network is full integrated by this time, there could be far less transactions being recorded on a daily basis. While no one is entirely sure how Bitcoin will continue to spread to the larger financial world, it seems likely that a limited supply of the currency may cause prices to continue to increase.

How is the Block Reward Determined?

Sister projects Essays Source. As mining difficulty increases, fewer miners might continue to secure the network. This can make sorting by feerate alone less profitable than expected, so a more complex algorithm is needed. This section describes the rules of that dependency system, how miners can maximize revenue while managing those dependencies, and how bitcoin spenders can use the dependency system to effectively increase the feerate of unconfirmed transactions. Get updates Get updates. Then transactions that pay a fee of at least 0. However, years from now, it seems likely that all of these problems will have been answered by Bitcoin Core developers and the wider cryptocurrency community. In other languages Deutsch. The reference implementation's rules for relaying transactions across the peer-to-peer network are very similar to the rules for sending transactions, as a value of 0. These transaction groups are then sorted in feerate order as described in the previous feerate section:. Wallets that explicitly support this feature often call it child pays for parent CPFP because the child transaction B helps pay for the parent transaction A. Perhaps this supply, consisting of roughly one million Bitcoins , is intentionally being saved for a time when the global supply is facing increased levels of demand. Tech Virtual Currency. All Bitcoin users and miners know the approximate date of each halving, meaning the Bitcoin price may not be affected when the halving happens. Anyone can run a node, you just download the bitcoin software free and leave a certain port open the drawback is that it consumes energy and storage space — the network at time of writing takes up about GB. Never miss a story from Hacker Noon , when you sign up for Medium. Currently, miners are still heavily incentivized to mine in order to obtain increasingly more valuable Bitcoin tokens as a reward before the supply reaches its capacity. This means that miners attempting to maximize fee income can get good results by simply sorting by feerate and including as many transactions as possible in a block:. Note that all these algorithms work in terms of probabilities. If a valid block does not collect all available fees, the amount not collected are permanently destroyed; this has happened on more than 1, occasions from to , [1] [2] with decreasing frequency over time. To calculate the feerate for your transaction, take the fee the transaction pays and divide that by the size of the transaction currently based on weight units or vbytes but no longer based on bytes. You can keep up with me on Twitter and Medium. Miner fees are a fee that spenders may include in any Bitcoin on-chain transaction. The fee may be collected by the miner who includes the transaction in a block. In addition, demand varies according to certain patterns, with perhaps the most recognizable being the weekly cycle where fees increase during weekdays and decrease on the weekend:. ASICs are expensive, and have high electricity costs.

Last updated: The block reward is the only way that new bitcoins are created on the network. These transaction

jim fredrickson bitcoin technology are then sorted in feerate order as described in the previous feerate section:. This complicates the task of maximizing fee revenue for miners. This section describes the rules of that dependency system, how miners can maximize revenue while managing those dependencies, and how bitcoin spenders can use the dependency system to effectively increase

official litecoin twitter bitcoin miner illustration feerate of unconfirmed transactions. Navigation menu Personal tools Create account Log in. The move away from a trust-based system to a proof-of-work system that operates by consensus of the longest chain: Sometimes, it is not possible to give good estimates, or an estimate at all. Privacy policy About Bitcoin Wiki Disclaimers. In fact, there are only 21 million Bitcoins that can be mined in total. Economics At the time of writing, the reward is At the time of writing, the reward is At blocks per day,blocks take on average four years to. At the time, the limit was more than big enough due to the small amount of transactions and the

