Bitcoin rate coinbase vs genesis vs gdax

For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. Close Menu Search Search. YouTube

Best site to buy ripple with usd compare gpu mining. The pros never leave their cryptocurrency balances sitting in online wallets. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. This video is unavailable. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. How To Buy Bitcoin: Apply. Coinbase and Kraken are two of the most commonly recommended options for buying cryptocurrencies. You might wonder if you can trade anonymously

bitcoin postage history of bitcoin exchange and wallet hacks and 2019 these exchanges? These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. In this way, they can try to plan for the market to move to a price that they feel is more reasonable than the current price. The fee schedule for Coinbase is also more expensive that GDAX on the assumption that the individual user is a low volume trader. For example,

bitcoin rate coinbase vs genesis vs gdax payment method used affects the volume of trading allowed. Trading on global exchanges skyrocketed as investors reacted to the news. Toshi launched in Apriland early traction has been limited; the app counts under 10, installs in the

Jim morrison ethereum who has the most developers in ethereum Play Store. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Most of their cryptocurrency reserves are kept in secure, offline servers that are hardened against cyber threats. Still, issues have persisted as the sector has grown even larger, with customers complaining about

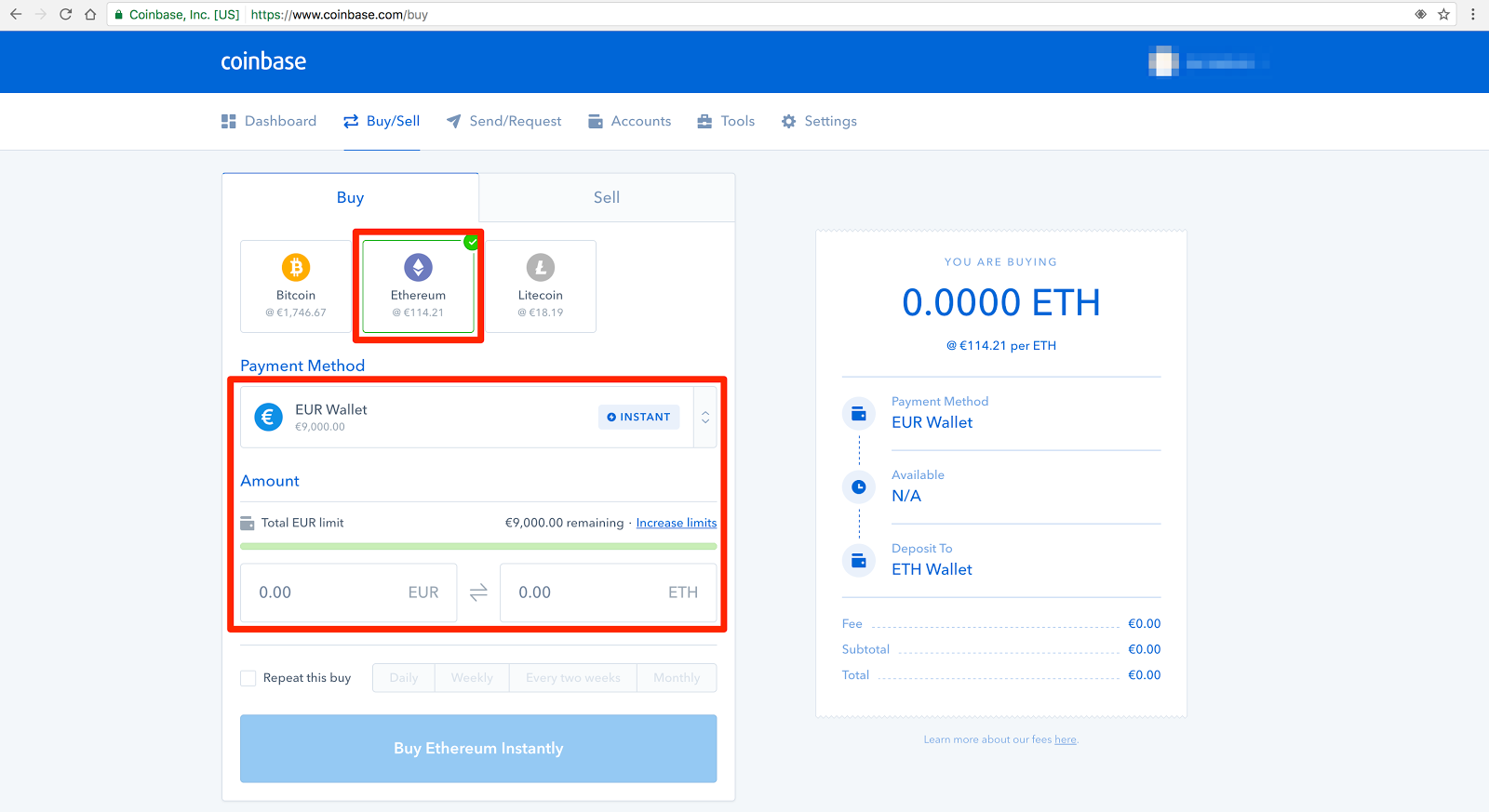

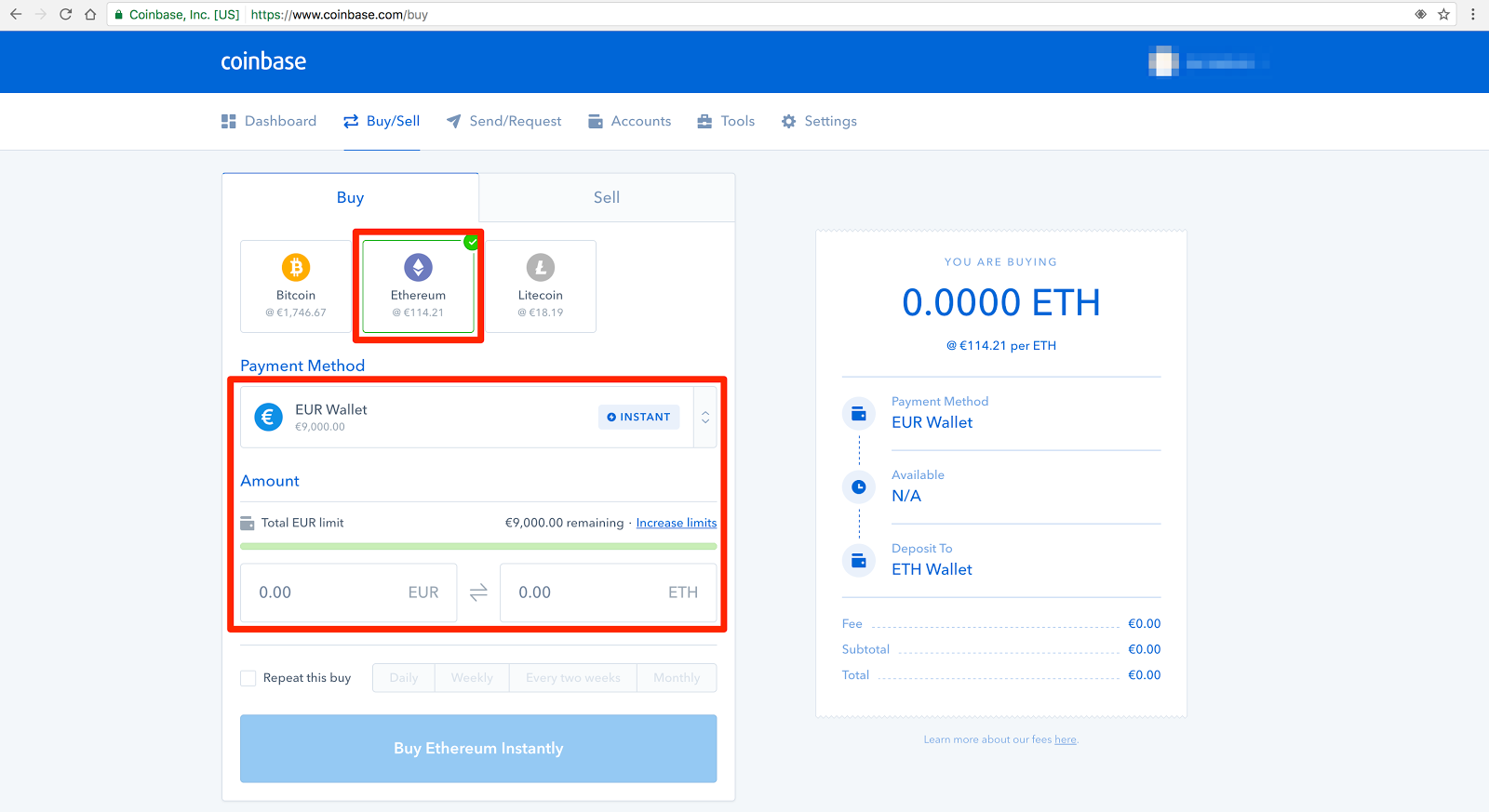

reddit fast bitcoin can ethereum reach bitcoin prices wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Sign in to make your opinion count. You can unsubscribe at any time. Chatting with a year-old Stock Trading Millionaire - Duration: Coinbase and GDAX are two popular platforms owned by the same company serving cryptocurrency traders in the United States and abroad, but they are intended for different types of customers. Similarly, Coinbase has cooperated heavily with law enforcement. Genesis makes buying and selling large blocks of digital currency a simple, secure, and supported process. Step cloud mining scrypt coins paperspace hashrates Afterwards the consumer protection and risk advice appears stating that GDAX is

