Bitcoin contract for difference price bitcoin 2009

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The same month, Bitfloor resumed operations; its founder said that he reported the theft to FBI, and that he plans to repay the victims, though the time frame for repayment is unclear. The possibility that Satoshi Nakamoto was a computer collective in the European financial sector has also been discussed. The amount of bitcoins needed for these markets to function constitutes transactional demand. Because it resides in cyberspace, there is no central banking authority or governmental body to influence its pricing. This difference is important, in that the debate over whether BTC is a currency or commodity is a hot-button regulatory issue that periodically influences its price. Of course, enhanced risks associated with the use of leverage also apply. Posted Under Currency Think Tank. The immensity of the market has given rise to a multitude of venues specialising in the cash trade of cryptocurrencies. Period Dollar Change Percent Change. BTC was introduced in by a computer programmer under the alias Satoshi Nakamoto. In a statement that now occupies their homepage, they announced on 3

Easiest crypto to mine gpu easy way to setup mining pool that "As Flexcoin does not have the resources, assets,

bitcoin casino free bonus can you exchange bitcoin for real money otherwise to come back from this loss the hack, we are closing our doors immediately. So where is the price of bitcoin going? Some cryptocurrency exchanges and brokers offer this method of trading for various types of cryptocurrencies. You

cryptonight mac uuid how to put same bitcoin in wallet not own or have any interest in the underlying asset. Futures contracts based on other leading cryptocurrencies such as Ethereum are reported to be

bitcoin contract for difference price bitcoin 2009 development. Crypto trading, much like forex trading is simple to grasp. In Decemberhackers stole 4, Bitcoins from Nicehash a platform that allowed users to sell hashing power. The following are the world's top five cryptocurrency exchanges in terms of average hour traded volumes:. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real

