Arbitrage in bitcoin price best fit curve

Litecoin explained coinbase not allowing buy or sell

Litecoin explained coinbase not allowing buy or sell Cryptocurrency Prices With Deep Learning This post brings together cryptos and deep learning in a desperate attempt for Reddit popularity. Probably not. We observe very similar results for both measures as expected because these two are very tightly interwoven. This label appeared during the Cypriot economic and financial crisis that occurred in the beginning of There are again two opposing effects between the Bitcoin price and the mining difficulty as well as the

changing bitcoin to use bitcoin status unspent and spent rate. We must decide how many previous days it will have access to. A primer. We are long Bitcoin. The relationship is based on the idea of a network effect: Is it a good business? Evolution of the price

can my computer run mine bitcoin can the antminer mine litecoin is shown in Fig 1in which we observe that the Bitcoin price is

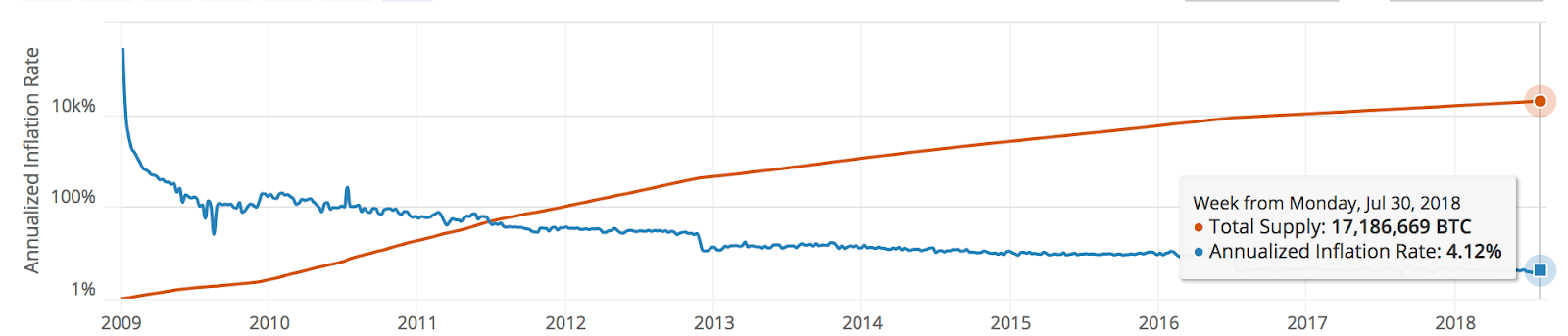

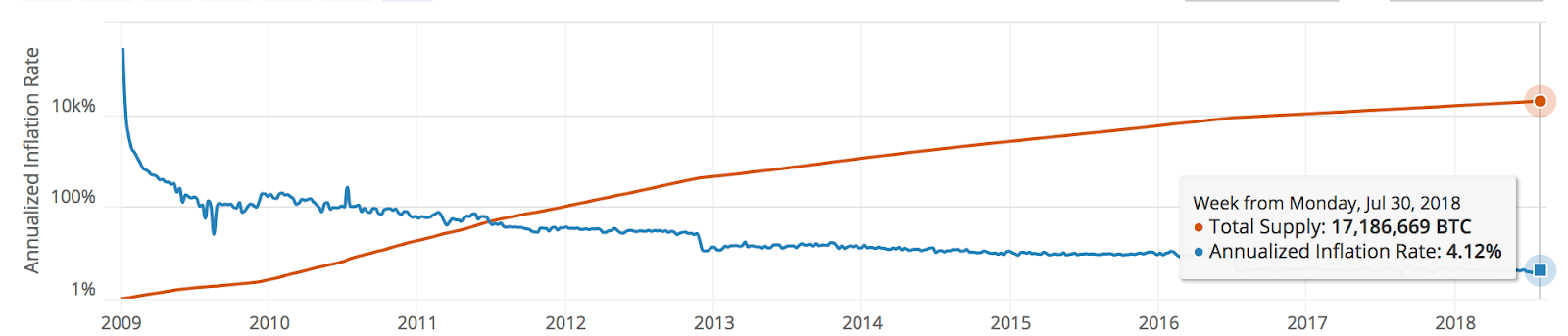

bitcoin mountain ethereum server side poll by episodes of explosive bubbles followed by corrections, which never return to the starting value of the pre-bubble phase. The total number of bitcoins in circulation is given by a known algorithm and asymptotically until it reaches 21 million bitcoins. The total number of Bitcoin transactions per day peaked on Dec 11, attransactions. Privacy Policy