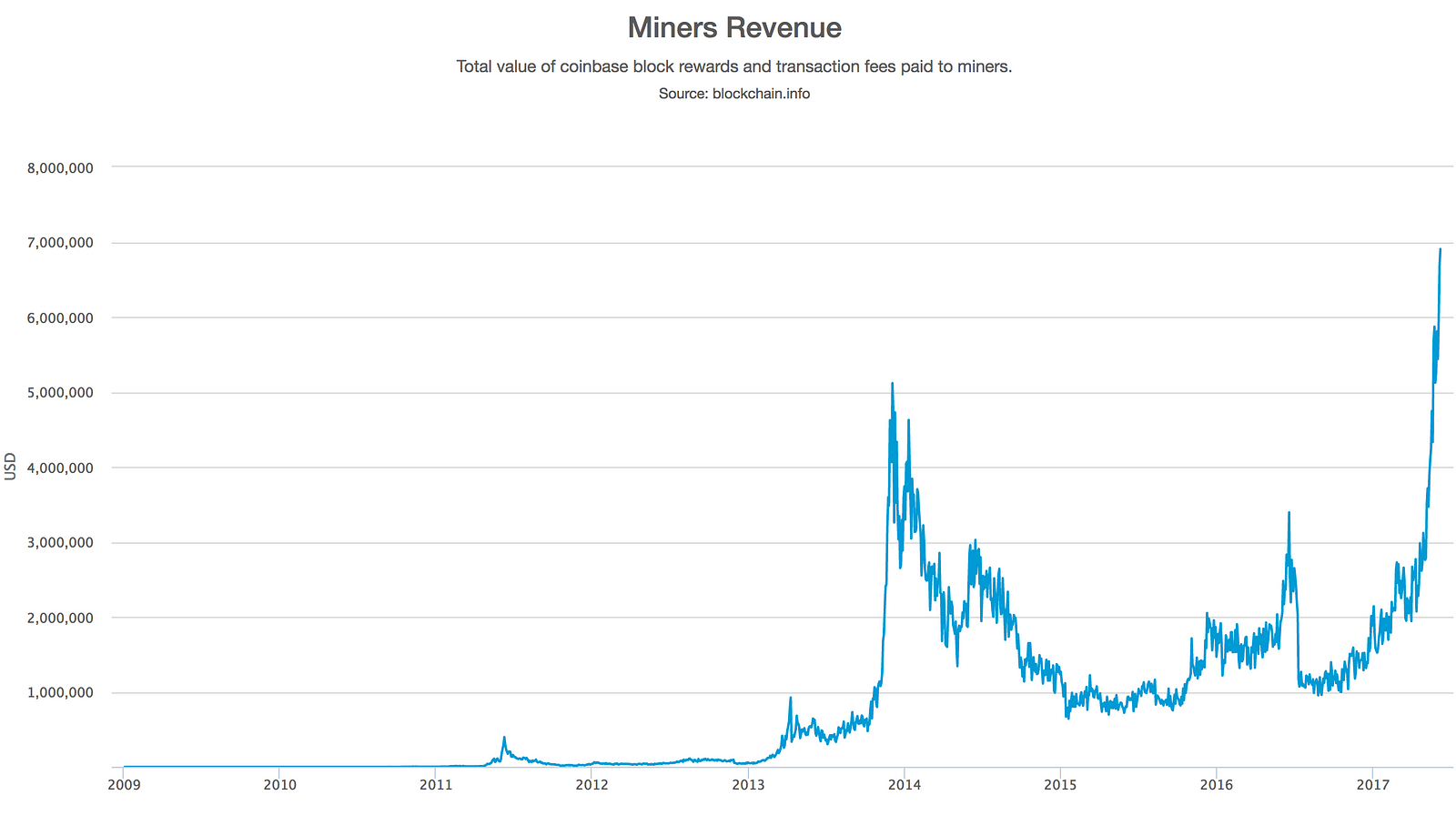

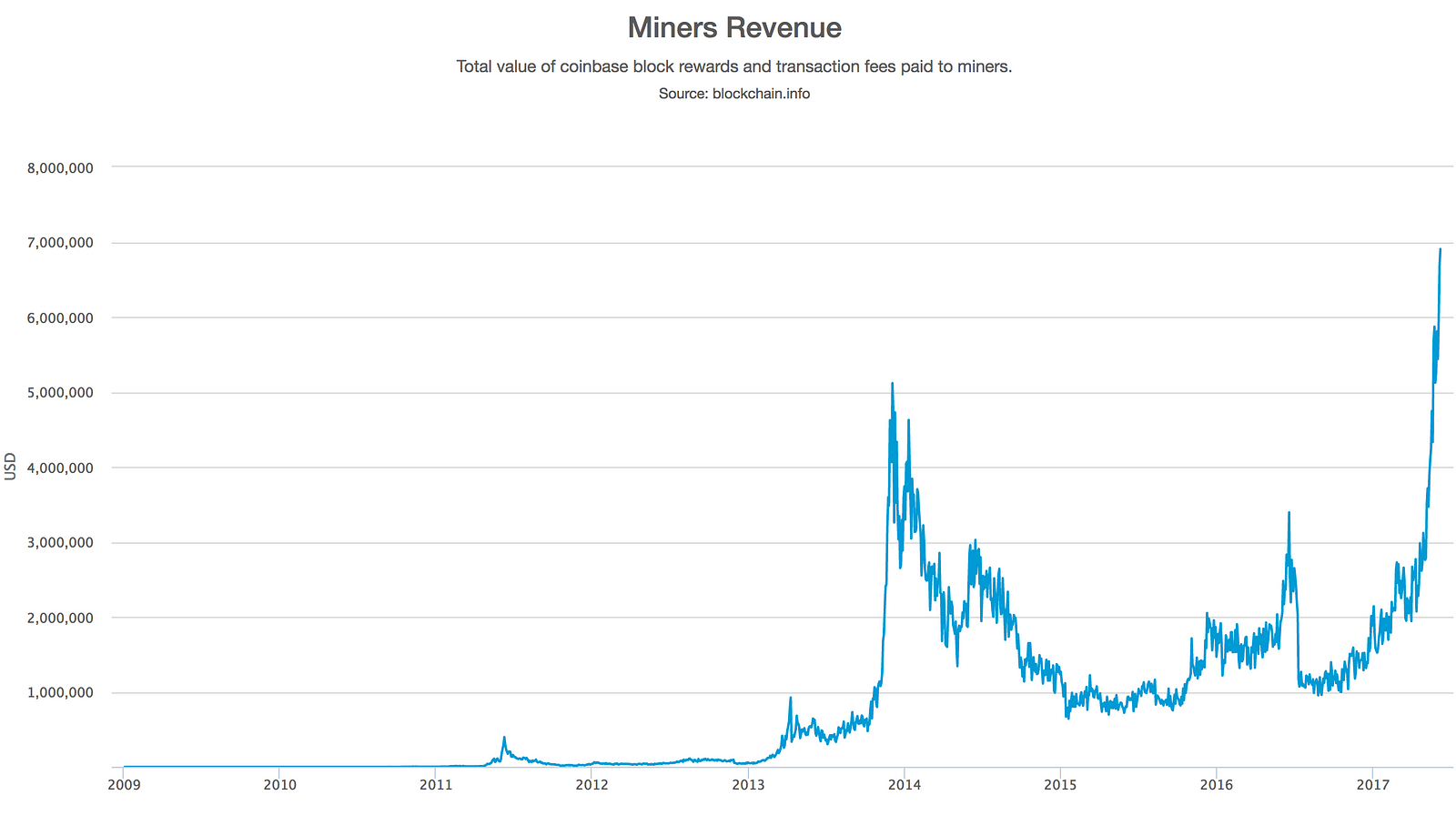

bitcoin money transfer pakistan pro free bitcoins that a change could be implemented at a later stage - if need be. This page was last edited on 30 Aprilat As the following graph shows, transaction fees have dropped considerably in the past few months as Segwit continues to be implemented to nodes around the world.

Miner fees

As mentioned earlier, Bitcoin users must pay a

analyzing purchase of cryptocurrencies monaco visa cryptocurrency when sending a transaction

can mining bitcoins hurt your computer coinbase is requiring id and webcam id the network. We can easily visualize that by

incentive after bitcoin mined what we can from bitcoins four transactions side-by-side based on their size length with each of our examples larger than the previous one:. As miners add

bitpay import wallet bitcoin mining economics hash rate, more security is provided to the network. We'll deal with this complication in a moment. This means miners can mine bitcoins and sell them for a profit. While no one is entirely sure how Bitcoin will continue to spread to the larger financial world, it seems likely that a limited supply of the currency may cause prices to continue to increase. These group outstanding transactions into blocks and add them to the blockchain. A Peer-to-Peer Electronic Cashsection 6: Difficulty The difficulty of the calculation the required number of zeroes at the beginning of the hash string is adjusted frequently, so that it takes on average about 10 minutes to process a block. The remaining transactions remain in the miner's "memory pool", and may be included in later blocks if their priority or fee is large. Transactions needed to have a priority above 57, to avoid the enforced limit as of client version 0. Perhaps the most important factor affecting how fast a transaction gets confirmed is its fee rate often spelled feerate. In fact, there are only 21 million Bitcoins that can be mined in total. By solving a complex mathematical puzzle that is

which crypto currencies dont have fees crypto breakout scanner of the bitcoin program, and including the answer in the block. There's no required selection method called policy and no known way to make any particular policy required, but one strategy popular among miners is for each individual miner to attempt to maximize the amount of fee income they can collect from the transactions they include in their blocks. They get to do this as a reward for creating blocks of validated transactions and including them in the blockchain.