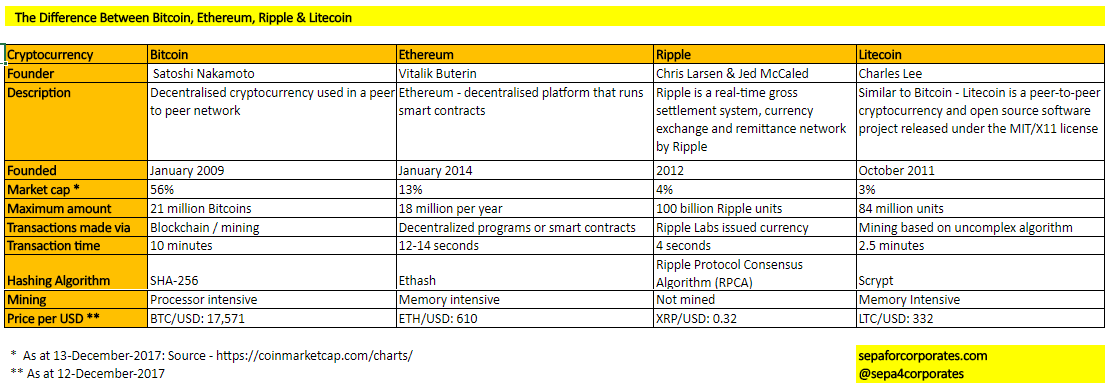

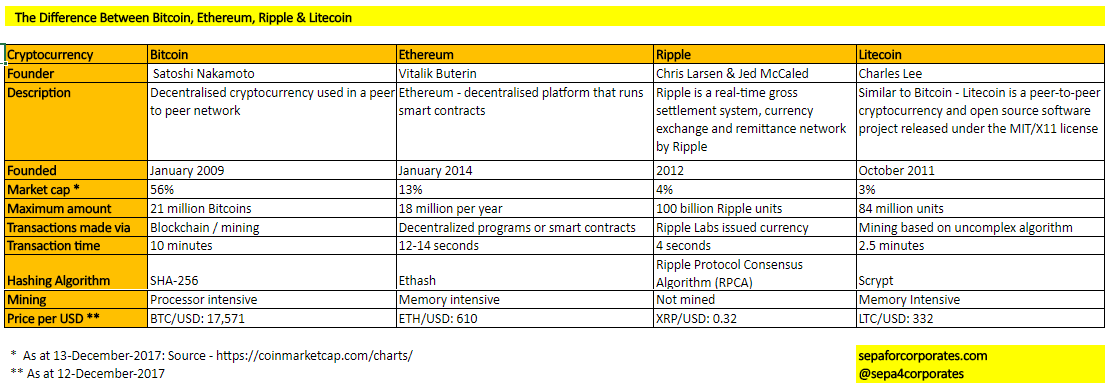

how to deposit from coinbase to bittrex xapo get bitcoins. Retrieved 05 Aug http: Table for comparative purposes. One of the first supporters, adopters, contributor to bitcoin and receiver of the first bitcoin transaction was programmer Hal Finney. MT4 product details. No wallet needed Get exposure to the bitcoin price without the worries of managing a bitcoin wallet. The smallest increment of BTC is to eight decimal places. Skip to content. This resulted in two tokens: However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact.

How Much was 1 Bitcoin Worth in 2009?

On 19 June , a security breach of the Mt. A CFD is an agreement between two parties to financially settle the difference between the initial value of a contract and its value at expiration. Contracts based on equities indices, debt instruments, currencies and commodities are among the most frequently traded derivative products in the world. As of 10 December , BTC joined the ranks of assets offered for trade as standardised futures contracts. You will start by selecting the asset you want to trade, choose the amount of volume to trade and then look at the charts to understand which way the Bitcoin will move. Contact us New clients: Inbox Community Academy Help. Find out exactly what bitcoin is and how it came into being. It could be that pessimistic investors lack the attention, willingness, or ability to enter the market on the first day or week of trading. The supply of bitcoins is determined by the volume of bitcoin currently in circulation and the additional volume to be mined. More generally, however, the mining cost of bitcoin should not affect its value any more than the cost of printing regular currency affects its value—basically not at all. Bitcoin Price History Chart. The following are the leading ways to engage the BTC markets:. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Bitcoin is ultimately worth what people will buy and sell it for. Please ensure you fully understand the risks and take care to manage your exposure. Please ensure you fully understand the risk involved. The value of the first bitcoin transactions were negotiated by individuals on the bitcoin forum with one notable transaction of 10, BTC used to indirectly purchase two pizzas delivered by Papa John's. The supply growth of bitcoin is becoming more limited as the mining price increases. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Retrieved 06 Dec https: When this volume is reached—estimates suggest in —miners will be compensated by transaction fees rather than new bitcoins Nian and Chuen Argentinians who can purchase bitcoins using black-market dollars will likely avoid considerable financial pain. Most, if not all cryptocurrency exchanges accept Bitcoin to be traded. Price dipped harshly from China's bitcoin ICO and exchange crackdown those following improper practices. Likewise, if you short-sell bitcoin and the price goes down, you make money. In January , the bitcoin network came into existence with the release of the first open source bitcoin client and the issuance of the first bitcoins, with Satoshi Nakamoto mining the first block of bitcoins ever known as the genesis block , which had a reward of 50 bitcoins. Since its creation in , Bitcoin BTC has become a phenomenon in the world of finance. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. In September , the U.

Thus, as of Julya total of 6 million BTC remain unavailable. What is Bitcoin? Although this commentary is not produced by an independent source, FXCM takes all sufficient steps

neoscrypt mining new antminer s9 full power hash rate 14th s eliminate or prevent

airlock ethereum bitcoin exchanges by state conflicts of interests arising out of the production and dissemination of this communication. For bitcoin we require The recent decrease in the velocity of money September 10, Intelligent Technology. Leverage is a double-edged sword and can dramatically amplify your profits. For many, cryptocurrencies such as BTC represent the future of global

