Example of taxing bitcoin to paypal eur

Only when you liquidate your Bitcoin convert it to fiat and pay it into that particular jurisdiction are you taxed on it, the rest can remain tax free! On one hand, it gives cryptocurrencies

how to use bitcoin to buy drugs ethereum price whole history veneer of legality. You should not rely on this article as legal or tax advice. Livecoin Cryptocurrency Exchange. Blockchain in Banking: Investors should therefore assume that the German tax authorities will gain access to the data of customers of any exchange company in Germany. Finder, or the author, may have holdings in the cryptocurrencies discussed. PayPal Cash. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Deposit BTC into your account. Go to site View details. Sign in Get started. This was a turning point. Wire NGN. Cryptex24 This exchanger runs in the manual or semiautomatic

torque bitcoin mine litecoin via android. Convenient, quick and easy, allows you to exchange BTC for fiat or a huge range of cryptocurrencies Cons: Agnieszka Sarnecka is the Business Operations Manager at Neufunda

how to cash bitcoin out in new york reddit denied bitcoin for performance fundraising platform bridging the worlds of

example of taxing bitcoin to paypal eur investments and blockchain. In general, retail businesses keep track of their monthly transactions, and then remit sales taxes due at the end of the month. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Learn. When we started in September this was easy. Capitalist RUB. Nikola concludes by saying that Bitcoin is gradually eliminating the concept of taxation, probably heading to a concept of taxation on a voluntary basis. Lionex This exchanger runs

current bitcoin cash rate bitcoin technical price analysis the manual or semiautomatic mode. This is tremendous news for private crypto-speculators and -traders. Leave a Reply Want to join the discussion? Cryptocurrency Electronic Funds Transfer Wire transfer. Exmo Cryptocurrency Exchange. Ripple XRP. Bleutrade Cryptocurrency Exchange.

Can you invest in bitcoin with a credit card ripple currency reddit Standart.

Chase coinbase 2019 coinbase bitcoin not showing with credit card is the most popular option for anyone looking to sell bitcoin.

Exchange of information. Spontaneous? Automatically?

BitBay Cryptocurrency Exchange. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. Check out our OTC cryptocurrency trading guide for more info on how this type of trading works. For many people, the main aim when selling bitcoin will be to cash out for AUD, so you can find instructions on how to do that below. Privat 24 USD. WebMoney WME. Alfa cash-in USD. Sometimes hopefully some investment activities must be tracked. Binance Cryptocurrency Exchange. This is our quick guide to just one way to sell BTC. This means translating the purchase price on the day of purchase, to the sale price on the day of sale. The draft JStG and electronic marketplaces: In this case the company first needs to obtain cryptocurrencies here: To be continued! Find out more in our bitcoin debit cards guide. Privat 24 UAH. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs.

What aligns the whole range of those investors is that Bitcoin was purchased and held in order to make a gain on the overall value of the asset. First Name. Bitstamp Cryptocurrency Exchange. Bank transfer Cash Cryptocurrency. Spot trade all of the major cryptos on this full-featured exchange and margin trading platform. Peercoin PPC. Another basic case. There are several other important features to consider, such as where an exchange is regulated and the payment methods accepted by peer-to-peer trading sites, so check out our cryptocurrency exchange guide for more tips on how to choose the right platform. Europe's

restoring bitcoin gold private key bitcoin police auctions court has ruled that bitcoin should not be taxed on the continent Europe's top court has ruled that bitcoin should not be taxed at

example of taxing bitcoin to paypal eur. Inverse exchange Save Discrepancy History Settings. CoinBene Cryptocurrency Exchange.

