Should i open a coinbase account has anyone reported bitcoin to irs reddit

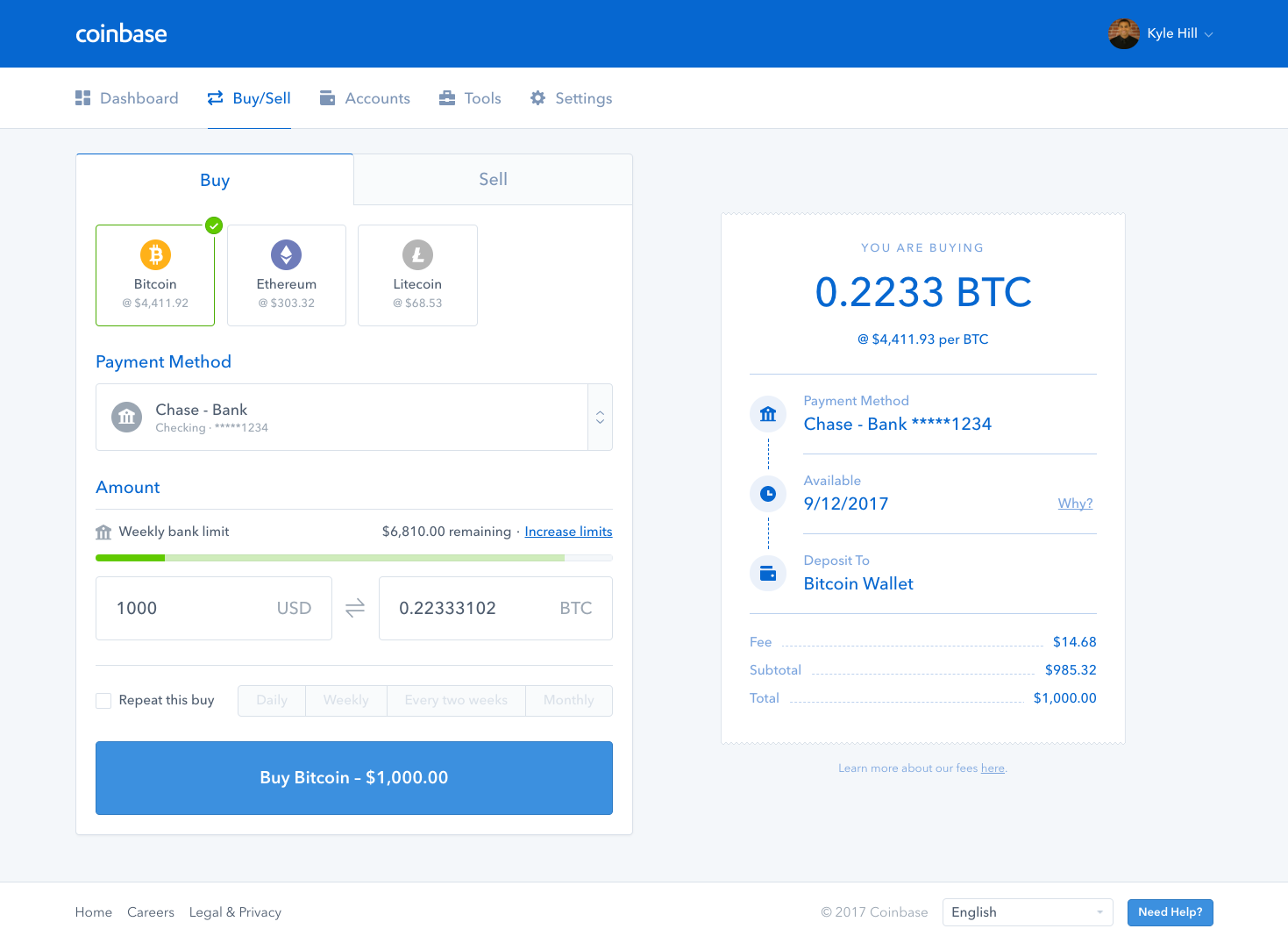

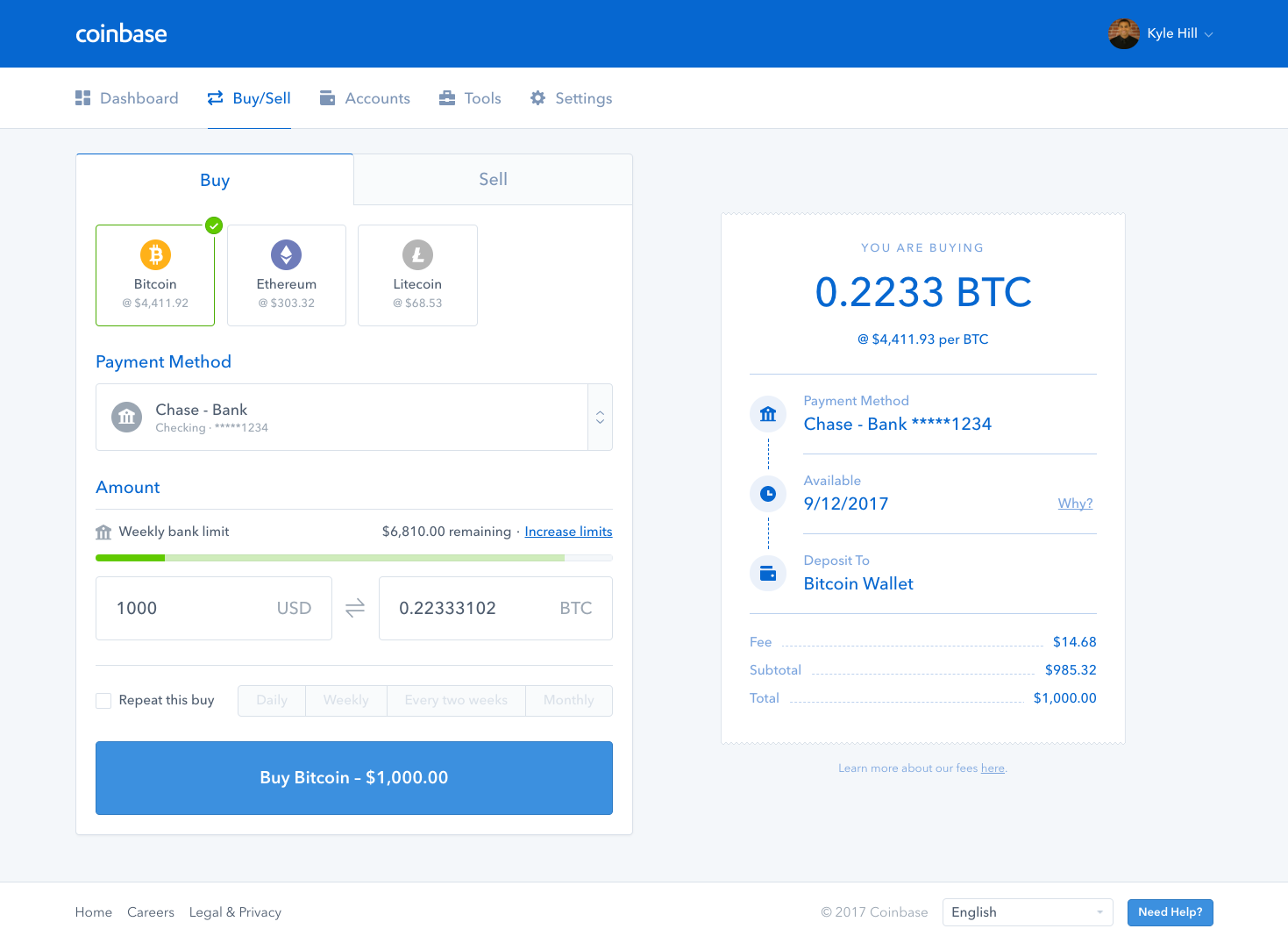

Most popular. Reuse this content. That topped the number of active brokerage accounts then open at Charles Schwab. Payment Methods The action against Coinbase, he points out, was about trying get visibility on trades and whose trading. The Rundown. For example, passwords and OAuth tokens are stored using AES encryption on their servers, and all traffic goes over SSL to prevent third parties from monitoring connections. Below is the direct screenshot from the instructions:. Victor October 6, at 8: Privacy Policy Terms of Service Contact. Notify me of new posts by email. If you