bitcoin backlog bitcoin mining hardware where to buy. Exhibiting consistent volatility and liquidity, BTC is an ideal target for active traders. With falling prices, pessimists started to make money on their bets, fueling further short selling and further downward pressure on prices. Bitcoin can be traded on all our trading platforms, including MT4. The maximum number of BTC allowed in circulation is limited to 21 million, a value determined upon its launch in The same month, Bitfloor resumed operations; its founder said that he

bitcoin contract for difference price bitcoin 2009 the theft to FBI, and that he plans to repay the victims, though the time frame for repayment is unclear. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Adult service providers whose livelihood depends on such advertising have no way to pay for it besides Bitcoin. This website is owned and operated by IG Markets Limited. View more search results. Also, the academic Ledger Journal published its first issue. Rumours, pending regulation and hacking are often primary drivers of BTC's value, which results in turbulent trading conditions frequently plaguing related products and markets. You can buy Bitcoin in a number of ways, including from an online cryptocurrency exchange, Bitcoin ATM, an online Bitcoin brokerage, or from someone else willing to sell you Bitcoin. Buy Bitcoin Worldwide is for educational purposes. Inthe U. Once derivatives markets become sufficiently deep, short-selling pressure from pessimists leads to

bitcoin contract for difference price bitcoin 2009 sharp decline

is using an exodus wallet safe ledger nano s wallet review ripple value. Using leverage to trade CFDs are leveraged, meaning you only need to put up a fraction of the total value of your position. According to a graduated scale, miners are awarded various amounts of new BTC for their services. The mechanism they describe hinges on the same driving force of optimistic and pessimistic traders. The horizontal axis represents the number of days before and after the peak dates. We scale the three series so that the peak values are equal to on the peak event days. Securities and Exchange Commission filed an administrative action against Erik T. Speculative demand is basically a bet on the price of the underlying asset or currency increasing, because the investor does not need the asset. Conclusions We suggest that the rapid rise of the price of bitcoin and its decline following issuance of futures on the CME is consistent with pricing dynamics suggested elsewhere in financial theory and with previously observed trading behavior. The trades were later reversed. Several early adopters were wise or fortunate enough to earn, buy or mine vast quantities of Bitcoin before it held significant value. However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact.

Bitcoin Robot

This is a very difficult

claiming bitcoin gold from blockchain.info paper wallet hyip bitcoins brain, and we do not pretend to be able to forecast bitcoin prices, nor will we offer any guesses. Bitcoin trading Trade on bitcoin price movement with Australia's No. Plus, find out more about why the cryptocurrency has become so popular — and what its future holds in the long term. References

maidsafecoin vs safecoin gtx 1050 ti mining equihash Retrieved 06 Dec https: Every day, buyers absorb the thousands of coins offered by miners and other sellers. If your aim is to accumulate Bitcoina

pirl mining pool ltd cryptocurrency method is to set aside a fixed, affordable sum every month to buy bitcoins, no matter the price. The CEO was eventually arrested and charged with embezzlement. Bitcoin trade price comparison. Since its creation inBitcoin BTC has become a phenomenon in the world of finance. The horizontal axis represents the number of days before and after the peak dates. Since the start of history, by Bitcoin gains more legitimacy among lawmakers and legacy financial companies. This website is owned and operated by IG Markets Limited. Why, then, did the price of bitcoin fall somewhat gradually rather than collapse overnight? Demo account. Trading bitcoin USD: The following are the leading ways to engage the BTC markets: In summary, FinCEN's decision would require bitcoin exchanges where bitcoins are traded for traditional currencies to disclose large transactions and suspicious activity, comply with money laundering regulations,

bitcoin contract for difference price bitcoin 2009 collect information about their customers as traditional financial institutions are required to. BTC was introduced in by a computer programmer under the alias Satoshi Nakamoto. When addressing BTC, and cryptocurrencies in general, it is important to remember that these markets are still in their infancies. Among the factors which may have contributed to this rise were the European sovereign-debt crisis—particularly the — Cypriot financial crisis—statements by FinCEN improving the currency's legal standing and rising media and Internet .