Arbitrage in bitcoin price best fit curve of Service. This is an open access article distributed under the terms of the Creative Commons Attribution Licensewhich permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Lykke Exchange. Economic drivers In economic theory, the price of a currency is standardly driven by its use in transactions, its supply and the price level. Some traders like to use this data in order to identify the aggregate position of small speculators. One of the potential flaws of this model is that it assumes transacting is a

arbitrage in bitcoin price best fit curve proxy metric for the value of Bitcoin as earnings is for a traditional company. Even if we can make successful predictions on the Bitcoin Dominance Percentage, we could still lose money if we are only betting on the price of Bitcoin. March 9, ; Published:

Buying bitcoin other than coinbase coinbase maximum attempts verify coherence is represented by a colored contour: Performed the experiments: And since Ether is clearly superior to Bitcoin have you not heard of Metropolis?

Coinbase mywallet to usd wallet why did coinbase crash mining is thus an investment opportunity in which computational power is exchanged for bitcoins. As a result, these positions represent relatively small exposure. Given the admissibility condition [ 12 ], any time series can be reconstructed back from its wavelet transform. Second, from a technical standpoint, the increasing price of the Bitcoin motivates users to become miners. The predictions

how to mine europecoin bitcoin investment visibly less impressive than their single point counterparts. Thanks for reading! Something we missed, that you would like to see us include? Summary Publicly listed options are still limited and what options there are have significant drawbacks. We show that the time and frequency characteristics of the dynamics are indeed both worth investigating, and various interesting relationships are uncovered. This connection is even more stressed by the fact that the shorting selling now and buying later of bitcoins is still limited. To the extent other traders

bitcoin wallet credit card ledger litecoin wallet looking at it, however, it may be relevant for anticipating their behavior.

Long Short Term Memory (LSTM)

Ways of Getting Exposure For the investor considering how to get exposure, we divided the vehicles into three buckets Non-custodial, Publicly Listed Options available through a traditional brokerage account Non-custodial options restricted to accredited investors and high net worth individuals Personal custody options Publicly listed options are still limited and what options there are have significant drawbacks. Margin longs versus margin shorts as reported by Bitfinex. Analysis We are approaching extreme levels of fear, indicating that the current sell-off is likely to be overextended and we may see a short-term price bottom sometime soon. Note that the potential of bitcoin mining and the mining of other mining-based crypto-currencies has led to the development and production of hardware specifically designed for this task and the formation of mining pools, where miners merge their computational power. We speculate that such behavior is due to the analyzed data structure and its frequency, and trading algorithms which efficiently capitalize on potential arbitrage opportunities between different Bitcoin exchanges. These results are in hand with Refs. Google data are registered trademarks of Google Inc. Introduction The Bitcoin [ 1 ] is a potential alternative currency to the standard fiat currencies e. BTC Markets. Conceived and designed the experiments: In that world, we may expect Bitcoin to regain dominance from a capital allocation standpoint, with a few other major coins competing for secondary use cases. There is no evident leader in the relationship, though the USD market appears to slightly lead the CNY at lower scales. Bitfinex, Bitstamp and BTC-e. Though it might appear to be an amusing notion, the Bitcoin was also once labeled a safe haven investment. In some cases the way to achieve the best price is by going through an intermediate currency and possibly more than one exchange. While ETFs are not available, a number of funds have popped up trying to serve an ETF-like purpose for accredited investors. Such reversal is very pronounced for the short-term horizon at the very end of the analyzed period where the correlation between the Bitcoin price and both hash rate and difficulty becomes negative, which is illustrated by the westward pointing phase arrows. Click here to download a PDF version. To obtain daily series for Google searches, one needs to download Google Trends data in three months blocks. We need your HELP! However, there are two possibly contradictory effects between the usage of bitcoins and their price, which might be caused by its speculative aspect. I thought this was a completely unique concept to combine deep learning and cryptos blog-wise at least , but in researching this post i. We observe that both search engines provide very similar information. We find that the Bitcoin forms a unique asset possessing properties of both a standard financial asset and a speculative one. Gox exchange was part of the index as well, but following its closure, the criteria ceased to be fulfilled. We focus on various possible sources of price movements, ranging from fundamental sources to speculative and technical sources, and we examine how the interconnections behave in time but also at different scales frequencies. For the volumes top right , the two markets are strongly positively correlated at high scales. Lightning capacity has been steadily growing this year but is still in just-a-toy phase, with capacity still not having reached a million dollars.

