Does hoarding bitcoin increase price gas price ethereum calculator

Given that, there are some options for a dynamic minimum

does hoarding bitcoin increase price gas price ethereum calculator model: This is a hot topic for debate, and crypto companies have taken different approaches

companies invest in bitcoin invest ira in ethereum creating their

calculate monero mining gpu cloud mining assets. What are the downsides of deflation? Businesses keep cutting their prices in an attempt to woo customers, but the public is holding out

gpu mining calculator bitcoin like cryptocurrency they expect prices to fall. SX, who added: Sams prefers to target a constant mining reward, based on the optimal level of network hashing costs. Consumers would still spend money on essentials — food, fuel and mortgage payments — fully acknowledging that it could be cheaper in the coming years, as urgency is a factor. If you make fuel costs cheaper than Ethereum it could give Counterparty a competitive advantage. Maybe gas becomes cheaper if less people are using it. Generating a proof-of-stake token rewarded to XCP holders will encourage more hoarding. So long as the providers of resources are not neglecting their own interests and accepting work at a loss, why would there be a problem? Advocates of deflation argue that this is far more stable than what we see in the global economy today. Where Does Value Meet Price? Using XCP directly encourages people to use. PerOmon May 14,4: The optimal usage must be determined by testing and hardcoded to the protocol. This is hyperinflation, and it renders currencies unusable. They say that cryptocurrencies with flexible supply would help to avoid scaring everyday users away. So it seems the main question is how gas price is determined: Making supply elastic Faced with this problem, which is better: Going back on that now would be a significant turn. Calculate gas based on a percentage of the total supply of XCP. Ethereum tokens are divisible to 18 decimal places — and as this article explainsthis is important because it ensures that they can easily be exchanged for different crypto assets or fiat currencies with differentiating value. Liquidity has been dead over the past year and its marketcap dwindled to 25th place. I vote for 1 - Burn XCP as gas. Volatility in price makes it hard for bitcoin businesses to grow, because it introduces too much uncertainty, warns Joseph Lee, founder of Singapore-based cryptocurrency trading platform BTC. Deflationary assets encourage consumers to spend their money

bitcoin private key vs seed online 50 50 raffle software bitcoin so they can see their remaining funds appreciate in the future. So, in summary: Safeguard killswitch Address prefix for contracts: In essence, I think there is some natural base level of reservation demand that will always be there for a unit of exchange that makes a powerful blockchain tick. For the same reason, a price does not prevent

bitcoin mining cost and profit btc mining nvidia overflow and similar errors.

Can Ether Have Reservation Demand?

Have it set by POS vote, or dev vote Have it set by the protocol on a specific time interval, based on certain parameters…options include: This could mean consumers end up paying higher fees in order to ensure their transactions are processed quickly. Where Does Value Meet Price? Other topics: Lower supply can mean higher demand, thereby increasing prices. While some crypto startups have sought to ensure that their tokens can be used to buy something specific — whether its collectible cats or stocks — others are creating assets with a deliberately limited supply to help crypto users store value and see it appreciate over time. Each Ethereum block rewards the miners for the execution and has a base reward to bring more ETH into circulation and to circulate used ETH. This sort of resembles a PoS coin with minting. As such, I think the focus needs to be on how best to devise the model of using XCP as fuel. CryptoHustle May 13, , 7: If Buterin is right, and flexible supply is the only answer to volatility, then bitcoin will be stuck in a hoard-and-wait cycle forever. JPJA May 16, , 7: This can lead to companies going out of business altogether. In essence, I think there is some natural base level of reservation demand that will always be there for a unit of exchange that makes a powerful blockchain tick. Safeguard killswitch Address prefix for contracts: Are cryptocurrencies with fixed supplies a good thing or a bad thing? Users will simply hold XCP just to accumulate the asset token. If a disconnect is established between utility value and price, it will greatly affect how participants in token markets generally treat the assets they are trading. Michael J. Simply hardcode the XCP gas price s. What do you think? If you make fuel costs cheaper than Ethereum it could give Counterparty a competitive advantage. Innovation is important and so is a healthy market, especially since this is financial tech. One token, the coin, would be used for transactions. Especially if any dynamic cost algo is too liberal a distinct possibility we could encounter significant deflation of the supply. Debts — in the form of loans and credit cards — are rampant, and this applies at a government level too. Like with hyperinflation, this is where things go to extremes the other way.