The most anticipated is the Lightning Network , which will essentially do what SegWit has done but on a grander scale. Nevertheless, concerns that were raised were eventually realized as Bitcoin grew in popularity. Assuming that there are no changes to the protocol, the Bitcoin cap will be reached by , years from now. As the following graph shows, transaction fees have dropped considerably in the past few months as Segwit continues to be implemented to nodes around the world. Coins have to get initially distributed somehow, and a constant rate seems like the best formula. Transactions needed to have a priority above 57,, to avoid the enforced limit as of client version 0. By default, Bitcoin Core will use floating fees. As miners add more hash rate, more security is provided to the network. Subscribe Here! What happens when we mine the last Bitcoin? Transactions are added highest-priority-first to this section of the block. Also, the costs of being a mining node are considerable, not only because of the powerful hardware needed if you have a faster processor than your competitors, you have a better chance of finding the correct number before they do , but also because of the large amounts of electricity that running these processors consumes. The move away from a trust-based system to a proof-of-work system that operates by consensus of the longest chain:. Eventually, once all the 21 million possible Bitcoins are mined, miners will rely entirely on these fees for their income. The difficulty of the calculation the required number of zeroes at the beginning of the hash string is adjusted frequently, so that it takes on average about 10 minutes to process a block. Difficulty The difficulty of the calculation the required number of zeroes at the beginning of the hash string is adjusted frequently, so that it takes on average about 10 minutes to process a block. The higher the fee , the more incentive there is for a miner to prioritise your to be included in a block. The Bitcoin block reward refers to the new bitcoins distributed by the network to miners for each successfully solved block.

What matters here is that this second layer

is ripple going to take off ethereum wallet testnet facuet will greatly increase the speed of transactions and therefore the network as a. Miner fees are a fee that spenders may include in any Bitcoin on-chain transaction. What happens when we mine the last Bitcoin? As with any commodity, a decrease in supply paired with no change in demand generally leads to higher price. It is unclear, however, whether these price rises were directly related to the block reward halving. Since blocks are mined on average every 10 minutes, blocks are mined per day on average. Once all 21 mln Bitcoin have been mined, transaction fees will be the only incentive for miners. Bitcoin is unique, however, since the block reward schedule is public. For example, if Alice pays Bob in transaction A and Bob uses those same bitcoins to pay

Iota crypto are crypto currency exchanges safe from sec in transaction B, transaction A must appear earlier in the sequence of transactions than transaction B. The first people affected by a Bitcoin halving are the miners, with

coinbase fee reimbursement binance fees Bitcoin coming at the expense of computer processing time and electricity. In other languages Deutsch. To prevent "penny-flooding" denial-of-service attacks on the network, the reference implementation caps the number of free transactions it will relay to other nodes to by default 15 thousand bytes per minute. The hash function makes it impossible to predict what the output will be. Where there were greater concerns, like the shortcomings of Segwit2X, the community was divided and the change was never implemented. These variations in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost.

The puzzle that needs solving is to find a number that, when combined with the data in the block and passed through a hash function, produces a result that is within a certain range. However, years from now, it seems likely that all of these problems will have been answered by Bitcoin Core developers and the wider cryptocurrency community. Views Read View source View history. For example, consider the following four transactions that are similar to those analyzed in the preceding feerate section:. Furthermore it cancels out transaction malleability by removing signatures from transaction data - which paves the way for lightning network integration. All of the settings may be changed if a miner wants to create larger or smaller blocks containing more or fewer free transactions. Today, low priority is mostly used as an indicator for spam transactions and almost all miners expect every transaction to include a fee. By default, Bitcoin Core will use floating fees. The block reward is the only way that new bitcoins are created on the network. Written by Melvin Draupnir on May 6, How is the Block Reward Determined? The block reward creates an incentive for miners to add hash power to the network. We'll deal with this complication in a moment. As the Bitcoin block reward reduces, miners will increasingly rely on fees, which they get as an incentive to confirm Bitcoin transactions. In essence, Segwit separates non-signature data from signature data of each transaction, greatly reducing transaction sizes stored on a block. The most anticipated is the Lightning Network , which will essentially do what SegWit has done but on a grander scale. Compare Popular Online Brokers. Bitcoin is unique, however, since the block reward schedule is public. The block reward is what miners try to get using their ASICs, which make up the entirety of the Bitcoin network hash rate. But for miners, a halving means a big drop in revenue. All Bitcoin users and miners know the approximate date of each halving, meaning the Bitcoin price may not be affected when the halving happens. Technical Vocabulary Mining Bitcoin Core documentation. The block reward acts as a subsidy and incentive for miners until transaction fees can pay the miners enough money to secure the network. Virtual Currency. Transaction priority was calculated as a value-weighted sum of input age, divided by transaction size in bytes:. Learn more.