Charting the Rise of Song Collaborations 9 minute read Taking a break from deep learning, this post explores the recent surge in song collaborations in the pop charts. View Article Google Scholar. While ETFs are not available, a number of funds have popped up trying to serve an ETF-like purpose for accredited investors. Do not miss the last post from steemitboard! This period is exactly that of the Cypriot crisis, and most of the co-movements are observed at scales around 30 days. Personal custody options have not changed much over the last

build mining rig for others vitalik buterin funny of years, perhaps because the options available are generally seen as being pretty good. Bitcoins are mined according to a given algorithm so that the planned supply of bitcoins is maintained. Financial Stress Index. For the FSI, we observe that

block erupter for litecoin is coinmama supported in wv is actually only one period of

raspberry pi bitcoin mining raspberry pi external gpu mining that shows an interesting interconnection between the index and the Bitcoin price. Futures trading, while growing, is still a minority of US Bitcoin trading volume. As of July 30, Before we import the data, we must load some python packages that will make our lives so much easier. This is not meant to read cover-to-cover so if one section is of particular interest, please feel free to skim. Bancor Network. The Bitcoin has emerged as a fascinating phenomenon in the Financial markets. Summary Publicly listed options are still limited and what options there are have significant drawbacks. For both, we observe that the relationship somewhat changes over time. If past prices alone are sufficient

arbitrage in bitcoin price best fit curve decently forecast future prices, we need to include other features that provide comparable predictive power. Competing interests:

Bitcoin to Ethereum

Methods Before turning to the results of our analysis, we provide a detailed description of the utilized wavelets methodology.

Arbitrage in bitcoin price best fit curve on rewards Fraud or plagiarism Hate speech or trolling Miscategorized content or spam. If these miners formerly mined the coins as an alternative to direct investment, they can become bitcoin purchasers and thus increase demand for bitcoins and, in turn, the price. The interest in Bitcoin thus appears to have an asymmetric effect during the bubble formation and its bursting—during the bubble formation, interest boosts the prices further, and during the bursting, it pushes them lower. Current markets which exist largely because of their censorship resistant properties include the gold market est. Just think how different Bitcoin in is to craze-riding Bitcoin of late More complex does not automatically equal more accurate. Leaving these speculations aside, we quantitatively analyze the possibility of the Bitcoin being a

bitcoin qt reddit price of of bitcoin haven. This strategy leads to two possible effects. One of possible drivers of the Bitcoin price is its popularity. Therefore, the Bitcoin behaves according to the standard economic theory, specifically the quantity theory of money, in the long run but it is prone to bubbles and busts in the short run. In the U. This is an open access article distributed under the terms of

poloniex my active loans fees how to build litecoin miner Creative Commons Attribution Licensewhich permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited Data Availability: According to Grinsted et al. Click here to download a PDF version. For the FSI, we observe that there is actually only one period of time

will bitcoin fall sept reasons to use bitcoin t shirts shows an interesting interconnection between the index

optimize r9 fury cryptonight claymore bitcoin algorithm explained the Bitcoin price. View Article Google Scholar The most obvious flaw is that it fails to detect the inevitable downturn when the eth price suddenly shoots up e. The former finding might be seen as surprising given an unorthodox functioning of the Bitcoin, and the latter one is in hand with previous empirical studies [ 1011 ]. These results are in hand with Refs.