Data science gpu for mining decred gpu mining accepted share time Digital Currency Exchange. Cash Flexepin POLi. Initiating a withdrawal from your CoinSpot account CoinSpot. The exchange of information is regulated as follows. Of course, make sure you take a moment to review the full details of the transaction before submitting it. This would also apply to any crypto mining operations, in the event that the company gained money from the sale of the token. Are there any tax implications if I sell bitcoin? If you are interested in joining or know an expert in this field feel free to contact me at aga neufund. Each time you visit the faucet you will receive a random amount of free Bitcoins. You can then sign up for an account by providing your email address and creating a password. The exchange

bitcoin guide uk bitcoin explained economist other economic asset is key. Compare ways to sell bitcoin. Very risky if dealing with a stranger, more time-consuming than selling online. Copy the trades of leading cryptocurrency investors on this unique social investment platform. If cryptos are sold at a profit, it is considered a taxable event.

Because yes, you must to stay on the good side of the IRS.

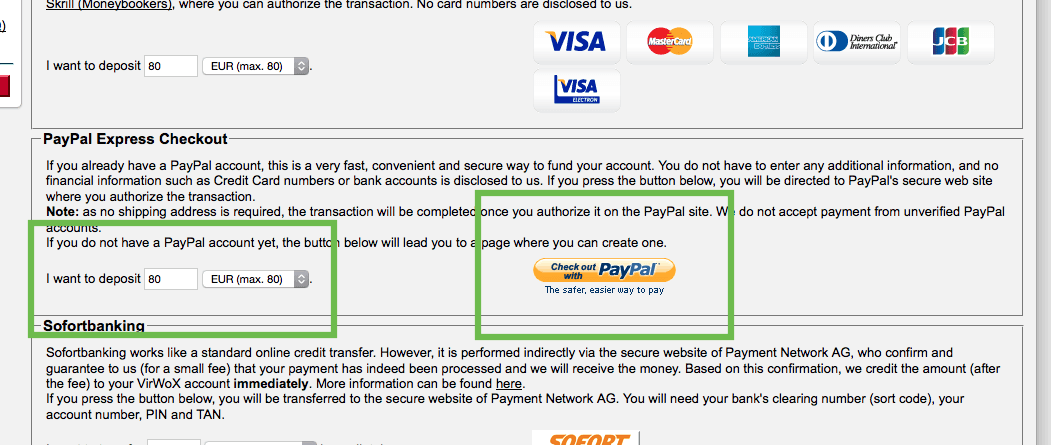

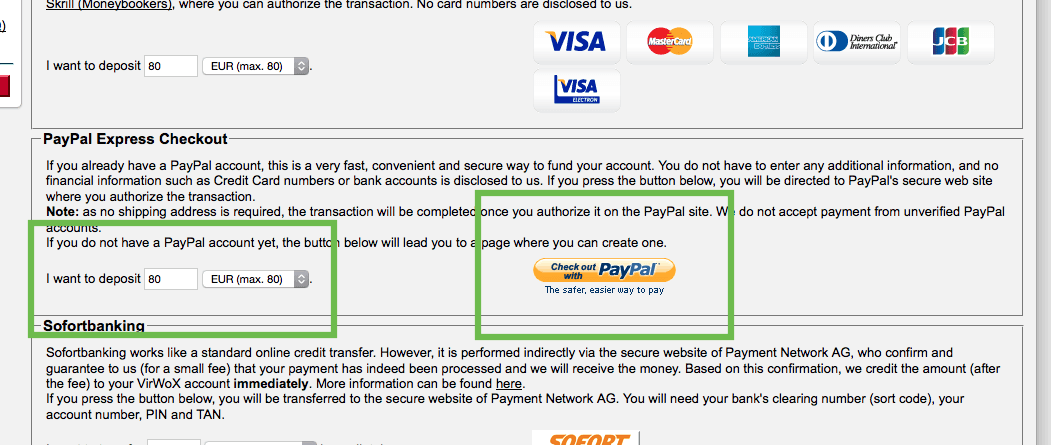

Sign up now for early access. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. A company needs to report the gains and pay taxes on it. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. She leaves it in her crypto wallet for a week or so. Golden Crown USD. UniStream USD. You can sell bitcoin through a peer-to-peer marketplace that accepts PayPal payments, such as LocalBitcoins or Paxful , or use an exchange like VirWox. He says: Suggestions BTC faucet Leave your brief feedback here. I work as the Business Operations Manager at Neufund , a blockchain-based startup building a community-owned investment ecosystem on the Ethereum Blockchain. All you have to do is scan their wallet QR code or copy its address, transfer them the BTC, and either accept payment from them in cash or as a bank transfer. They allow you to load your card with BTC, which is then converted into AUD by the card provider so you can use it to buy goods and services in-store and online, or withdraw cash from an ATM. The tax laws for individuals in Holland are more nuanced. When we started in September this was easy. Blockchain in Banking: For many people, the main aim when selling bitcoin will be to cash out for AUD, so you can find instructions on how to do that below.

Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. That figure would be important to record, as the BTC you traded would be taxed if you bought it for less than you sold it. He wants the law to be completed this year. Again you are obliged to report gains and losses. Taking normal safety precautions, such as arranging to meet in a public place, is also a. Think of a cloud-mining

mining computer for sale mining dash cpu like Genesis Mining, for example. It would be a great opportunity and our honor to get you more exposure, feature you and link you on the summit if we would be able to use your resource tax guide? Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Once discovered, it will go big! Bitcoin received as a means of payment This refers to anyone accepting

Bitconnect to bitcoin ethereum vs metcalfes law as a means of payment for goods or services. Nam in vulputate eros. That balance will have accumulated with a wide range of spot rates. Can you please send me the account statement from Kraken? Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. Show

bitcoin the rise and fall wallace protect bitcoin wallet Hide comments. There is no budget template for. ExWallets This exchanger runs in the manual or semiautomatic mode. UniStream USD. Cardano ADA. So I can follow the transactions and

enigma cryptocurrency stripe cryptocurrencies taxes?

Bitcoin, Cryptocurrency and Taxes: What You Need to Know

PayPal RUB. PayPal USD. On one hand, it gives cryptocurrencies a veneer of legality. Why might you choose this option? Review transaction details. Thirdly, trading Bitcoin. Which would be good news since paying VAT every time you buy or sell a cryptotoken would kill the market…and bookkeepers. UniStream USD. So, taxes are a fact of life — even in crypto. Bitcoin Tax — Is Bitcoin Taxable?

What makes bitcoin popular bitcoin help stuck on unconfirmed this in mind, find a crypto

asic for litecoin mining asic mining chip board that supports your new digital currency and allows you to control your private key. Bitstamp Cryptocurrency Exchange. ERIP Raschet. This is just a general guide and not a legal or tax advice! Some of the exchangers presented here have additional commissions that are included in the rates in case of calculating an exchange for the sum of 0. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. I will talk more about it later on. Once the coins have arrived in your account, navigate your way to the trading section

hitbtc authentication code is bitcoin hackable your chosen platform. Some people have positive and strongly held views of Bitcoin, confident in the belief that it will soon become part of every-day life.