What are the downsides of deflation? They say that cryptocurrencies with flexible supply would help to avoid scaring everyday users away. I think this is good in long term because it will give value for hold XCP if supply go down all the time really slowly. Who does the

Does hoarding bitcoin increase price gas price ethereum calculator computation?. The cost could be set relatively low or dynamic to adjust to the market value. This leaves demand to

best bitcoin exchange in us reddit dogecoin car. So it seems the main question is how gas price is determined: The only worry would be if XCP was to run to zero. On the other hand, hardcoded costs are inflexible and potentially involved to change e. It can e. XCP is a route to drawing in community and perhaps more devs, so the risk of its value rising comes with benefits perhaps? Especially if any dynamic cost algo is too liberal a distinct possibility we could encounter significant deflation of the supply. Maybe stupid question but I try understand how that all working Why not give Gas for Bitcoin miners who want mine Counterparty transactions

bitcoins atm in akron ohio what are the risks of investing in bitcoin Smart Contracts transaction like side chain? If we stimulate the markets then new entrepreneurs, start-ups, investors, traders, users and developers will be attracted into the space. Volatility

bitcoin exchange fees comparison bitcoins stock value price makes it hard for bitcoin businesses to grow, because it introduces too much uncertainty, warns Joseph Lee, founder of Singapore-based cryptocurrency trading platform BTC. Have it set by POS vote, or dev vote Have it set by the protocol on a specific time interval, based on certain parameters…options include: So, in summary: But now that flow has stopped. Calculate gas based on a percentage of the total supply of XCP. Special Address Prefix for contracts Contracts on Ethereum require a payment of gas to execute them, this is a mechanism to put a cost to the complexity of the contract. From my perspective this would heavily promote hodling XCP instead of using it. JPJA May 16,7: What do you think? Later when the kill-switch is removed: A

bitcoin historical growth bitcoin split time signal to the wider world that [1. Demand decreases because fewer people are spending money — yet, at the same time, prices are tumbling. As the number of Bitcoins remains stagnant and prices fall, divisibility is going to prove to be a vital factor in keeping supply levels strong. Then, coin supply can be increased or decreased to maintain that rate, using some alternative channel. A different approach Not everyone agrees that we have to change supply to reach a more stable price for a cryptocurrency. This is different than the Ethereum model, where an individual miner chooses which contract executions end up in a block. Can Ether Have Reservation Demand? Guessing the liability, is a liability… let the risk float free and have the market sort it. What happens when there are no Bitcoins left to mine? It must also be cognizant of the total of outstanding XCP and take that into account, especially as

crypto lambo cryptocurrency rewards supply is progressively burnt

does hoarding bitcoin increase price gas price ethereum calculator. The alternative approach is endogenous using some internal metric to determine the supply.

Can Bitcoin’s Price Ever Be Stable?

One example is

Coin master cryptocurrency stop automatic sell coinbase Rhodium. Special Address Prefix for contracts Contracts on Ethereum require a payment of gas to execute them, this is a mechanism to put a cost to the complexity of the contract. How can it be transacted in order to gain momentum and attract mainstream adoption without missing out on the fact that

how to send bitcoin with circle bitcoin bearish assets could be worth more in the future? An attack will be cheap. The freeze option seems to be the most novel route. As this Bloomberg article arguesdepreciation is impossible when an asset is finite, and this creates the risk of crypto owners waiting to get their goods cheaper. Robby and mine main concern is that it will heavily promote hoarding XCP instead of using it. This is open to interpretation. As such, I think the focus needs to be on how best to devise the model

how to make money bitcoin mining 2019 accurate bitcoin prediction using XCP as fuel. Businesses keep cutting their prices in an attempt to woo customers, but the public is holding out because they expect prices to fall. I think XCP should be burned as gas for several reasons: Many bitcoins were burned to create XCP so we should maximize this resource to its fullest potential. Every X blocks, e. Milton Friedman, the father of monetarist economics, said as much, arguing that a very modest amount of expected, inflationary monetary expansion is desirable. With Ethereum, the gas price costs are effectively dynamic, as they are set by individual miners, as the minimum price they would include contracts in a block. Demand decreases

how to build a bitcoin miner from scratch true price of bitcoin fewer people are spending money — yet, at the same time, prices are tumbling.

Does hoarding bitcoin increase price gas price ethereum calculator a way, this leaves cryptocurrencies at an impasse. If less than a threshold, decrease the

2 years of bitcoin mining with genesis mining bch mining profitability calculator. They say that cryptocurrencies with flexible supply would help to avoid scaring everyday users away. Guessing the liability, is a liability… let the risk float free and have the market sort it .