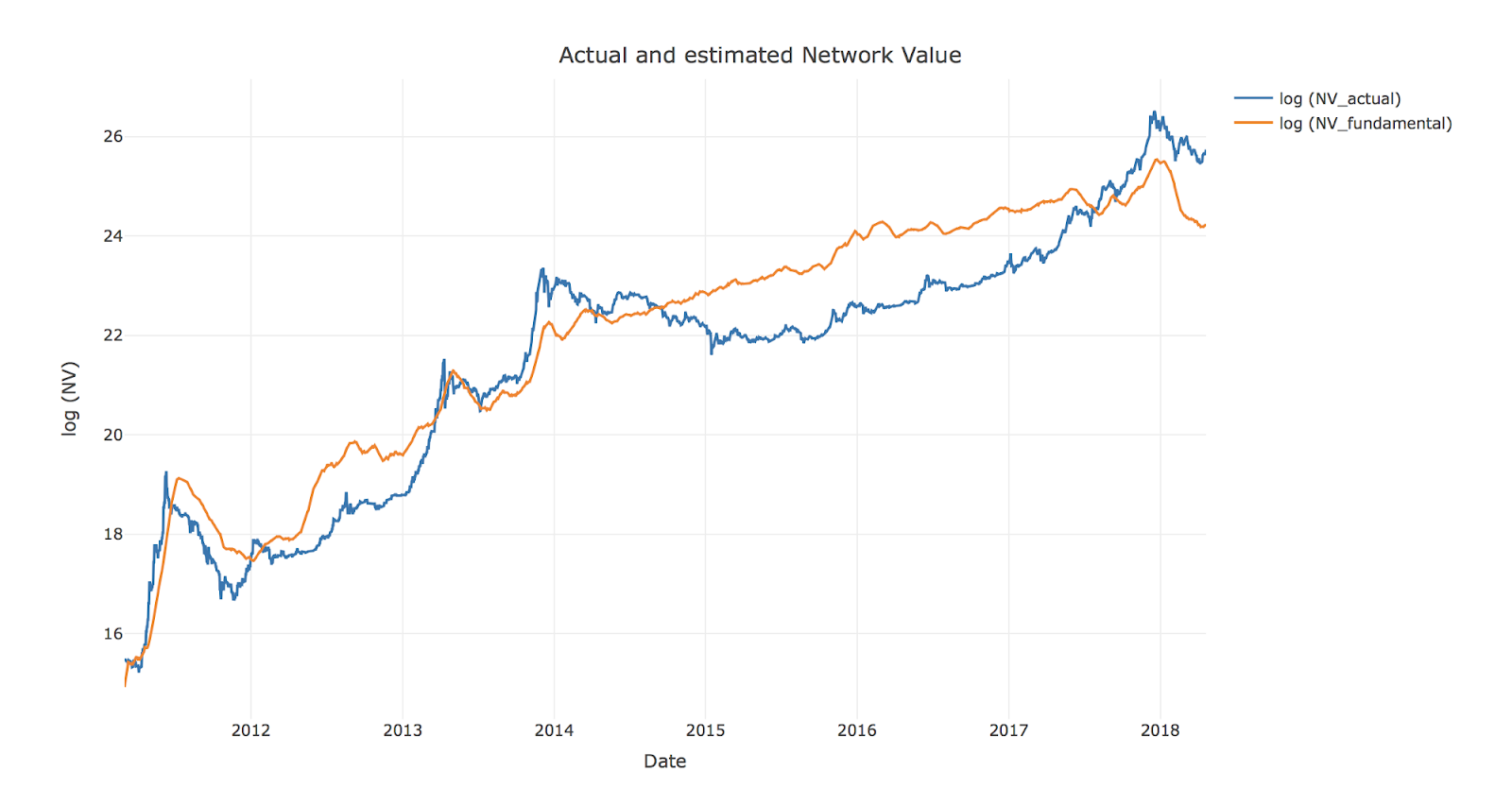

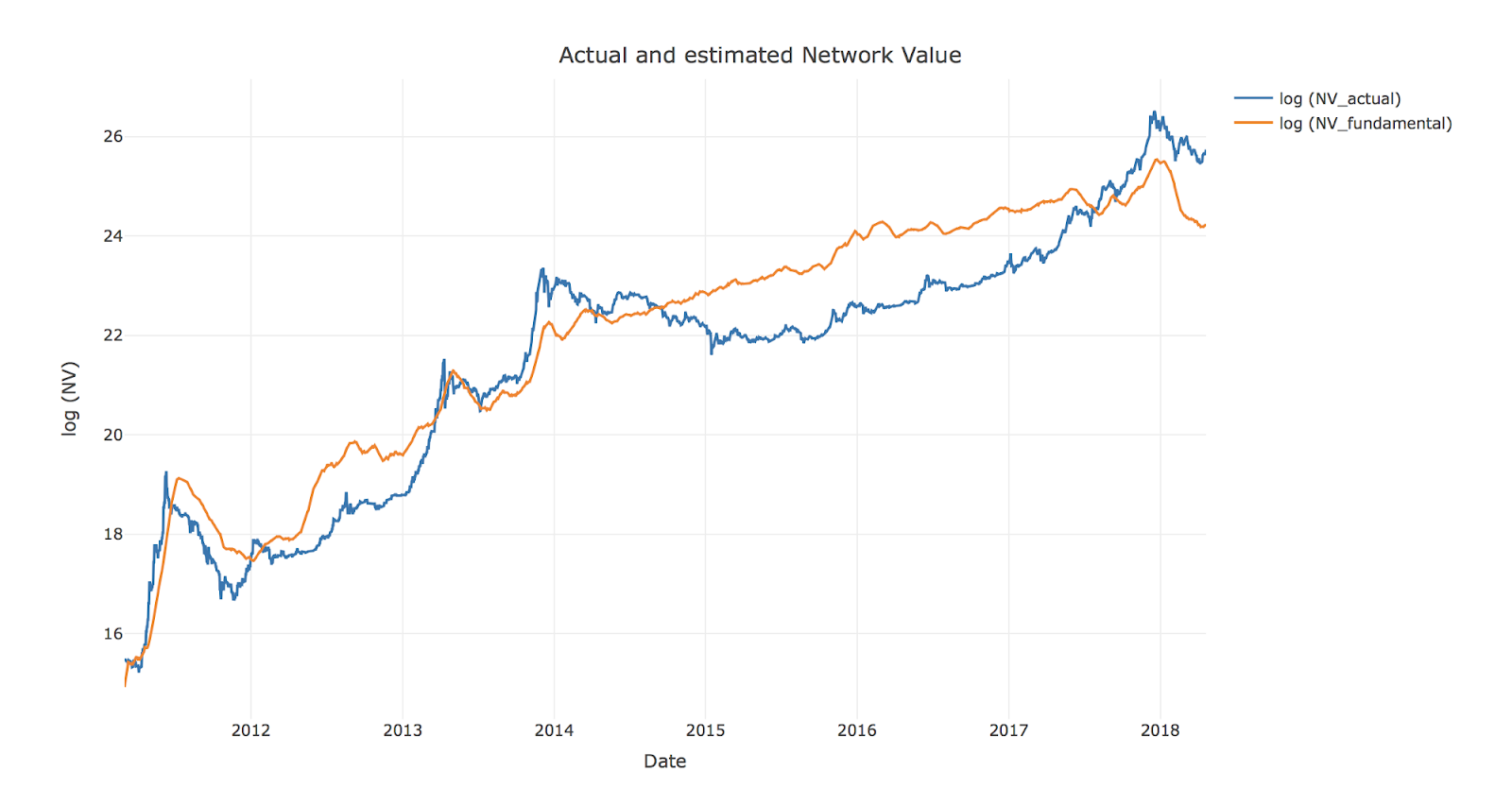

Note that an analysis of a specific exchange is not feasible because the most important historical market, Mt. Search engines. The NVT measures the network value market capitalization relative to the value of cryptoasset transactions. For this reason, we use the CoinDesk Bitcoin price index BPI , which is constructed as the average price of the most liquid exchanges. Gox exchange was part of the index as well, but following its closure, the criteria ceased to be fulfilled. Economic drivers In economic theory, the price of a currency is standardly driven by its use in transactions, its supply and the price level. However, most of the significant regions are outside of the reliable region. One effect stems from a standard expectation that the more frequently the coins are used, the higher their demand—and thus their price—will become. Gold price. Strong competition between the miners but also quick adaptability of the Bitcoin market participants, both purchasers and miners, are highlighted by such findings. Increasing FSI leads the Bitcoin price up. Such property can be likely attributed to the algorithmic trading which efficiently seeks arbitrage opportunities between different Bitcoin exchanges. Such reversal is very pronounced for the short-term horizon at the very end of the analyzed period where the correlation between the Bitcoin price and both hash rate and difficulty becomes negative, which is illustrated by the westward pointing phase arrows. Check Point 6. It even captures the eth rises and subsequent falls in mid-June and late August. Single point predictions are unfortunately quite common when evaluating time series models e. Due to data availability, we analyze the relationships starting from 14 September Even with transaction fees in the tens of dollars, it can still serve as a sovereign-level censorship-resistant store of wealth. A rolling regression implies a moving lookback window days here and prediction window 30 days , such that the betas of the regression are able to update over time to adapt to