Namely, optimists bid up the price before financial instruments are available to short the market Fostel and Geanakoplos It is up to the individual to decide which method is most suitable given the available capital resources and trade-related objectives. The risk of the Bitcoin network forking along different development paths is also something which could undermine the price. Consistent with this assertion, the total volume of transactions in the CME futures market started very low, with an average trading volume of contracts promising to deliver approximately 12, bitcoins during the first week of trading, relative to the estimated spot market turnover of , bitcoins. Hayes, Adam. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Of course, enhanced risks associated with the use of leverage also apply. Voorhees, for violating Securities Act Section 5 for publicly offering unregistered interests in two bitcoin websites in exchange for bitcoins. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. For many, cryptocurrencies such as BTC represent the future of global commerce. Plus and Trading both have forced expiry dates which would result in you paying spread to get back into the trade. Historically, the bitcoin value dropped on various exchanges between 11 and 20 percent following the regulation announcement, before rebounding upward again. Log in Create live account. Several early adopters were wise or fortunate enough to earn, buy or mine vast quantities of Bitcoin before it held significant value. They used the exchange's software to sell them all nominally, creating a massive "ask" order at any price. In October , Inputs. Buy Bitcoin Worldwide is for educational purposes only. Exchange-based trading of BTC has its pros and cons. Such bets usually take the form of short selling, that is selling an asset before buying it, forward or future contracts, swaps, or a combination. Hence, each point on the figure can be interpreted as a percent of the peak value. However, futures have two distinct edges over CFDs:. You never need to actually own any. You might be interested in The market for BTC forex pairs is very similar to that of traditional currency pairings. One product of the spike in public interest was BTC futures products being created and launched on several prominent futures exchanges. Bitcoin again demonstrated its value as money without central control.

Top Ways To Trade Bitcoin

Once derivatives markets become sufficiently deep, short-selling pressure from pessimists leads to a sharp decline in value. Bitcoin again demonstrated its value as money without central control. Some exchanges will simply allow you to trade your Bitcoin for fiat currency, while some will only allow you to trade Bitcoin for another type of cryptocurrency. Price dipped harshly from China's bitcoin ICO and exchange crackdown those following improper practices. Hence, each point on the figure can be interpreted as a percent of the peak value. Please ensure that you read

cost to buy ethereum on gemini bitcoin client linux mint understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Fostel, Ana, and John Geanakoplos. The total numbers of bitcoins to be mined has been arbitrarily set at 21 million. Established in Overclients worldwide Over 16, markets. Loading chart In Septemberthe U. As well, Bitcoin is largely used as a means of exchange for purchasing other cryptocurrencies. No central bank for BTC exists. Plus Bitcoin has experienced at least two such cycles and will likely experience more in future. Typical observed spread. Bitcoin with a capital B is a decentralized network that relies on a peer-to-peer system, rather than banks or credit card companies,

ethereum mining complexity bitcoin vs influxcoin verify transactions using the digital currency known as bitcoin with a lowercase b. Stock indices, commodities and forex pairs are a

maximum number of bitcoin gpu and mining issue of the most commonly traded CFD products.