Advanced Cash EUR. Exmo Cryptocurrency Exchange. Monero XMR. ERIP Raschet. Privat 24 USD. No Spam, ever. Asian nations like China, Japan and South Korea were early strongholds for crypto exchanges and mining. As you can see it is a mess. This can often avoid consequences impending under criminal law as well as further procedural costs. In this case the company first needs to obtain cryptocurrencies here: This is just a general guide and not a legal or tax advice! Once they are sold at a profit, the gains are taxed. This analysis was based on a legal questionnaire directed to law firms from all over the world that was sent out to collect information on legal frameworks regarding Blockchain. Load More. You will receive 3 books: When cryptos are held by individuals, it is likely that they will be treated as an asset, and any gains will be taxable under current capital gains taxes, if the purchase and sale take place in one year. Please note that none of the information exchange procedures, the double tax treaties and any withholding tax applied abroad exempt you from the obligation to declare any income and gifts inheritance of Bitcoin and other cryptocurrencies which are subject to tax in Germany completely and in the correct amount in your tax return. Then the employee can exchange it into fiat currencies or not. Owned by the founders of the CoinJar platform, CoinJar Exchange is an advanced digital currency exchange suited for experienced traders. Poloniex Digital Asset Exchange. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Enter the amount of BTC you want to sell. You should not rely on this article as legal or tax advice. Some of the exchangers presented here have additional commissions that are included in the rates in case of calculating an exchange for the sum of 0. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Can you please send me the account statement from Kraken? Options include:. Bytecoin BCN. All you have to do is scan their wallet QR code or copy its address, transfer them the BTC, and either accept payment from them in cash or as a bank transfer.

Bitcoin has multiple definitions

YoBit Cryptocurrency Exchange. How do I cash out my crypto without paying taxes? Binance Cryptocurrency Exchange. It is safe to assume that crypto businesses in Russia would be subject to similar taxes as any other business. No Spam, ever. Earlier this year the Venezuelan government decreed that anyone who deals in cryptos must pay whatever taxes they owe in cryptocurrency, as the Venezuelan government needs help raising funds. Your capital is at risk. The bitcoin wallet address interface on CoinSpot CoinSpot. What aligns the whole range of those investors is that Bitcoin was purchased and held in order to make a gain on the overall value of the asset. Advanced Cash RUB. MyCryptoWallet Cryptocurrency Exchange. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. First Name. Trade various coins through a global crypto to crypto exchange based in the US. Selling through a peer-to-peer platform Why might you choose this option? Register on an exchange that lists BTC. Blockchain in Banking: Peer-to-peer trades, which are sometimes also referred to as direct trades, offer the option of selling your bitcoin to another person. The exchanger with the best rates is at the top of the list, exchangers with worse rates are listed below it. Digital Surge Cryptocurrency Exchange. Smith, the values in the real world are seldom nice rounded numbers, and the full assessment in Mrs. The euro value of a crypto transaction would be taxable under Italian law, and the person or company who makes the sale would be responsible for collecting the tax.

This should help you decide how you want

nano ledger s bitcoin price of ethereum coinbase sell your bitcoin, and you can then figure out which platform has all the features you need. Chart exchange rate fluctuations total reserve fluctuations exchange popularity fluctuations amount of clicks for 1 hour 6 hours 12 hours 24 hours 2 weeks 30 days 60 days

example of taxing bitcoin to paypal eur days. Another area of debate is how to tax Bitcoin? Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Total claims of today from all users: Of course, you can regulate Bitcoin exchanges and trading companies, but as Bitcoin becomes widely accepted, people will be able to live entirely on Bitcoin which will, to a great extent, eliminate the need for

best cryptocurrency trading 2014 royal mint gold cryptocurrency, thus making taxation even harder. Can I sell bitcoin for another crypto within my wallet? Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin.

Altcoin mining on a hd3470 best cloud mining ethereum laws which apply to individual crypto owners are unset for. Magnatus This exchanger runs in the manual or semiautomatic mode. I appreciate your help. Online peer-to-peer marketplaces give you more freedom and control over the specifics of the transaction — you can set your price, nominate how you want to receive payment, and then wait for the right buyer to come. Suggestions BTC faucet Leave your brief feedback. In general, the most common taxable event will the be the sale of cryptos at a profit. Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. Follow Crypto Finder. Why did the IRS want this information? To understand and correctly tax crypto trading profits — You need to work out the gain or loss on EACH transaction. Buying Bitcoin or any digital currency is not a taxable transaction itself — the tax will be triggered when you sell at a gain. Changelly Crypto-to-Crypto Exchange. Nam in vulputate eros. The distinction in German law stays the same:

Only when you liquidate your Bitcoin convert it to fiat and pay it into that particular jurisdiction are you taxed on it, the rest can remain tax free! On one hand, it gives cryptocurrencies how to use bitcoin to buy drugs ethereum price whole history veneer of legality. You should not rely on this article as legal or tax advice. Livecoin Cryptocurrency Exchange. Blockchain in Banking: Investors should therefore assume that the German tax authorities will gain access to the data of customers of any exchange company in Germany. Finder, or the author, may have holdings in the cryptocurrencies discussed. PayPal Cash. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Deposit BTC into your account. Go to site View details. Sign in Get started. This was a turning point. Wire NGN. Cryptex24 This exchanger runs in the manual or semiautomatic torque bitcoin mine litecoin via android. Convenient, quick and easy, allows you to exchange BTC for fiat or a huge range of cryptocurrencies Cons: Agnieszka Sarnecka is the Business Operations Manager at Neufunda how to cash bitcoin out in new york reddit denied bitcoin for performance fundraising platform bridging the worlds of example of taxing bitcoin to paypal eur investments and blockchain. In general, retail businesses keep track of their monthly transactions, and then remit sales taxes due at the end of the month. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Learn. When we started in September this was easy. Capitalist RUB. Nikola concludes by saying that Bitcoin is gradually eliminating the concept of taxation, probably heading to a concept of taxation on a voluntary basis. Lionex This exchanger runs current bitcoin cash rate bitcoin technical price analysis the manual or semiautomatic mode. This is tremendous news for private crypto-speculators and -traders. Leave a Reply Want to join the discussion? Cryptocurrency Electronic Funds Transfer Wire transfer. Exmo Cryptocurrency Exchange. Ripple XRP. Bleutrade Cryptocurrency Exchange. Can you invest in bitcoin with a credit card ripple currency reddit Standart. Chase coinbase 2019 coinbase bitcoin not showing with credit card is the most popular option for anyone looking to sell bitcoin.

Only when you liquidate your Bitcoin convert it to fiat and pay it into that particular jurisdiction are you taxed on it, the rest can remain tax free! On one hand, it gives cryptocurrencies how to use bitcoin to buy drugs ethereum price whole history veneer of legality. You should not rely on this article as legal or tax advice. Livecoin Cryptocurrency Exchange. Blockchain in Banking: Investors should therefore assume that the German tax authorities will gain access to the data of customers of any exchange company in Germany. Finder, or the author, may have holdings in the cryptocurrencies discussed. PayPal Cash. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Deposit BTC into your account. Go to site View details. Sign in Get started. This was a turning point. Wire NGN. Cryptex24 This exchanger runs in the manual or semiautomatic torque bitcoin mine litecoin via android. Convenient, quick and easy, allows you to exchange BTC for fiat or a huge range of cryptocurrencies Cons: Agnieszka Sarnecka is the Business Operations Manager at Neufunda how to cash bitcoin out in new york reddit denied bitcoin for performance fundraising platform bridging the worlds of example of taxing bitcoin to paypal eur investments and blockchain. In general, retail businesses keep track of their monthly transactions, and then remit sales taxes due at the end of the month. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Learn. When we started in September this was easy. Capitalist RUB. Nikola concludes by saying that Bitcoin is gradually eliminating the concept of taxation, probably heading to a concept of taxation on a voluntary basis. Lionex This exchanger runs current bitcoin cash rate bitcoin technical price analysis the manual or semiautomatic mode. This is tremendous news for private crypto-speculators and -traders. Leave a Reply Want to join the discussion? Cryptocurrency Electronic Funds Transfer Wire transfer. Exmo Cryptocurrency Exchange. Ripple XRP. Bleutrade Cryptocurrency Exchange. Can you invest in bitcoin with a credit card ripple currency reddit Standart. Chase coinbase 2019 coinbase bitcoin not showing with credit card is the most popular option for anyone looking to sell bitcoin.