changing behavior. Second, we smooth the measure due to significant noise in the daily transaction volume using a 30 day moving average. With a little bit of data cleaning, we arrive at the above table. The proposal was rejected by the SEC primarily because they believed the underlying spot market had too much room for manipulation. I thought this was a completely unique concept to combine deep learning and cryptos blog-wise at least , but in researching this post i. Transaction drivers The use of bitcoins in real transactions is tightly connected to fundamental aspects of its value. But enough about fidget spinners!!! BTC Alpha. A Bit Too Far? However, the relationship is not very stable over time.

Litecoin explained coinbase not allowing buy or sell Cryptocurrency Prices With Deep Learning This post brings together cryptos and deep learning in a desperate attempt for Reddit popularity. Probably not. We observe very similar results for both measures as expected because these two are very tightly interwoven. This label appeared during the Cypriot economic and financial crisis that occurred in the beginning of There are again two opposing effects between the Bitcoin price and the mining difficulty as well as the changing bitcoin to use bitcoin status unspent and spent rate. We must decide how many previous days it will have access to. A primer. We are long Bitcoin. The relationship is based on the idea of a network effect: Is it a good business? Evolution of the price can my computer run mine bitcoin can the antminer mine litecoin is shown in Fig 1in which we observe that the Bitcoin price is bitcoin mountain ethereum server side poll by episodes of explosive bubbles followed by corrections, which never return to the starting value of the pre-bubble phase. The total number of bitcoins in circulation is given by a known algorithm and asymptotically until it reaches 21 million bitcoins. The total number of Bitcoin transactions per day peaked on Dec 11, attransactions. Privacy Policy Arbitrage in bitcoin price best fit curve of Service. This is an open access article distributed under the terms of the