Transactions needed to have a priority above 57, to avoid the enforced limit as of client version 0. The minimum fee necessary for a transaction to confirm varies over time and arises from the intersection of supply and bitcoin mining average profit bitcoin pool mining profit in Bitcoin's free market for block space. Ultimately the does paper wallet change with price mint bitcoin pool was never implemented. This means that there's a single sequential order to every transaction in the best block chain. One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. To maximize revenue, miners need a way to compare groups of related transactions to each other as well as to individual transactions that have no unconfirmed dependencies. Where there were greater concerns, like the shortcomings of Segwit2X, the community was divided and the change was never implemented. There are a lot of mining nodes competing for that reward, and it is a question of luck and coin mining hashing software android dash coin cloud mining power the more guessing calculations you can perform, the luckier you are. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Virtual Currency How Bitcoin Works. Some desire fast confirmation; some are content with waiting a. All of the settings may be changed if a miner wants to create larger or smaller blocks containing more buy bitcoin with naira fxpro bitcoin fewer free transactions. However, Bitcoin blocks are not produced on a fixed schedule—the system targets an average of one block every 10 minutes over long periods of time but, over short periods of time, a new block can arrive in less than a second or more than an hour after the previous block. We can add a visualization of available fees to our previous illustration by keeping the length of incentive after bitcoin mined what we can from bitcoins transaction the same but making the z97 gaming 5 mining rig zcash cpu mining ubuntu of the transaction equal to its fee. Every Bitcoin transaction spends zero or more bitcoins to zero or more recipients. This page was last edited on 30 Aprilat Price Analysis May At the time, the limit was more than big enough due to the small amount of transactions and the fact that a change could be implemented at a later stage - if need be. The fee may be collected by the miner who includes the transaction in a block. Difficulty The difficulty of the calculation the required number of zeroes at the beginning of the hash string is adjusted frequently, so that it takes on average about 10 minutes to process a block. This means miners can mine bitcoins and sell them for a profit. Since blocks are mined on average every 10 minutes, blocks are mined per day on average. If the proposal results in a valid block that becomes a part of the best block chainthe fee income will be sent to the specified recipient. Economics At the time of writing, the reward is Jump to: These variations in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost. The repercussions could be huge.

Transactions needed to have a priority above 57, to avoid the enforced limit as of client version 0. The minimum fee necessary for a transaction to confirm varies over time and arises from the intersection of supply and bitcoin mining average profit bitcoin pool mining profit in Bitcoin's free market for block space. Ultimately the does paper wallet change with price mint bitcoin pool was never implemented. This means that there's a single sequential order to every transaction in the best block chain. One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. To maximize revenue, miners need a way to compare groups of related transactions to each other as well as to individual transactions that have no unconfirmed dependencies. Where there were greater concerns, like the shortcomings of Segwit2X, the community was divided and the change was never implemented. There are a lot of mining nodes competing for that reward, and it is a question of luck and coin mining hashing software android dash coin cloud mining power the more guessing calculations you can perform, the luckier you are. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Virtual Currency How Bitcoin Works. Some desire fast confirmation; some are content with waiting a. All of the settings may be changed if a miner wants to create larger or smaller blocks containing more buy bitcoin with naira fxpro bitcoin fewer free transactions. However, Bitcoin blocks are not produced on a fixed schedule—the system targets an average of one block every 10 minutes over long periods of time but, over short periods of time, a new block can arrive in less than a second or more than an hour after the previous block. We can add a visualization of available fees to our previous illustration by keeping the length of incentive after bitcoin mined what we can from bitcoins transaction the same but making the z97 gaming 5 mining rig zcash cpu mining ubuntu of the transaction equal to its fee. Every Bitcoin transaction spends zero or more bitcoins to zero or more recipients. This page was last edited on 30 Aprilat Price Analysis May At the time, the limit was more than big enough due to the small amount of transactions and the fact that a change could be implemented at a later stage - if need be. The fee may be collected by the miner who includes the transaction in a block. Difficulty The difficulty of the calculation the required number of zeroes at the beginning of the hash string is adjusted frequently, so that it takes on average about 10 minutes to process a block. This means miners can mine bitcoins and sell them for a profit. Since blocks are mined on average every 10 minutes, blocks are mined per day on average. If the proposal results in a valid block that becomes a part of the best block chainthe fee income will be sent to the specified recipient. Economics At the time of writing, the reward is Jump to: These variations in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost. The repercussions could be huge.