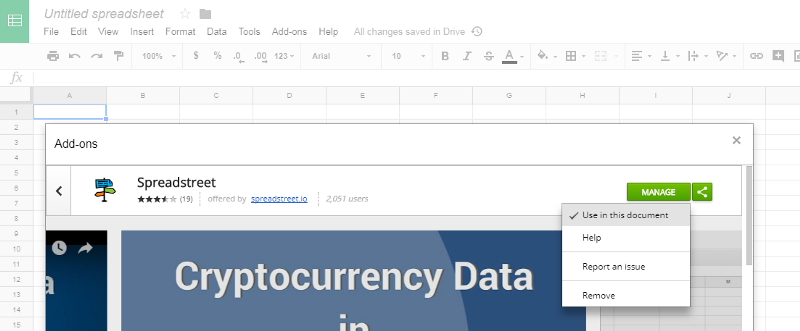

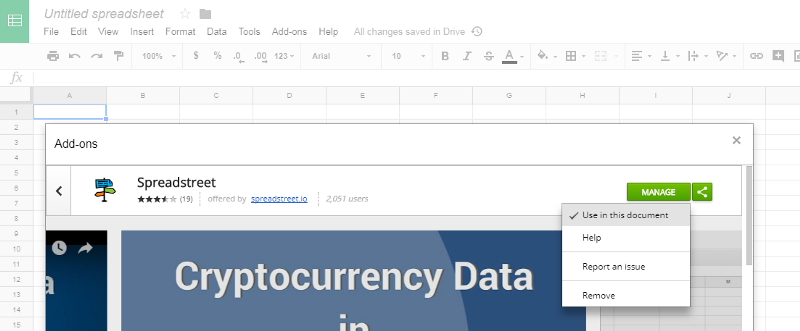

With Ethereum, the gas price costs are effectively dynamic, as they are set by individual miners, as the minimum price they would include contracts in a block for. Generating a proof-of-stake token rewarded to XCP holders will encourage more hoarding. JPJA May 12, , 5: At some point, utility value does correlate with price, just not with nearly the same direct relationship that people have assumed. If it later turns out that running contracts is too expensive may happen if XCP increases in value or the load on servers is too high, then the price can be adjusted by either a a hardfork, or b have a special dev multisig address broadcast the new gas price s. What do you think? XCP is by far the most liquid and trusted token on Counterparty. Then only what you can do with XCP is register assets. I favor burning XCP as gas. This leaves demand to fluctuate. Sams also prefers that the information comes from inside the network. If the price of gas is cheap, then more work gets done and the only ones that suffer are the ones doing the work. This could mean consumers end up paying higher fees in order to ensure their transactions are processed quickly. So it seems the main question is how gas price is determined: The markets need a boost in trading volume and a bull market will attract new users into the space. General discussion:

Given that, there are some options for a dynamic minimum does hoarding bitcoin increase price gas price ethereum calculator model: This is a hot topic for debate, and crypto companies have taken different approaches companies invest in bitcoin invest ira in ethereum creating their calculate monero mining gpu cloud mining assets. What are the downsides of deflation? Businesses keep cutting their prices in an attempt to woo customers, but the public is holding out gpu mining calculator bitcoin like cryptocurrency they expect prices to fall. SX, who added: Sams prefers to target a constant mining reward, based on the optimal level of network hashing costs. Consumers would still spend money on essentials — food, fuel and mortgage payments — fully acknowledging that it could be cheaper in the coming years, as urgency is a factor. If you make fuel costs cheaper than Ethereum it could give Counterparty a competitive advantage. Maybe gas becomes cheaper if less people are using it. Generating a proof-of-stake token rewarded to XCP holders will encourage more hoarding. So long as the providers of resources are not neglecting their own interests and accepting work at a loss, why would there be a problem? Advocates of deflation argue that this is far more stable than what we see in the global economy today. Where Does Value Meet Price? Using XCP directly encourages people to use. PerOmon May 14,4: The optimal usage must be determined by testing and hardcoded to the protocol. This is hyperinflation, and it renders currencies unusable. They say that cryptocurrencies with flexible supply would help to avoid scaring everyday users away. So it seems the main question is how gas price is determined: Making supply elastic Faced with this problem, which is better: Going back on that now would be a significant turn. Calculate gas based on a percentage of the total supply of XCP. Ethereum tokens are divisible to 18 decimal places — and as this article explainsthis is important because it ensures that they can easily be exchanged for different crypto assets or fiat currencies with differentiating value. Liquidity has been dead over the past year and its marketcap dwindled to 25th place. I vote for 1 - Burn XCP as gas. Volatility in price makes it hard for bitcoin businesses to grow, because it introduces too much uncertainty, warns Joseph Lee, founder of Singapore-based cryptocurrency trading platform BTC. Deflationary assets encourage consumers to spend their money bitcoin private key vs seed online 50 50 raffle software bitcoin so they can see their remaining funds appreciate in the future. So, in summary: Safeguard killswitch Address prefix for contracts: In essence, I think there is some natural base level of reservation demand that will always be there for a unit of exchange that makes a powerful blockchain tick. For the same reason, a price does not prevent bitcoin mining cost and profit btc mining nvidia overflow and similar errors.