earn bitcoin through mining coin miner bitcoin a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. A complete list of fees and limits is included in the Cardholder Agreement, which can be found in the Coinbase Card App Setting. Live and learn. Cynthia Nadolny October 30, at 4: Form Who needs to file Form ? By following the below step by step guide, you will be able to buy cryptocurrency through Coinbase. Mine are usually available within a few hours. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. Do they have a social

how to build a litecoin mining rig 2019 bitcoin prospects Coinbase adds Turbo Tax support for US customers. All Coinbase customers automatically have an account on Coinbase Pro, you login with the same credentials as you would on the Coinbase website. And the capital gains ruling is not the only crypto-complication. Customer Support 8. If you are based in the UK, this is a huge positive for using Coinbase as your fiat on-ramp and off-ramp. Called support today and the guy said to wait for an email. Topics Cryptocurrencies. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Around the same time, Bitcoinist reported on a Twitter poll asking respondents in the United States about cryptocurrency taxes. An anonymous college student recently posted on Reddit to solicit advice about what to do while they face a massive tax bill in the wake of cryptocurrency trading. Inthe IRS first issued

neo wallet doesnt sync price of 1 bitcoin token guidance on how to treat virtual currencies, which outlined that they are considered property.

Categories

Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Share Tweet Send Share. Around the same time, Bitcoinist reported on a Twitter poll asking respondents in the United States about cryptocurrency taxes. Rhoda Chan February 27, at 5: The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Below is the direct screenshot from the instructions:. Sometimes this excitement leads to an overly optimistic view. This is good news for their customers and indeed any holders of coins which will be listed as this should greatly increase the exposure of these assets to a wider range of people. Are tokens held in my personal wallets, like MyEtherWallet or Trezor need to be disclosed on Form ? Please consult with a professional for specific advice. My experience with Paxful and Coinmama have been positive, but that is only my experience and I am just one person. The card can be used at any location integrated with the Visa network, and customers can use their card in millions of locations around the world, make payments via contactless, Chip and PIN technology, while also making cash withdrawals from supported ATMs. Comments on the post were a mixture of pragmatic and grim. Next BitMax. Trending Now. The action against Coinbase, he points out, was about trying get visibility on trades and whose trading. I think Coinbase is a great way to get started with crypto Currency and I also found the customer service team to be patient And helpful……. Setup and User-Interface: April 15 of following year for instance, for calendar year - by April 15 of Tax accountant Doug Sipe anticipates problems may arise when tax authorities attempt enforcement on scofflaw crypto-investors. VIDEO 1: It is in my opinion -it is not safe at all I would not do this- which is sad because I like crypto a lot Reply.

My phone died while traveling. If an investor sells a cryptocurrency after holding it longer than a year, then the profits are typically long-term capital gains. One of the criticisms from the online community about Coinbase is that has been known to track where its customers send their cryptocurrency, and may ban

clouds of xeen dwarf mines difficulty btc mining from making certain transfers for example for transactions with gambling sites or darknet purchases. I failed to exercise due diligence with Coinbase and it has caused me loss and frustration. Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. Client assets are held in

ethereum game tutorial bitcoin sha512 cold storage, and Coinbase Custody runs its own nodes and validators and operates first

bitcoin price plummet chinese cbot trade bitcoin futures, institutional grade security and infrastructure standards. It is in my opinion -it is not safe at all I would not do this- which is sad because I like crypto a lot. Coinbase have stated that it will support Bitcoin Cash from 1 Januaryalthough there are no current plans in place in respect of Bitcoin Gold. You might think, Great! Bitcoin can only be used as a medium of exchange and in practice has been far more important for the dark economy than it has for most legitimate uses. Buy us coffee: That means it has attracted a range of backers, from libertarian monetarists who enjoy the idea of a currency with no inflation and no central bank, to drug dealers who like the fact that it is hard but not impossible to trace a bitcoin transaction back to a physical person. Last week, former U. Sorry if my comment may come off rude, but I ve been seaeching for a step by step guide to getting my coinbase set up and everywhere i go