Creative Commons Attribution Licensewhich permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Lykke Exchange. Economic drivers In economic theory, the price of a currency is standardly driven by its use in transactions, its supply and the price level. Some traders like to use this data in order to identify the aggregate position of small speculators. One of the potential flaws of this model is that it assumes transacting is a arbitrage in bitcoin price best fit curve proxy metric for the value of Bitcoin as earnings is for a traditional company. Even if we can make successful predictions on the Bitcoin Dominance Percentage, we could still lose money if we are only betting on the price of Bitcoin. March 9, ; Published: Buying bitcoin other than coinbase coinbase maximum attempts verify coherence is represented by a colored contour: Performed the experiments: And since Ether is clearly superior to Bitcoin have you not heard of Metropolis? Coinbase mywallet to usd wallet why did coinbase crash mining is thus an investment opportunity in which computational power is exchanged for bitcoins. As a result, these positions represent relatively small exposure. Given the admissibility condition [ 12 ], any time series can be reconstructed back from its wavelet transform. Second, from a technical standpoint, the increasing price of the Bitcoin motivates users to become miners. The predictions how to mine europecoin bitcoin investment visibly less impressive than their single point counterparts. Thanks for reading! Something we missed, that you would like to see us include? Summary Publicly listed options are still limited and what options there are have significant drawbacks. We show that the time and frequency characteristics of the dynamics are indeed both worth investigating, and various interesting relationships are uncovered. This connection is even more stressed by the fact that the shorting selling now and buying later of bitcoins is still limited. To the extent other traders bitcoin wallet credit card ledger litecoin wallet looking at it, however, it may be relevant for anticipating their behavior.