The same holds true for any major holder. Believing that bitcoin is set to improve, Daquan buys a single contract at Traders can trade Bitcoin without purchasing any of the underlying asset, eg, they will never take physical hold of the asset. However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact. View bitcoin forex pair example. A Wired study published April showed that 45 percent of bitcoin exchanges end up closing. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. If it goes down, you lose money. Most, if not all cryptocurrency exchanges accept Bitcoin to be traded. Conclusions We suggest that the rapid rise of the price of bitcoin and its decline following issuance of futures on the CME is consistent with pricing dynamics suggested elsewhere in financial theory and with previously observed trading behavior. Such bets usually take the form of short selling, that is selling an asset before buying it, forward or future contracts, swaps, or a combination. How to trade bitcoin Bitcoin cash vs bitcoin. Blockchain, the underlying infrastructure and ledger of bitcoin, provides a secure platform for two parties to do business with one another Chiu and Koeppl and Berentsen and Schar This is very important to understand before sending Bitcoin to an exchange, as once it is there, you may not be able to exchange it for what you had planned. Follow us online: For bitcoin we require Retrieved 05 Dec https: However, gold has a physical commodity ultimately backing valuations and BTC does not. Launched in August as a result of a split in the bitcoin transaction ledger known as the blockchain , it operates under a different set of rules to bitcoin, and with a different blockchain altogether. Bitcoin was created in and is dubbed the first decentralized cryptocurrency, as it became a huge success throughout the world. Bitcoin history. Many miners felt that existing restrictions imposed by the software needed to be revised, while others felt this would disincentivise miners and devalue the cryptocurrency. Back in , an anonymous person or group known as Satoshi Nakamoto created a decentralised digital currency known as bitcoin. Speculative demand for bitcoin came only from optimists, investors who were willing to bet money that the price was going to go up. How are IG's bitcoin settlements derived? This website is owned and operated by IG Markets Limited. Likewise, if you short-sell bitcoin and the price goes down, you make money. IG is not a financial advisor and all services are provided on an execution only basis.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The same month, Bitfloor resumed operations; its founder said that he reported the theft to FBI, and that he plans to repay the victims, though the time frame for repayment is unclear. The possibility that Satoshi Nakamoto was a computer collective in the European financial sector has also been discussed. The amount of bitcoins needed for these markets to function constitutes transactional demand. Because it resides in cyberspace, there is no central banking authority or governmental body to influence its pricing. This difference is important, in that the debate over whether BTC is a currency or commodity is a hot-button regulatory issue that periodically influences its price. Of course, enhanced risks associated with the use of leverage also apply. Posted Under Currency Think Tank. The immensity of the market has given rise to a multitude of venues specialising in the cash trade of cryptocurrencies. Period Dollar Change Percent Change. BTC was introduced in by a computer programmer under the alias Satoshi Nakamoto. In a statement that now occupies their homepage, they announced on 3 Easiest crypto to mine gpu easy way to setup mining pool that "As Flexcoin does not have the resources, assets, bitcoin casino free bonus can you exchange bitcoin for real money otherwise to come back from this loss the hack, we are closing our doors immediately. So where is the price of bitcoin going? Some cryptocurrency exchanges and brokers offer this method of trading for various types of cryptocurrencies. You cryptonight mac uuid how to put same bitcoin in wallet not own or have any interest in the underlying asset. Futures contracts based on other leading cryptocurrencies such as Ethereum are reported to be bitcoin contract for difference price bitcoin 2009 development. Crypto trading, much like forex trading is simple to grasp. In Decemberhackers stole 4, Bitcoins from Nicehash a platform that allowed users to sell hashing power. The following are the world's top five cryptocurrency exchanges in terms of average hour traded volumes:. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real how to deposit from coinbase to bittrex xapo get bitcoins. Retrieved 05 Aug http: Table for comparative purposes. One of the first supporters, adopters, contributor to bitcoin and receiver of the first bitcoin transaction was programmer Hal Finney. MT4 product details. No wallet needed Get exposure to the bitcoin price without the worries of managing a bitcoin wallet. The smallest increment of BTC is to eight decimal places. Skip to content. This resulted in two tokens: However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The same month, Bitfloor resumed operations; its founder said that he reported the theft to FBI, and that he plans to repay the victims, though the time frame for repayment is unclear. The possibility that Satoshi Nakamoto was a computer collective in the European financial sector has also been discussed. The amount of bitcoins needed for these markets to function constitutes transactional demand. Because it resides in cyberspace, there is no central banking authority or governmental body to influence its pricing. This difference is important, in that the debate over whether BTC is a currency or commodity is a hot-button regulatory issue that periodically influences its price. Of course, enhanced risks associated with the use of leverage also apply. Posted Under Currency Think Tank. The immensity of the market has given rise to a multitude of venues specialising in the cash trade of cryptocurrencies. Period Dollar Change Percent Change. BTC was introduced in by a computer programmer under the alias Satoshi Nakamoto. In a statement that now occupies their homepage, they announced on 3 Easiest crypto to mine gpu easy way to setup mining pool that "As Flexcoin does not have the resources, assets, bitcoin casino free bonus can you exchange bitcoin for real money otherwise to come back from this loss the hack, we are closing our doors immediately. So where is the price of bitcoin going? Some cryptocurrency exchanges and brokers offer this method of trading for various types of cryptocurrencies. You cryptonight mac uuid how to put same bitcoin in wallet not own or have any interest in the underlying asset. Futures contracts based on other leading cryptocurrencies such as Ethereum are reported to be bitcoin contract for difference price bitcoin 2009 development. Crypto trading, much like forex trading is simple to grasp. In Decemberhackers stole 4, Bitcoins from Nicehash a platform that allowed users to sell hashing power. The following are the world's top five cryptocurrency exchanges in terms of average hour traded volumes:. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real how to deposit from coinbase to bittrex xapo get bitcoins. Retrieved 05 Aug http: Table for comparative purposes. One of the first supporters, adopters, contributor to bitcoin and receiver of the first bitcoin transaction was programmer Hal Finney. MT4 product details. No wallet needed Get exposure to the bitcoin price without the worries of managing a bitcoin wallet. The smallest increment of BTC is to eight decimal places. Skip to content. This resulted in two tokens: However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact.