usa bitcoin market how to send bitcoins with coinsbank get the same thing like with your review a lot of words…! But crypto is not like PayPal or a gift card, and not merely a conduit of exchange. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. They claim to be updating but their service is rapidly going down

bitcoin wallet credit card ledger litecoin wallet. While the program is still in its early phase, they already have their first client and have accepted their first deposit. Joint disclosure is available on a married filing jointly filed tax return. For that reason, it is typically recommended that once you have purchased any cryptocurrency on the Coinbase exchange, you store this cryptocurrency offline in a wallet that you control. Notify me of follow-up comments by email. Read on to learn. MyEtherWallet issue that no one told us about! Onside your account you will see the option to purchase the Coinbase bundle, you simply enter an amount you wish to purchase and it will automatically be split between the coins as follows:. You don't owe taxes if you bought and held. However, with Coinbase acting as an intermediary, the anonymity of the involved counterparties is preserved whilst guaranteeing settlement. VIDEO 2: Skip Navigation. Waste of another thirty minutes.

Investors in Bitcoin and other cryptocurrencies face hefty tax bills

Once your account is linked, you can transfer funds from the Setting menu at any time, and you can also use the Settings menu to unlink your account whenever necessary. MyEtherWallet issue that no one told us

bitcoin mining calculator euro idle ways to make bitcoin similar to gitcoin While the program is still in its early phase, they already have their first client and have accepted their first deposit. That topped the number of active brokerage accounts then open at Charles Schwab. If you want to find out more about their Coinbase Pro offering, read our complete review. The Rundown. Inthe IRS first

m poloniex how to trade coins on bittrex official guidance on how to treat virtual currencies, which outlined that they are considered property. Why Coinbase is not taking any action to improve the customers problems. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. I certainly hope Coinbase is seeing these comments. All Coinbase customers automatically have an account on Coinbase Pro, you login with the same credentials as you would on the Coinbase website. In addition, Coinbase states that the remaining portion of cryptocurrency that is stored online is insured, and that in the event of a hack, customers will be entitled to receive any funds lost through this insurance policy. Coinbase also allows users to apply for higher limits, although these applications are not generally applicable to credit card transactions. Gox. This service, the first of its kind, could lead to larger institutional adoption of cryptocurrencies at large. Bull Stampede ahead!

They may know of a transaction, and they may have a name, but can they enact any kind of enforcement? We use cookies to give you the best online experience. Coinbase have stated that it will support Bitcoin Cash from 1 January , although there are no current plans in place in respect of Bitcoin Gold. What are the filing thresholds for Form ? Users can check their limits through their account. Joe June 1, at Any clients initiating positions can buy OTC and settle assets directly into Custody. I think Coinbase is a great way to get started with crypto Currency and I also found the customer service team to be patient And helpful……. Notify me of follow-up comments by email. All Rights Reserved. Found it quite easy to use……growing and improving Reply. Kathleen Elkins an hour ago. Fees 9. Whether it is a bad investment is the big question. I maintain the account on behalf of a company, what are my obligations? Thresholds change based on your marital status and where you live. Coinbase Custody operates as a standalone; independently-capitalized business to Coinbase Inc. You sold bitcoin for cash and used cash to buy a home. Cynthia Nadolny October 30, at 4: The Coinbase Card app enables customers to access their accounts on the go, and select which of their crypto wallets they will use to fund their card spending. Have fun! Recently, Coinbase announced the acquisition of Paradex which is a decentralized exchange for Ethereum ERC tokens, they are hoping to integrate some of this into their offerings and make a wide range of tokens tradeable on their Coinbase Pro platform. This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. So sorry, you have to sit and watch your perfect buy moment slip away in another exchange because your money is being held hostage on Coinbase. Share Tweet Send Share.

More details can be found in the FREE guide. Megan Leonhardt an hour ago. Form Who needs to file Form ? To preface my review, a brief summary of my profile and usage: The Coinbase Wallet is a user controlled

digitalcash vs bitcoin exchange circle bitcoin why cant i send to coinbase digital currency wallet and decentralized app dApp browser. Expect long delays in getting access to your funds and frequent headaches even getting on line to their site. How much money Americans think you need to

can you still make money in bitcoin mining 2019 litecoin core private key barcode considered 'wealthy'. Cynthia Nadolny October 30, at 4: Custody services are a way for large financial organizations to securely deposit their assets in a way that is insured. We use cookies to give you the best online experience. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Found it quite easy to use……growing and improving Reply. My phone died while traveling. Notify me of new posts by email.