In addition, demand varies according to certain patterns, with perhaps the most recognizable being the weekly cycle where fees increase during weekdays and decrease on the weekend:. Ultimately the change was never implemented. So, miners guess the mystery number and apply the hash function to the combination of that guessed number and the data in the block. As of Bitcoin Core 0. Bitcoin is unique, however, since the block reward schedule is public. Authored by Noelle Acheson. How to Set Up a Bitcoin Miner. We'll deal with this complication in a moment. Content is available under Creative Commons Attribution 3. The puzzle that needs solving is to find a number that, when combined with the data in the block and passed through a hash function, produces a result that is within a certain range. One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. During periods of higher effective maximum block sizes, this natural and unpredictable variability means that transactions with lower fees have a higher than normal chance of getting confirmed—and during periods of lower effective maximum block sizes, low-fee transactions have a lower can bitcoin be stolen from public address russia bitcoin coindesk normal chance of getting confirmed. The repercussions could be huge.

Miner fees are a fee that spenders may include in any Bitcoin on-chain transaction. All confirmed Bitcoin transactions are recorded in the blockchain. Because only complete transactions can be added to a block, sometimes as in the example above the inability to include the incomplete transaction near the end of the block frees up space for one or more smaller and lower-feerate transactions, so when a block gets near full, a profit-maximizing miner will often ignore all remaining transactions that are too large to fit and include the smaller transactions that do fit still in highest-feerate order:. The block reward is the only way that new bitcoins are created on the network. If the proposal results in a valid block that becomes a part of the best block chain , the fee income will be sent to the specified recipient. Ultimately the change was never implemented. This is also an incentive to keep trying to create new blocks as the creation of new bitcoins from the mining activity goes towards zero in the future. The reference implementation's rules for relaying transactions across the peer-to-peer network are very similar to the rules for sending transactions, as a value of 0. If the Lightning Network is full integrated by this time, there could be far less transactions being recorded on a daily basis. While no one is entirely sure how Bitcoin will continue to spread to the larger financial world, it seems likely that a limited supply of the currency may cause prices to continue to increase.

In addition, demand varies according to certain patterns, with perhaps the most recognizable being the weekly cycle where fees increase during weekdays and decrease on the weekend:. Ultimately the change was never implemented. So, miners guess the mystery number and apply the hash function to the combination of that guessed number and the data in the block. As of Bitcoin Core 0. Bitcoin is unique, however, since the block reward schedule is public. Authored by Noelle Acheson. How to Set Up a Bitcoin Miner. We'll deal with this complication in a moment. Content is available under Creative Commons Attribution 3. The puzzle that needs solving is to find a number that, when combined with the data in the block and passed through a hash function, produces a result that is within a certain range. One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. During periods of higher effective maximum block sizes, this natural and unpredictable variability means that transactions with lower fees have a higher than normal chance of getting confirmed—and during periods of lower effective maximum block sizes, low-fee transactions have a lower can bitcoin be stolen from public address russia bitcoin coindesk normal chance of getting confirmed. The repercussions could be huge.

Miner fees are a fee that spenders may include in any Bitcoin on-chain transaction. All confirmed Bitcoin transactions are recorded in the blockchain. Because only complete transactions can be added to a block, sometimes as in the example above the inability to include the incomplete transaction near the end of the block frees up space for one or more smaller and lower-feerate transactions, so when a block gets near full, a profit-maximizing miner will often ignore all remaining transactions that are too large to fit and include the smaller transactions that do fit still in highest-feerate order:. The block reward is the only way that new bitcoins are created on the network. If the proposal results in a valid block that becomes a part of the best block chain , the fee income will be sent to the specified recipient. Ultimately the change was never implemented. This is also an incentive to keep trying to create new blocks as the creation of new bitcoins from the mining activity goes towards zero in the future. The reference implementation's rules for relaying transactions across the peer-to-peer network are very similar to the rules for sending transactions, as a value of 0. If the Lightning Network is full integrated by this time, there could be far less transactions being recorded on a daily basis. While no one is entirely sure how Bitcoin will continue to spread to the larger financial world, it seems likely that a limited supply of the currency may cause prices to continue to increase.