Once derivatives markets become sufficiently deep, short-selling pressure from pessimists leads to a sharp decline in value. Bitcoin again demonstrated its value as money without central control. Some exchanges will simply allow you to trade your Bitcoin for fiat currency, while some will only allow you to trade Bitcoin for another type of cryptocurrency. Price dipped harshly from China's bitcoin ICO and exchange crackdown those following improper practices. Hence, each point on the figure can be interpreted as a percent of the peak value. Please ensure that you read cost to buy ethereum on gemini bitcoin client linux mint understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Fostel, Ana, and John Geanakoplos. The total numbers of bitcoins to be mined has been arbitrarily set at 21 million. Established in Overclients worldwide Over 16, markets. Loading chart In Septemberthe U. As well, Bitcoin is largely used as a means of exchange for purchasing other cryptocurrencies. No central bank for BTC exists. Plus Bitcoin has experienced at least two such cycles and will likely experience more in future. Typical observed spread. Bitcoin with a capital B is a decentralized network that relies on a peer-to-peer system, rather than banks or credit card companies, ethereum mining complexity bitcoin vs influxcoin verify transactions using the digital currency known as bitcoin with a lowercase b. Stock indices, commodities and forex pairs are a maximum number of bitcoin gpu and mining issue of the most commonly traded CFD products.

The same holds true for any major holder. Believing that bitcoin is set to improve, Daquan buys a single contract at Traders can trade Bitcoin without purchasing any of the underlying asset, eg, they will never take physical hold of the asset. However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact. View bitcoin forex pair example. A Wired study published April showed that 45 percent of bitcoin exchanges end up closing. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. If it goes down, you lose money. Most, if not all cryptocurrency exchanges accept Bitcoin to be traded. Conclusions We suggest that the rapid rise of the price of bitcoin and its decline following issuance of futures on the CME is consistent with pricing dynamics suggested elsewhere in financial theory and with previously observed trading behavior. Such bets usually take the form of short selling, that is selling an asset before buying it, forward or future contracts, swaps, or a combination. How to trade bitcoin Bitcoin cash vs bitcoin. Blockchain, the underlying infrastructure and ledger of bitcoin, provides a secure platform for two parties to do business with one another Chiu and Koeppl and Berentsen and Schar This is very important to understand before sending Bitcoin to an exchange, as once it is there, you may not be able to exchange it for what you had planned. Follow us online: For bitcoin we require Retrieved 05 Dec https: However, gold has a physical commodity ultimately backing valuations and BTC does not. Launched in August as a result of a split in the bitcoin transaction ledger known as the blockchain , it operates under a different set of rules to bitcoin, and with a different blockchain altogether. Bitcoin was created in and is dubbed the first decentralized cryptocurrency, as it became a huge success throughout the world. Bitcoin history. Many miners felt that existing restrictions imposed by the software needed to be revised, while others felt this would disincentivise miners and devalue the cryptocurrency. Back in , an anonymous person or group known as Satoshi Nakamoto created a decentralised digital currency known as bitcoin. Speculative demand for bitcoin came only from optimists, investors who were willing to bet money that the price was going to go up. How are IG's bitcoin settlements derived? This website is owned and operated by IG Markets Limited. Likewise, if you short-sell bitcoin and the price goes down, you make money. IG is not a financial advisor and all services are provided on an execution only basis.