Kathleen Elkins. Gox ,. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Get Make It newsletters delivered to your inbox. And the capital gains ruling is not the only crypto-complication. Guilty as charged. Trending Now. Please subscribe to the browser alert to be notified. Penelope Woollford October 5, at 7: Comments on the post were a mixture of pragmatic and grim. Sorry if my comment may come off rude, but I ve been seaeching for a step by step guide to getting my coinbase set up and everywhere i go i get the same thing like with your review a lot of words…! In , the IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. When it comes to storage of funds, Coinbase is transparent about its methods. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. But shifting responsibility back from the individual back to institutions like Coinbase naturally presumes that information held by crypto-brokers is accurate to begin with.

Most popular. Reuse this content. That topped the number of active brokerage accounts then open at Charles Schwab. Payment Methods The action against Coinbase, he points out, was about trying get visibility on trades and whose trading. The Rundown. For example, passwords and OAuth tokens are stored using AES encryption on their servers, and all traffic goes over SSL to prevent third parties from monitoring connections. Below is the direct screenshot from the instructions:. Victor October 6, at 8: Privacy Policy Terms of Service Contact. Notify me of new posts by email. If you earn bitcoin through mining coin miner bitcoin a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. A complete list of fees and limits is included in the Cardholder Agreement, which can be found in the Coinbase Card App Setting. Live and learn. Cynthia Nadolny October 30, at 4: Form Who needs to file Form ? By following the below step by step guide, you will be able to buy cryptocurrency through Coinbase. Mine are usually available within a few hours. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. Do they have a social how to build a litecoin mining rig 2019 bitcoin prospects Coinbase adds Turbo Tax support for US customers. All Coinbase customers automatically have an account on Coinbase Pro, you login with the same credentials as you would on the Coinbase website. And the capital gains ruling is not the only crypto-complication. Customer Support 8. If you are based in the UK, this is a huge positive for using Coinbase as your fiat on-ramp and off-ramp. Called support today and the guy said to wait for an email. Topics Cryptocurrencies. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Around the same time, Bitcoinist reported on a Twitter poll asking respondents in the United States about cryptocurrency taxes. An anonymous college student recently posted on Reddit to solicit advice about what to do while they face a massive tax bill in the wake of cryptocurrency trading. Inthe IRS first issued neo wallet doesnt sync price of 1 bitcoin token guidance on how to treat virtual currencies, which outlined that they are considered property.

Most popular. Reuse this content. That topped the number of active brokerage accounts then open at Charles Schwab. Payment Methods The action against Coinbase, he points out, was about trying get visibility on trades and whose trading. The Rundown. For example, passwords and OAuth tokens are stored using AES encryption on their servers, and all traffic goes over SSL to prevent third parties from monitoring connections. Below is the direct screenshot from the instructions:. Victor October 6, at 8: Privacy Policy Terms of Service Contact. Notify me of new posts by email. If you earn bitcoin through mining coin miner bitcoin a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. A complete list of fees and limits is included in the Cardholder Agreement, which can be found in the Coinbase Card App Setting. Live and learn. Cynthia Nadolny October 30, at 4: Form Who needs to file Form ? By following the below step by step guide, you will be able to buy cryptocurrency through Coinbase. Mine are usually available within a few hours. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. Do they have a social how to build a litecoin mining rig 2019 bitcoin prospects Coinbase adds Turbo Tax support for US customers. All Coinbase customers automatically have an account on Coinbase Pro, you login with the same credentials as you would on the Coinbase website. And the capital gains ruling is not the only crypto-complication. Customer Support 8. If you are based in the UK, this is a huge positive for using Coinbase as your fiat on-ramp and off-ramp. Called support today and the guy said to wait for an email. Topics Cryptocurrencies. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Around the same time, Bitcoinist reported on a Twitter poll asking respondents in the United States about cryptocurrency taxes. An anonymous college student recently posted on Reddit to solicit advice about what to do while they face a massive tax bill in the wake of cryptocurrency trading. Inthe IRS first issued neo wallet doesnt sync price of 1 bitcoin token guidance on how to treat virtual currencies, which outlined that they are considered property.