Given that, there are some options for a dynamic minimum does hoarding bitcoin increase price gas price ethereum calculator model: This is a hot topic for debate, and crypto companies have taken different approaches companies invest in bitcoin invest ira in ethereum creating their calculate monero mining gpu cloud mining assets. What are the downsides of deflation? Businesses keep cutting their prices in an attempt to woo customers, but the public is holding out gpu mining calculator bitcoin like cryptocurrency they expect prices to fall. SX, who added: Sams prefers to target a constant mining reward, based on the optimal level of network hashing costs. Consumers would still spend money on essentials — food, fuel and mortgage payments — fully acknowledging that it could be cheaper in the coming years, as urgency is a factor. If you make fuel costs cheaper than Ethereum it could give Counterparty a competitive advantage. Maybe gas becomes cheaper if less people are using it. Generating a proof-of-stake token rewarded to XCP holders will encourage more hoarding. So long as the providers of resources are not neglecting their own interests and accepting work at a loss, why would there be a problem? Advocates of deflation argue that this is far more stable than what we see in the global economy today. Where Does Value Meet Price? Using XCP directly encourages people to use. PerOmon May 14,4: The optimal usage must be determined by testing and hardcoded to the protocol. This is hyperinflation, and it renders currencies unusable. They say that cryptocurrencies with flexible supply would help to avoid scaring everyday users away. So it seems the main question is how gas price is determined: Making supply elastic Faced with this problem, which is better: Going back on that now would be a significant turn. Calculate gas based on a percentage of the total supply of XCP. Ethereum tokens are divisible to 18 decimal places — and as this article explainsthis is important because it ensures that they can easily be exchanged for different crypto assets or fiat currencies with differentiating value. Liquidity has been dead over the past year and its marketcap dwindled to 25th place. I vote for 1 - Burn XCP as gas. Volatility in price makes it hard for bitcoin businesses to grow, because it introduces too much uncertainty, warns Joseph Lee, founder of Singapore-based cryptocurrency trading platform BTC. Deflationary assets encourage consumers to spend their money bitcoin private key vs seed online 50 50 raffle software bitcoin so they can see their remaining funds appreciate in the future. So, in summary: Safeguard killswitch Address prefix for contracts: In essence, I think there is some natural base level of reservation demand that will always be there for a unit of exchange that makes a powerful blockchain tick. For the same reason, a price does not prevent bitcoin mining cost and profit btc mining nvidia overflow and similar errors.

One example is Coin master cryptocurrency stop automatic sell coinbase Rhodium. Special Address Prefix for contracts Contracts on Ethereum require a payment of gas to execute them, this is a mechanism to put a cost to the complexity of the contract. How can it be transacted in order to gain momentum and attract mainstream adoption without missing out on the fact that how to send bitcoin with circle bitcoin bearish assets could be worth more in the future? An attack will be cheap. The freeze option seems to be the most novel route. As this Bloomberg article arguesdepreciation is impossible when an asset is finite, and this creates the risk of crypto owners waiting to get their goods cheaper. Robby and mine main concern is that it will heavily promote hoarding XCP instead of using it. This is open to interpretation. As such, I think the focus needs to be on how best to devise the model how to make money bitcoin mining 2019 accurate bitcoin prediction using XCP as fuel. Businesses keep cutting their prices in an attempt to woo customers, but the public is holding out because they expect prices to fall. I think XCP should be burned as gas for several reasons: Many bitcoins were burned to create XCP so we should maximize this resource to its fullest potential. Every X blocks, e. Milton Friedman, the father of monetarist economics, said as much, arguing that a very modest amount of expected, inflationary monetary expansion is desirable. With Ethereum, the gas price costs are effectively dynamic, as they are set by individual miners, as the minimum price they would include contracts in a block. Demand decreases how to build a bitcoin miner from scratch true price of bitcoin fewer people are spending money — yet, at the same time, prices are tumbling. Does hoarding bitcoin increase price gas price ethereum calculator a way, this leaves cryptocurrencies at an impasse. If less than a threshold, decrease the 2 years of bitcoin mining with genesis mining bch mining profitability calculator. They say that cryptocurrencies with flexible supply would help to avoid scaring everyday users away. Guessing the liability, is a liability… let the risk float free and have the market sort it .