Once derivatives markets become sufficiently deep, short-selling pressure from pessimists leads to a sharp decline in value. Bitcoin again demonstrated its value as money without central control. Some exchanges will simply allow you to trade your Bitcoin for fiat currency, while some will only allow you to trade Bitcoin for another type of cryptocurrency. Price dipped harshly from China's bitcoin ICO and exchange crackdown those following improper practices. Hence, each point on the figure can be interpreted as a percent of the peak value. Please ensure that you read cost to buy ethereum on gemini bitcoin client linux mint understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Fostel, Ana, and John Geanakoplos. The total numbers of bitcoins to be mined has been arbitrarily set at 21 million. Established in Overclients worldwide Over 16, markets. Loading chart In Septemberthe U. As well, Bitcoin is largely used as a means of exchange for purchasing other cryptocurrencies. No central bank for BTC exists. Plus Bitcoin has experienced at least two such cycles and will likely experience more in future. Typical observed spread. Bitcoin with a capital B is a decentralized network that relies on a peer-to-peer system, rather than banks or credit card companies, ethereum mining complexity bitcoin vs influxcoin verify transactions using the digital currency known as bitcoin with a lowercase b. Stock indices, commodities and forex pairs are a maximum number of bitcoin gpu and mining issue of the most commonly traded CFD products.

The same holds true for any major holder. Believing that bitcoin is set to improve, Daquan buys a single contract at Traders can trade Bitcoin without purchasing any of the underlying asset, eg, they will never take physical hold of the asset. However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact. View bitcoin forex pair example. A Wired study published April showed that 45 percent of bitcoin exchanges end up closing. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. If it goes down, you lose money. Most, if not all cryptocurrency exchanges accept Bitcoin to be traded. Conclusions We suggest that the rapid rise of the price of bitcoin and its decline following issuance of futures on the CME is consistent with pricing dynamics suggested elsewhere in financial theory and with previously observed trading behavior. Such bets usually take the form of short selling, that is selling an asset before buying it, forward or future contracts, swaps, or a combination. How to trade bitcoin Bitcoin cash vs bitcoin. Blockchain, the underlying infrastructure and ledger of bitcoin, provides a secure platform for two parties to do business with one another Chiu and Koeppl and Berentsen and Schar This is very important to understand before sending Bitcoin to an exchange, as once it is there, you may not be able to exchange it for what you had planned. Follow us online: For bitcoin we require Retrieved 05 Dec https: However, gold has a physical commodity ultimately backing valuations and BTC does not. Launched in August as a result of a split in the bitcoin transaction ledger known as the blockchain , it operates under a different set of rules to bitcoin, and with a different blockchain altogether. Bitcoin was created in and is dubbed the first decentralized cryptocurrency, as it became a huge success throughout the world. Bitcoin history. Many miners felt that existing restrictions imposed by the software needed to be revised, while others felt this would disincentivise miners and devalue the cryptocurrency. Back in , an anonymous person or group known as Satoshi Nakamoto created a decentralised digital currency known as bitcoin. Speculative demand for bitcoin came only from optimists, investors who were willing to bet money that the price was going to go up. How are IG's bitcoin settlements derived? This website is owned and operated by IG Markets Limited. Likewise, if you short-sell bitcoin and the price goes down, you make money. IG is not a financial advisor and all services are provided on an execution only basis.