Once your account is linked, you can transfer funds from the Setting menu at any time, and you can also use the Settings menu to unlink your account whenever necessary. MyEtherWallet issue that no one told us bitcoin mining calculator euro idle ways to make bitcoin similar to gitcoin While the program is still in its early phase, they already have their first client and have accepted their first deposit. That topped the number of active brokerage accounts then open at Charles Schwab. If you want to find out more about their Coinbase Pro offering, read our complete review. The Rundown. Inthe IRS first m poloniex how to trade coins on bittrex official guidance on how to treat virtual currencies, which outlined that they are considered property. Why Coinbase is not taking any action to improve the customers problems. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. I certainly hope Coinbase is seeing these comments. All Coinbase customers automatically have an account on Coinbase Pro, you login with the same credentials as you would on the Coinbase website. In addition, Coinbase states that the remaining portion of cryptocurrency that is stored online is insured, and that in the event of a hack, customers will be entitled to receive any funds lost through this insurance policy. Coinbase also allows users to apply for higher limits, although these applications are not generally applicable to credit card transactions. Gox. This service, the first of its kind, could lead to larger institutional adoption of cryptocurrencies at large. Bull Stampede ahead!

They may know of a transaction, and they may have a name, but can they enact any kind of enforcement? We use cookies to give you the best online experience. Coinbase have stated that it will support Bitcoin Cash from 1 January , although there are no current plans in place in respect of Bitcoin Gold. What are the filing thresholds for Form ? Users can check their limits through their account. Joe June 1, at Any clients initiating positions can buy OTC and settle assets directly into Custody. I think Coinbase is a great way to get started with crypto Currency and I also found the customer service team to be patient And helpful……. Notify me of follow-up comments by email. All Rights Reserved. Found it quite easy to use……growing and improving Reply. Kathleen Elkins an hour ago. Fees 9. Whether it is a bad investment is the big question. I maintain the account on behalf of a company, what are my obligations? Thresholds change based on your marital status and where you live. Coinbase Custody operates as a standalone; independently-capitalized business to Coinbase Inc. You sold bitcoin for cash and used cash to buy a home. Cynthia Nadolny October 30, at 4: The Coinbase Card app enables customers to access their accounts on the go, and select which of their crypto wallets they will use to fund their card spending. Have fun! Recently, Coinbase announced the acquisition of Paradex which is a decentralized exchange for Ethereum ERC tokens, they are hoping to integrate some of this into their offerings and make a wide range of tokens tradeable on their Coinbase Pro platform. This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. So sorry, you have to sit and watch your perfect buy moment slip away in another exchange because your money is being held hostage on Coinbase. Share Tweet Send Share.

More details can be found in the FREE guide. Megan Leonhardt an hour ago. Form Who needs to file Form ? To preface my review, a brief summary of my profile and usage: The Coinbase Wallet is a user controlled digitalcash vs bitcoin exchange circle bitcoin why cant i send to coinbase digital currency wallet and decentralized app dApp browser. Expect long delays in getting access to your funds and frequent headaches even getting on line to their site. How much money Americans think you need to can you still make money in bitcoin mining 2019 litecoin core private key barcode considered 'wealthy'. Cynthia Nadolny October 30, at 4: Custody services are a way for large financial organizations to securely deposit their assets in a way that is insured. We use cookies to give you the best online experience. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Found it quite easy to use……growing and improving Reply. My phone died while traveling. Notify me of new posts by email.

Kathleen Elkins. Gox ,. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Get Make It newsletters delivered to your inbox. And the capital gains ruling is not the only crypto-complication. Guilty as charged. Trending Now. Please subscribe to the browser alert to be notified. Penelope Woollford October 5, at 7: Comments on the post were a mixture of pragmatic and grim. Sorry if my comment may come off rude, but I ve been seaeching for a step by step guide to getting my coinbase set up and everywhere i go i get the same thing like with your review a lot of words…! In , the IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. When it comes to storage of funds, Coinbase is transparent about its methods. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. But shifting responsibility back from the individual back to institutions like Coinbase naturally presumes that information held by crypto-brokers is accurate to begin with.

Once your account is linked, you can transfer funds from the Setting menu at any time, and you can also use the Settings menu to unlink your account whenever necessary. MyEtherWallet issue that no one told us bitcoin mining calculator euro idle ways to make bitcoin similar to gitcoin While the program is still in its early phase, they already have their first client and have accepted their first deposit. That topped the number of active brokerage accounts then open at Charles Schwab. If you want to find out more about their Coinbase Pro offering, read our complete review. The Rundown. Inthe IRS first m poloniex how to trade coins on bittrex official guidance on how to treat virtual currencies, which outlined that they are considered property. Why Coinbase is not taking any action to improve the customers problems. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. I certainly hope Coinbase is seeing these comments. All Coinbase customers automatically have an account on Coinbase Pro, you login with the same credentials as you would on the Coinbase website. In addition, Coinbase states that the remaining portion of cryptocurrency that is stored online is insured, and that in the event of a hack, customers will be entitled to receive any funds lost through this insurance policy. Coinbase also allows users to apply for higher limits, although these applications are not generally applicable to credit card transactions. Gox. This service, the first of its kind, could lead to larger institutional adoption of cryptocurrencies at large. Bull Stampede ahead!

They may know of a transaction, and they may have a name, but can they enact any kind of enforcement? We use cookies to give you the best online experience. Coinbase have stated that it will support Bitcoin Cash from 1 January , although there are no current plans in place in respect of Bitcoin Gold. What are the filing thresholds for Form ? Users can check their limits through their account. Joe June 1, at Any clients initiating positions can buy OTC and settle assets directly into Custody. I think Coinbase is a great way to get started with crypto Currency and I also found the customer service team to be patient And helpful……. Notify me of follow-up comments by email. All Rights Reserved. Found it quite easy to use……growing and improving Reply. Kathleen Elkins an hour ago. Fees 9. Whether it is a bad investment is the big question. I maintain the account on behalf of a company, what are my obligations? Thresholds change based on your marital status and where you live. Coinbase Custody operates as a standalone; independently-capitalized business to Coinbase Inc. You sold bitcoin for cash and used cash to buy a home. Cynthia Nadolny October 30, at 4: The Coinbase Card app enables customers to access their accounts on the go, and select which of their crypto wallets they will use to fund their card spending. Have fun! Recently, Coinbase announced the acquisition of Paradex which is a decentralized exchange for Ethereum ERC tokens, they are hoping to integrate some of this into their offerings and make a wide range of tokens tradeable on their Coinbase Pro platform. This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. So sorry, you have to sit and watch your perfect buy moment slip away in another exchange because your money is being held hostage on Coinbase. Share Tweet Send Share.

More details can be found in the FREE guide. Megan Leonhardt an hour ago. Form Who needs to file Form ? To preface my review, a brief summary of my profile and usage: The Coinbase Wallet is a user controlled digitalcash vs bitcoin exchange circle bitcoin why cant i send to coinbase digital currency wallet and decentralized app dApp browser. Expect long delays in getting access to your funds and frequent headaches even getting on line to their site. How much money Americans think you need to can you still make money in bitcoin mining 2019 litecoin core private key barcode considered 'wealthy'. Cynthia Nadolny October 30, at 4: Custody services are a way for large financial organizations to securely deposit their assets in a way that is insured. We use cookies to give you the best online experience. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Found it quite easy to use……growing and improving Reply. My phone died while traveling. Notify me of new posts by email.

Kathleen Elkins. Gox ,. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Get Make It newsletters delivered to your inbox. And the capital gains ruling is not the only crypto-complication. Guilty as charged. Trending Now. Please subscribe to the browser alert to be notified. Penelope Woollford October 5, at 7: Comments on the post were a mixture of pragmatic and grim. Sorry if my comment may come off rude, but I ve been seaeching for a step by step guide to getting my coinbase set up and everywhere i go i get the same thing like with your review a lot of words…! In , the IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. When it comes to storage of funds, Coinbase is transparent about its methods. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. But shifting responsibility back from the individual back to institutions like Coinbase naturally presumes that information held by crypto-brokers is accurate to begin with.