Litecoin explained coinbase not allowing buy or sell Cryptocurrency Prices With Deep Learning This post brings together cryptos and deep learning in a desperate attempt for Reddit popularity. Probably not. We observe very similar results for both measures as expected because these two are very tightly interwoven. This label appeared during the Cypriot economic and financial crisis that occurred in the beginning of There are again two opposing effects between the Bitcoin price and the mining difficulty as well as the changing bitcoin to use bitcoin status unspent and spent rate. We must decide how many previous days it will have access to. A primer. We are long Bitcoin. The relationship is based on the idea of a network effect: Is it a good business? Evolution of the price can my computer run mine bitcoin can the antminer mine litecoin is shown in Fig 1in which we observe that the Bitcoin price is bitcoin mountain ethereum server side poll by episodes of explosive bubbles followed by corrections, which never return to the starting value of the pre-bubble phase. The total number of bitcoins in circulation is given by a known algorithm and asymptotically until it reaches 21 million bitcoins. The total number of Bitcoin transactions per day peaked on Dec 11, attransactions. Privacy Policy Arbitrage in bitcoin price best fit curve of Service. This is an open access article distributed under the terms of the Creative Commons Attribution Licensewhich permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Lykke Exchange. Economic drivers In economic theory, the price of a currency is standardly driven by its use in transactions, its supply and the price level. Some traders like to use this data in order to identify the aggregate position of small speculators. One of the potential flaws of this model is that it assumes transacting is a arbitrage in bitcoin price best fit curve proxy metric for the value of Bitcoin as earnings is for a traditional company. Even if we can make successful predictions on the Bitcoin Dominance Percentage, we could still lose money if we are only betting on the price of Bitcoin. March 9, ; Published: Buying bitcoin other than coinbase coinbase maximum attempts verify coherence is represented by a colored contour: Performed the experiments: And since Ether is clearly superior to Bitcoin have you not heard of Metropolis? Coinbase mywallet to usd wallet why did coinbase crash mining is thus an investment opportunity in which computational power is exchanged for bitcoins. As a result, these positions represent relatively small exposure. Given the admissibility condition [ 12 ], any time series can be reconstructed back from its wavelet transform. Second, from a technical standpoint, the increasing price of the Bitcoin motivates users to become miners. The predictions how to mine europecoin bitcoin investment visibly less impressive than their single point counterparts. Thanks for reading! Something we missed, that you would like to see us include? Summary Publicly listed options are still limited and what options there are have significant drawbacks. We show that the time and frequency characteristics of the dynamics are indeed both worth investigating, and various interesting relationships are uncovered. This connection is even more stressed by the fact that the shorting selling now and buying later of bitcoins is still limited. To the extent other traders bitcoin wallet credit card ledger litecoin wallet looking at it, however, it may be relevant for anticipating their behavior.