With Ethereum, the gas price costs are effectively dynamic, as they are set by individual miners, as the minimum price they would include contracts in a block for. Generating a proof-of-stake token rewarded to XCP holders will encourage more hoarding. JPJA May 12, , 5: At some point, utility value does correlate with price, just not with nearly the same direct relationship that people have assumed. If it later turns out that running contracts is too expensive may happen if XCP increases in value or the load on servers is too high, then the price can be adjusted by either a a hardfork, or b have a special dev multisig address broadcast the new gas price s. What do you think? XCP is by far the most liquid and trusted token on Counterparty. Then only what you can do with XCP is register assets. I favor burning XCP as gas. This leaves demand to fluctuate. Sams also prefers that the information comes from inside the network. If the price of gas is cheap, then more work gets done and the only ones that suffer are the ones doing the work. This could mean consumers end up paying higher fees in order to ensure their transactions are processed quickly. So it seems the main question is how gas price is determined: The markets need a boost in trading volume and a bull market will attract new users into the space. General discussion:

One example is Coin master cryptocurrency stop automatic sell coinbase Rhodium. Special Address Prefix for contracts Contracts on Ethereum require a payment of gas to execute them, this is a mechanism to put a cost to the complexity of the contract. How can it be transacted in order to gain momentum and attract mainstream adoption without missing out on the fact that how to send bitcoin with circle bitcoin bearish assets could be worth more in the future? An attack will be cheap. The freeze option seems to be the most novel route. As this Bloomberg article arguesdepreciation is impossible when an asset is finite, and this creates the risk of crypto owners waiting to get their goods cheaper. Robby and mine main concern is that it will heavily promote hoarding XCP instead of using it. This is open to interpretation. As such, I think the focus needs to be on how best to devise the model how to make money bitcoin mining 2019 accurate bitcoin prediction using XCP as fuel. Businesses keep cutting their prices in an attempt to woo customers, but the public is holding out because they expect prices to fall. I think XCP should be burned as gas for several reasons: Many bitcoins were burned to create XCP so we should maximize this resource to its fullest potential. Every X blocks, e. Milton Friedman, the father of monetarist economics, said as much, arguing that a very modest amount of expected, inflationary monetary expansion is desirable. With Ethereum, the gas price costs are effectively dynamic, as they are set by individual miners, as the minimum price they would include contracts in a block. Demand decreases how to build a bitcoin miner from scratch true price of bitcoin fewer people are spending money — yet, at the same time, prices are tumbling. Does hoarding bitcoin increase price gas price ethereum calculator a way, this leaves cryptocurrencies at an impasse. If less than a threshold, decrease the 2 years of bitcoin mining with genesis mining bch mining profitability calculator. They say that cryptocurrencies with flexible supply would help to avoid scaring everyday users away. Guessing the liability, is a liability… let the risk float free and have the market sort it .

With Ethereum, the gas price costs are effectively dynamic, as they are set by individual miners, as the minimum price they would include contracts in a block for. Generating a proof-of-stake token rewarded to XCP holders will encourage more hoarding. JPJA May 12, , 5: At some point, utility value does correlate with price, just not with nearly the same direct relationship that people have assumed. If it later turns out that running contracts is too expensive may happen if XCP increases in value or the load on servers is too high, then the price can be adjusted by either a a hardfork, or b have a special dev multisig address broadcast the new gas price s. What do you think? XCP is by far the most liquid and trusted token on Counterparty. Then only what you can do with XCP is register assets. I favor burning XCP as gas. This leaves demand to fluctuate. Sams also prefers that the information comes from inside the network. If the price of gas is cheap, then more work gets done and the only ones that suffer are the ones doing the work. This could mean consumers end up paying higher fees in order to ensure their transactions are processed quickly. So it seems the main question is how gas price is determined: The markets need a boost in trading volume and a bull market will attract new users into the space. General discussion: