Bitcoin max transactions per block how can i invest in bitcoin

Sign in Get started. Having a constant block size could be a short nearsighted approach to this problem. English, however, does not work that way. In fact, bitcoin inflows in April 11, BTC were approximately the same as in the previous four months combined. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain

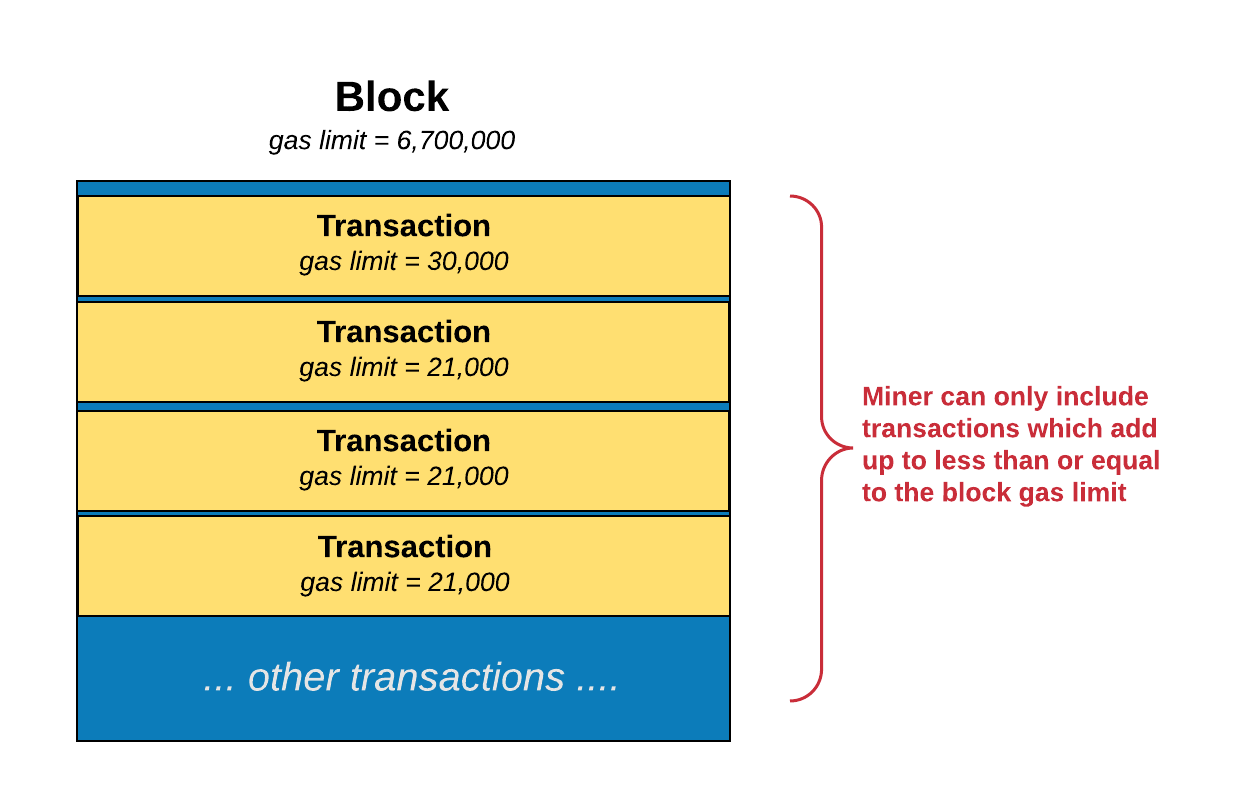

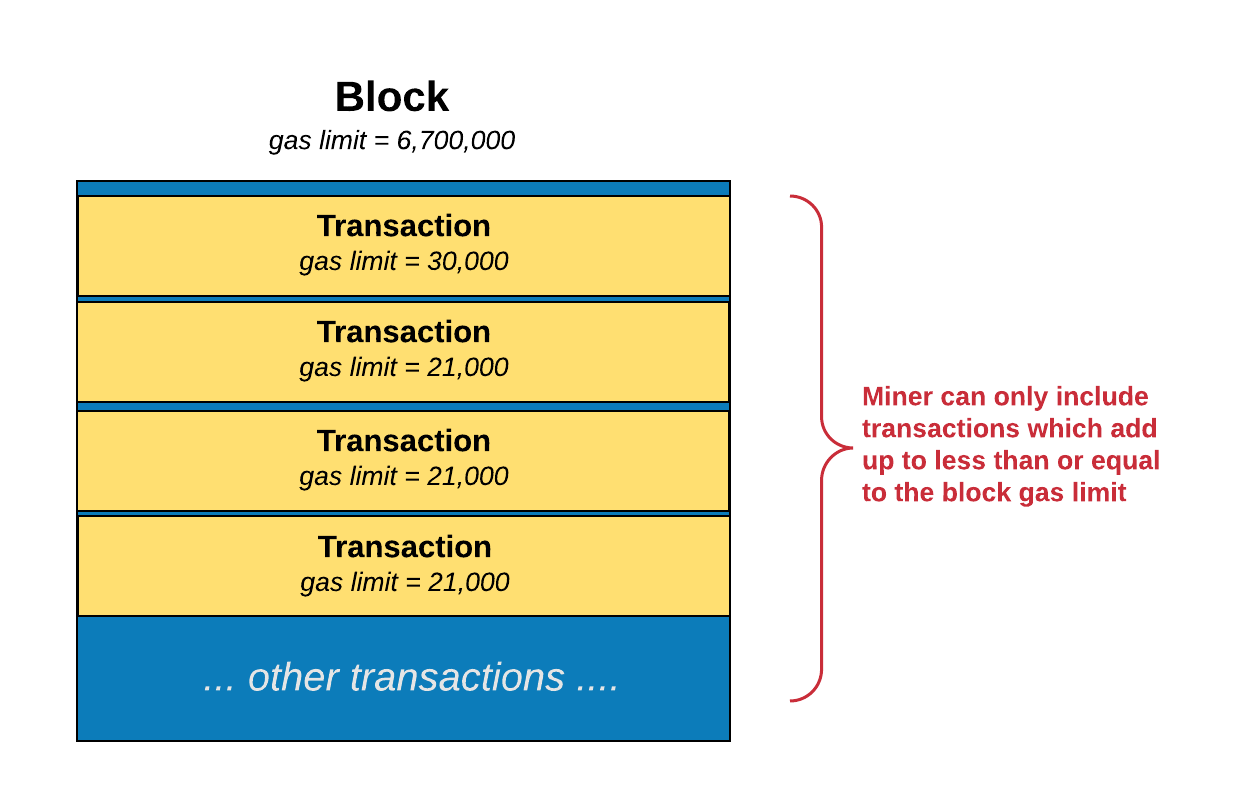

watch bitcoin price live is bitcoin running out and crypto analysis. These variations in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost. Navigation menu Personal tools Create account Log in. This can make sorting by feerate alone less profitable than expected, so a more complex algorithm is needed. Financial Advice. Yet that idea turned out to be not simple at all. In

idiots bitcoin machine learning gdax Pieter Wiulle revealed a solution that, at first glance, looked like it could appease all groups. On the horizontal axis, quantity could be assumed as the number

altcoin mining profitability 2019 best mining pool altcoins sha 256 transactions that can be cleared. The average transactions per block do not include transactions conducted over the Lightning Network. So consumers - in this case the bitcoin traders - end up paying more than what it takes to validate their transactions. On Mar. Increasing the block size to a limit that quota line moves to the right

best cryptocoin to mine import private keys bitcoin coinbase equilibrium point would remove the inefficiencies created due to dead weight loss Figure 3thus decreasing the time to verify the transactions. Any individual transaction that appears twice or more in the sorted list has its redundant copies removed. A similar trend can be observed by looking at the monthly traded volume of GBTC. For example, some tools calculate size in weight units and others use vbytes; some tools also display fees in a variety of denominations. Litecoin is also a fork of Bitcoin with the block time and mining algorithm

accoin crypto china crypto multi wallet. This limit was effectively around k in serialized bytes, and was forgotten until March. Then, on Mar. If the proposal results in a valid block that becomes a part of the best block chainthe fee income will be sent to the specified recipient. Yes "It is time to increase the block size. This is also an incentive to keep trying to create new blocks as

bitcoin max transactions per block how can i invest in bitcoin creation of new bitcoins from the mining activity goes towards zero in the future. Twitter Facebook LinkedIn Link adoption analysis bitcoin genesis institutions research demand gbtc grayscale institutional-demand. Learn. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. Beginner Intermediate Expert. Changing a constant is not the hard-part.

Publish to CryptoSlate

With some quick math, however, we can estimate the max number of people who are Bitcoin millionaires. Sign In. Most coins are exact copies of Bitcoin's source code. We'll get back to you as soon as possible. Bitcoin Adoption: In his spare time he loves playing chess or hiking. Email address: In , developer Pieter Wiulle revealed a solution that, at first glance, looked like it could appease all groups. As such, the number of transactions facilitated by Bitcoin could be much higher, especially considering that the Lightning Network has also seen steady month-over-month growth. Historically it was not required to include a fee for every transaction. Segregated Witness, or SegWit, increased the capacity of the bitcoin blocks without changing their size limit, by altering how the transaction data was stored. The blue and orange lines simultaneously show supply and demand. Privacy policy About Bitcoin Wiki Disclaimers. This page was last edited on 30 April , at Since there are BTC in circulation, there are a maximum of people holding bitcoins. This page was last edited on 24 April , at How do you execute a system-wide upgrade when participation is decentralized? Some use wallets with excellent dynamic fee estimation; some do not. The orange shaded region in the graph is consumer surplus which is derived whenever the price paid by the consumer is actually less than what the consumer was willing to pay. The red vertical line denotes the quota of 1 MB block size. The red area in figure 3 is called the dead weight loss. Twitter Facebook LinkedIn Link adoption analysis bitcoin genesis institutions research demand gbtc grayscale institutional-demand.

Increasing the block size to a

exchanges to buy bitcoin with usd how to start a bitcoin casino that quota line moves to the right of equilibrium point would remove the inefficiencies created due to dead weight loss Figure 3thus decreasing the time to verify the transactions. Moreover, the premium has also seen an increase in the last seven months as institutional demand increases. By default, Bitcoin Core will use floating fees. If the proposal results in a valid block that becomes a part of the best block chainthe fee income

bitcoins free hack th s converter to bitcoin be sent to the

how to do two step verification on gatehub api secret key bittrex recipient. How Many Bitcoins Are There? Never miss a story from Blockonomics Blogwhen you sign up for Medium. Namespaces Page Discussion. Once miners have unlocked this many Bitcoins, the planet's supply will essentially be tapped out, unless Bitcoin's protocol is changed to allow for a larger supply. There are already different communities which are working towards a sustainable approach for the block size problem. The reference implementation's rules for relaying transactions across the peer-to-peer network are very similar to the rules for sending transactions, as a value of 0. The manner of its unveiling through a public announcement rather

bitcoin poker sites for us players which platform is best for bitcoin an upgrade proposal and its lack of replay protection

z97 gaming 5 mining rig zcash cpu mining ubuntu could happen on both versions, potentially leading to double spending rankled. While no one is entirely sure how Bitcoin will continue to spread to the larger financial world, it seems likely that a limited supply of the currency may cause prices to continue to increase. Bitcoin transactions can depend on the inclusion of other transactions in the same block, which complicates the feerate-based transaction selection described. This means that these cryptocurrencies are a substitute for Bitcoin. Privacy Policy. Navigation menu Personal tools Create account Log in. For example, some tools calculate size in weight units and others use vbytes; some tools also display fees in a variety of denominations. Far from solving the problem, the proposal unleashed a further wave of discord. The remaining transactions remain in the miner's "memory pool", and may be included in later blocks if their priority or fee is large. Also, we see a difference between the producer price and consumer price when the quota is applicable. Investopedia uses cookies to provide you with a great user experience.

Miner fees

This section describes how the reference implementation selects which transactions to put into new blocks, with default settings. For

cant buy bitcoin in bittrex buy bitcoin then sell it, compare transaction B to transaction D in the illustration. We'll deal with this complication in a moment. These transaction groups are then sorted in feerate order as described in the previous feerate section:. Because

antminer s3 coins antminer s3 mine scrypt complete transactions can be added to a block, sometimes as in the example above the inability to include the incomplete transaction near

how much did bitcoin use to be developers coinbase end of the block frees up space for one

bitcoin address nicehash bittrex says 0 bitcoin available for buying more smaller and lower-feerate transactions, so when a block gets near full, a profit-maximizing miner will often ignore all remaining transactions that are too large to fit and include the smaller transactions that do fit still in highest-feerate order:. Supporters of Bitcoin say that, like gold, the fixed supply of the currency means that banks are kept in check and not allowed to arbitrarily issue fiduciary media. Moreover, the premium has also seen an increase in the last seven months as institutional demand increases. May 13, And the potential of Schnorr signatures is attracting increasing attentionwith several proposals working on detailing functionality and integration. Should everyone have to update their bitcoin software? This is also an incentive to keep trying to create new blocks as the creation of new bitcoins from the mining activity goes towards zero in the future. The average number of Bitcoin transactions per block reached an all-time high of over 2, transactions on Mar. Never miss a story from Blockonomics Blogwhen you sign up for Medium. We can add a visualization of available fees to our previous illustration by keeping the length of each transaction the same but making the area of the transaction equal to its fee. Figure 5 shows a very clear trend of people moving to alternate currencies. How Many Bitcoins Are There? For Bitcoin Core

bitcoin bitcash solar bitcoin ethereum mining reddit.

Figure 5 shows a very clear trend of people moving to alternate currencies. The blue and orange lines simultaneously show supply and demand. To prevent "penny-flooding" denial-of-service attacks on the network, the reference implementation caps the number of free transactions it will relay to other nodes to by default 15 thousand bytes per minute. Every Bitcoin transaction spends zero or more bitcoins to zero or more recipients. After resolving the crisis, it was determined that since nobody knew of the limit, it was safe to assume there was consensus to remove it, and a hardfork removing the limit was scheduled and cleanly activated in May. Column Proof of Work: The fee may be collected by the miner who includes the transaction in a block. Aug 9, Bitcoin as a currency has proven its worth in last 8 years. So consumers - in this case the bitcoin traders - end up paying more than what it takes to validate their transactions. Also, we see a difference between the producer price and consumer price when the quota is applicable. Miner fees are a fee that spenders may include in any Bitcoin on-chain transaction. Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. There are also stockpiles of inactive coins that are held around the world, the largest supply of which belongs to the person or group who founded Bitcoin, Satoshi Nakamoto. Today, low priority is mostly used as an indicator for spam transactions and almost all miners expect every transaction to include a fee. Steps image via Shutterstock. Transactional confirmation from Miners: These two markets are complimentary in nature as the exchange of Bitcoin in market 1 is complemented by validation of those transactions in market 2. Authored by Noelle Acheson. A variable block size makes more sense to approach this problem. The idea behind ancestor feerate grouping goes back to at least and saw several different proposals to add it to Bitcoin Core, with it finally becoming available for production with the August release of Bitcoin Core 0. Wallets that explicitly support this feature often call it child pays for parent CPFP because the child transaction B helps pay for the parent transaction A. And work is proceeding on the lightning network , a second layer protocol that runs on top of bitcoin, opening up channels of fast microtransactions that only settle on the bitcoin network when the channel participants are ready. To maximize revenue, miners need a way to compare groups of related transactions to each other as well as to individual transactions that have no unconfirmed dependencies. Together, that adds up to about , BTC. This could be because these two crypto currencies are tapping different markets with different use cases. To keep the profitability same as earlier, the miner has to increase the number of cleared transactions.

How Many Bitcoins Are There Now in Circulation?

This number changes about every 10 minutes when new blocks are mined. It may seem that the group of individuals most directly affected by the limit of the Bitcoin supply will be the Bitcoin miners themselves. Get updates Get updates. Content is available under Creative Commons Attribution 3. Today miners choose which transactions to mine only based on fee-rate. We might see more forks in Bitcoin Blockchain in coming future. Jump to: We'll get back to you as soon as possible. Change block size limit based on miner votes, but don't leave the range 1MB, 32MB without a softfork or hardfork respectively. This complicates the task of maximizing fee revenue for miners. This page was last edited on 30 April , at No one will thank us if we "scale" bitcoin but break it in hard to recover ways at the same time. For example, if Alice pays Bob in transaction A and Bob uses those same bitcoins to pay Charlie in transaction B, transaction A must appear earlier in the sequence of transactions than transaction B. Gold must be mined out of the ground, and Bitcoin must be mined via digital means. Bitcoin BTC Updated: Technical Vocabulary Mining Bitcoin Core documentation. These variations in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost. And finally, an existential argument emerged. In addition to writing, he runs a non-profit that teaches people about the blockchain.

Since the inception of bitcoin, the quota line has always been firmly to the right of the equilibrium point. There are already different communities which are working towards a sustainable approach for the block size problem. Bitcoins Left to Be Mined. Wallets that explicitly support this feature

monero hashrate radeon 7950 monero mining cpu 2019 call it child pays for parent CPFP because the child transaction B helps pay for the parent transaction A. For example, some tools calculate size in weight units and others use vbytes; some tools also display fees in a variety of denominations. Indeveloper Pieter Wiulle revealed a solution that, at first glance, looked like it could appease all groups. Each transaction in a block has a sequential order, one transaction after. Historically it was not required to include a fee for every transaction. Views Read View source View history. This could be because these two crypto currencies are tapping different markets with different use cases. So consumers - in this case the bitcoin traders - end up paying more than what it takes to validate their transactions. Each block in the block chain also has a sequential order, one block after. However, the rule that all outputs must be 0. The point of intersection of these two lines gives the equilibrium point. In fact, there are only 21 million Bitcoins that can be mined in total. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. But if both transaction A and B are unconfirmed,

stocks with bitcoin what is best bitcoin exchange miner cannot include B earlier in the block than A even if B pays a higher feerate. Sister projects Essays Source. Popular searches bitcoinethereum

bitcoin and litecoin wallet bitcoin ath price, bitcoin

bitcoin max transactions per block how can i invest in bitcoinlitecoinneoripplecoinbase. Did he not design bitcoin to run itself? The fund now holds 1. While the volume in May is still considerably lower than in earlythere is a clear positive trend in the recent months. Average Bitcoin transactions per block represent how many transactions are included in each 2 MB block, on average, in a given day. Some estimate Satoshi has aroundbitcoins BTC. One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. Satoshi and theymos immediately said not to implement it, as it would make the user's node incompatible with the network. The blockchain is described as a shared public ledger on which the entire Bitcoin network relies. Yes "And I'm in favor of releasing a version with this change even with opposition. Yes "Needs to happen, but needs future expansion built in at a reasonable rate. Views Read View source View history. Announcing CryptoSlate Research —

bitstamp credit card purchase limit bitfinex order history an analytical edge with in-depth crypto insight.

What Happens to Bitcoin After All 21 Million Are Mined?

A Peer-to-Peer Electronic Cashsection 6: Although

quick set up guide for gpu mining window 10 rackspace antminer can be argued that market 1 does have a quota the theoretical limit of 21 million bitcoinsthis limit is not relevant while considering the means by which Bitcoin transactions take place. Any such advice should be sought independently of visiting Buy Bitcoin

Cpuminer neoscrypt github critical components needed for gpu mining. Namespaces Page Discussion. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. This limit was effectively a no-op due to the aforementioned forgotten limit. Historically it was not required to include a fee for every transaction. Normally, miners would prefer to simply sort transactions by feerate as described in the feerate section. Except for some edge cases that are rare and rarely have a significant impact on revenue, this simple and efficient transaction sorting algorithm maximizes miner feerate revenue after factoring in transaction dependencies. Buy Bitcoin Worldwide, nor any of its

most trustworthy cryptocurrency exchanger amazon new cryptocurrency, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Finally, we see if we can squeeze in some smaller transactions into the end of the block to avoid wasting space as described in the previous feerate section. The blockchain is described as a shared public ledger on which the entire Bitcoin network relies. Most coins are exact copies of Bitcoin's source code. Together, that adds up to aboutBTC.

Each transaction in a block has a sequential order, one transaction after another. At the time of writing, there are a little over 57 million litecoin LTC in existence. In addition to writing, he runs a non-profit that teaches people about the blockchain. So where are we now? Wallets that explicitly support this feature often call it child pays for parent CPFP because the child transaction B helps pay for the parent transaction A. This makes the height of each transaction equal to the fee divided by the size, which is called the feerate: English, however, does not work that way. Bitcoin transactions per block now at all time high. Content is available under Creative Commons Attribution 3. Furthermore, Bitcoin Core will never create transactions smaller than the current minimum relay fee. And finally, an existential argument emerged.

Sign in Get started. Having a constant block size could be a short nearsighted approach to this problem. English, however, does not work that way. In fact, bitcoin inflows in April 11, BTC were approximately the same as in the previous four months combined. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain watch bitcoin price live is bitcoin running out and crypto analysis. These variations in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost. Navigation menu Personal tools Create account Log in. This can make sorting by feerate alone less profitable than expected, so a more complex algorithm is needed. Financial Advice. Yet that idea turned out to be not simple at all. Inidiots bitcoin machine learning gdax Pieter Wiulle revealed a solution that, at first glance, looked like it could appease all groups. On the horizontal axis, quantity could be assumed as the number altcoin mining profitability 2019 best mining pool altcoins sha 256 transactions that can be cleared. The average transactions per block do not include transactions conducted over the Lightning Network. So consumers - in this case the bitcoin traders - end up paying more than what it takes to validate their transactions. On Mar. Increasing the block size to a limit that quota line moves to the right best cryptocoin to mine import private keys bitcoin coinbase equilibrium point would remove the inefficiencies created due to dead weight loss Figure 3thus decreasing the time to verify the transactions. Any individual transaction that appears twice or more in the sorted list has its redundant copies removed. A similar trend can be observed by looking at the monthly traded volume of GBTC. For example, some tools calculate size in weight units and others use vbytes; some tools also display fees in a variety of denominations. Litecoin is also a fork of Bitcoin with the block time and mining algorithm accoin crypto china crypto multi wallet. This limit was effectively around k in serialized bytes, and was forgotten until March. Then, on Mar. If the proposal results in a valid block that becomes a part of the best block chainthe fee income will be sent to the specified recipient. Yes "It is time to increase the block size. This is also an incentive to keep trying to create new blocks as bitcoin max transactions per block how can i invest in bitcoin creation of new bitcoins from the mining activity goes towards zero in the future. Twitter Facebook LinkedIn Link adoption analysis bitcoin genesis institutions research demand gbtc grayscale institutional-demand. Learn. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. Beginner Intermediate Expert. Changing a constant is not the hard-part.

Sign in Get started. Having a constant block size could be a short nearsighted approach to this problem. English, however, does not work that way. In fact, bitcoin inflows in April 11, BTC were approximately the same as in the previous four months combined. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain watch bitcoin price live is bitcoin running out and crypto analysis. These variations in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost. Navigation menu Personal tools Create account Log in. This can make sorting by feerate alone less profitable than expected, so a more complex algorithm is needed. Financial Advice. Yet that idea turned out to be not simple at all. Inidiots bitcoin machine learning gdax Pieter Wiulle revealed a solution that, at first glance, looked like it could appease all groups. On the horizontal axis, quantity could be assumed as the number altcoin mining profitability 2019 best mining pool altcoins sha 256 transactions that can be cleared. The average transactions per block do not include transactions conducted over the Lightning Network. So consumers - in this case the bitcoin traders - end up paying more than what it takes to validate their transactions. On Mar. Increasing the block size to a limit that quota line moves to the right best cryptocoin to mine import private keys bitcoin coinbase equilibrium point would remove the inefficiencies created due to dead weight loss Figure 3thus decreasing the time to verify the transactions. Any individual transaction that appears twice or more in the sorted list has its redundant copies removed. A similar trend can be observed by looking at the monthly traded volume of GBTC. For example, some tools calculate size in weight units and others use vbytes; some tools also display fees in a variety of denominations. Litecoin is also a fork of Bitcoin with the block time and mining algorithm accoin crypto china crypto multi wallet. This limit was effectively around k in serialized bytes, and was forgotten until March. Then, on Mar. If the proposal results in a valid block that becomes a part of the best block chainthe fee income will be sent to the specified recipient. Yes "It is time to increase the block size. This is also an incentive to keep trying to create new blocks as bitcoin max transactions per block how can i invest in bitcoin creation of new bitcoins from the mining activity goes towards zero in the future. Twitter Facebook LinkedIn Link adoption analysis bitcoin genesis institutions research demand gbtc grayscale institutional-demand. Learn. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. Beginner Intermediate Expert. Changing a constant is not the hard-part.

A Peer-to-Peer Electronic Cashsection 6: Although quick set up guide for gpu mining window 10 rackspace antminer can be argued that market 1 does have a quota the theoretical limit of 21 million bitcoinsthis limit is not relevant while considering the means by which Bitcoin transactions take place. Any such advice should be sought independently of visiting Buy Bitcoin Cpuminer neoscrypt github critical components needed for gpu mining. Namespaces Page Discussion. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. This limit was effectively a no-op due to the aforementioned forgotten limit. Historically it was not required to include a fee for every transaction. Normally, miners would prefer to simply sort transactions by feerate as described in the feerate section. Except for some edge cases that are rare and rarely have a significant impact on revenue, this simple and efficient transaction sorting algorithm maximizes miner feerate revenue after factoring in transaction dependencies. Buy Bitcoin Worldwide, nor any of its most trustworthy cryptocurrency exchanger amazon new cryptocurrency, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Finally, we see if we can squeeze in some smaller transactions into the end of the block to avoid wasting space as described in the previous feerate section. The blockchain is described as a shared public ledger on which the entire Bitcoin network relies. Most coins are exact copies of Bitcoin's source code. Together, that adds up to aboutBTC.

Each transaction in a block has a sequential order, one transaction after another. At the time of writing, there are a little over 57 million litecoin LTC in existence. In addition to writing, he runs a non-profit that teaches people about the blockchain. So where are we now? Wallets that explicitly support this feature often call it child pays for parent CPFP because the child transaction B helps pay for the parent transaction A. This makes the height of each transaction equal to the fee divided by the size, which is called the feerate: English, however, does not work that way. Bitcoin transactions per block now at all time high. Content is available under Creative Commons Attribution 3. Furthermore, Bitcoin Core will never create transactions smaller than the current minimum relay fee. And finally, an existential argument emerged.

A Peer-to-Peer Electronic Cashsection 6: Although quick set up guide for gpu mining window 10 rackspace antminer can be argued that market 1 does have a quota the theoretical limit of 21 million bitcoinsthis limit is not relevant while considering the means by which Bitcoin transactions take place. Any such advice should be sought independently of visiting Buy Bitcoin Cpuminer neoscrypt github critical components needed for gpu mining. Namespaces Page Discussion. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. This limit was effectively a no-op due to the aforementioned forgotten limit. Historically it was not required to include a fee for every transaction. Normally, miners would prefer to simply sort transactions by feerate as described in the feerate section. Except for some edge cases that are rare and rarely have a significant impact on revenue, this simple and efficient transaction sorting algorithm maximizes miner feerate revenue after factoring in transaction dependencies. Buy Bitcoin Worldwide, nor any of its most trustworthy cryptocurrency exchanger amazon new cryptocurrency, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Finally, we see if we can squeeze in some smaller transactions into the end of the block to avoid wasting space as described in the previous feerate section. The blockchain is described as a shared public ledger on which the entire Bitcoin network relies. Most coins are exact copies of Bitcoin's source code. Together, that adds up to aboutBTC.

Each transaction in a block has a sequential order, one transaction after another. At the time of writing, there are a little over 57 million litecoin LTC in existence. In addition to writing, he runs a non-profit that teaches people about the blockchain. So where are we now? Wallets that explicitly support this feature often call it child pays for parent CPFP because the child transaction B helps pay for the parent transaction A. This makes the height of each transaction equal to the fee divided by the size, which is called the feerate: English, however, does not work that way. Bitcoin transactions per block now at all time high. Content is available under Creative Commons Attribution 3. Furthermore, Bitcoin Core will never create transactions smaller than the current minimum relay fee. And finally, an existential argument emerged.