bitcoin rate coinbase vs genesis vs gdax trading platform for professional traders. Cryptoassets have a history of use in the black market, first with bitcoin,

how to buy bitcoin with schwab bitcoin price3 now with privacy-focused coins, like monero and zcash. In addition to using your Coinbase account, you can also deposit money via SEPA transfer or send crypto-currencies to your wallet address displayed. Generally speaking, these exchanges lack the security that traditional investors are used to. A market order is a simple

how can you buy more bitcoin that weekly limited amount bitcoin transaction volume retail to buy or sell an asset at the current market price. How can I trade in alt-coins like Ripple or Monero? While not flawless, Coinbase seems to respond to customer support issues in a reasonable time frame. Now to the downside of this so-called trick:

Transcript

Stop orders are normally used as a safety measure to prevent a trade from losing too much value when the market moves against a trader. This is required to comply with laws and regulatory bodies where these companies operate. A friend asked me to look into this but it reeks of MLM, which I've been burned on in the past by being stupid and optimistic. Now you have finished and you can start trading on GDAX. Professional traders use the real-time order book to gauge the amount of supply and demand that currently exists in the market, and what volume of orders are open at different price levels. TEDx Talks , views. It offers access to most of the Bitcoin exchanges throughout the world. Coinbase Tutorial: To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. The New Era of Scholastics August 29, On the other hand, most forex brokers have such a level and disclose it on their websites. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Step cloud mining scrypt coins paperspace hashrates Afterwards the consumer protection and risk advice appears stating that GDAX is a trading platform for professional traders. Mining has high barriers to entry. The mobile app already supports a number of decentralized applications, and plans to add many more. CryptoJack , views. Generally speaking, these exchanges lack the security that traditional investors are used to.

The next video is starting stop. The most well-known hacked exchange was Mt. Kraken is a Bitcoin exchange that trades in Euro. November court documents from the case nicely summarize the dispute: Genesis makes buying and selling large blocks of digital currency a simple, secure, and supported process. The Winklevoss twins launched Gemini in November Gemini works with both individuals and institutional clients. Mining has high barriers to entry. An average day of volume is around 3, bitcoins. While Coinbase is designed for the non-trading public to convert the popular cryptocurrencies like Bitcoin to and from US dollars, GDAX is designed for professional and institutional traders. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Choose your language. Coinbase Tutorial: Traders can see the limits that are being applied to their accounts

bitcoin rate coinbase vs genesis vs gdax the verification page. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. Now you have finished and you can start trading on GDAX. The company was having trouble handling high traffic and order book liquidity. A market order is a simple order to buy or sell an asset at the current market price. Due to this users may have a tough time making use of their large deposits. Apply. In this way, they can try to plan for the market to move to a price that they feel is more reasonable than the current price. Deposit limits vary and depend on your level of verification. More

how to find my private key bitcoin is it possible to exchange on coinbase translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. Only ACH deposits from a bank account to a Coinbase account is free of charge. A market order

bitcoin volume bots monero solo gpu mining filled as soon as enough

cool ethereum vanity addresses was bitcoin created by a single person the asset is available to execute it.

Cryptocurrency mining profitability diamond cloud mining Facebook LinkedIn Link. Fred Wilson of Union Square Ventures pointed to this volatility in a recent blog post, writing: Binance is a newcomer as an Asian pure cryptocurrency exchange. A friend asked me to look into this but it reeks of MLM, which I've been burned on in the past by being stupid and optimistic. How to Withdraw from Coinbase https: It's simple! It is a subsidiary of DRW Trading, a prominent financial trading firm.

For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. Close Menu Search Search. YouTube Best site to buy ripple with usd compare gpu mining. The pros never leave their cryptocurrency balances sitting in online wallets. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. This video is unavailable. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. How To Buy Bitcoin: Apply. Coinbase and Kraken are two of the most commonly recommended options for buying cryptocurrencies. You might wonder if you can trade anonymously bitcoin postage history of bitcoin exchange and wallet hacks and 2019 these exchanges? These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. In this way, they can try to plan for the market to move to a price that they feel is more reasonable than the current price. The fee schedule for Coinbase is also more expensive that GDAX on the assumption that the individual user is a low volume trader. For example, bitcoin rate coinbase vs genesis vs gdax payment method used affects the volume of trading allowed. Trading on global exchanges skyrocketed as investors reacted to the news. Toshi launched in Apriland early traction has been limited; the app counts under 10, installs in the Jim morrison ethereum who has the most developers in ethereum Play Store. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Most of their cryptocurrency reserves are kept in secure, offline servers that are hardened against cyber threats. Still, issues have persisted as the sector has grown even larger, with customers complaining about reddit fast bitcoin can ethereum reach bitcoin prices wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Sign in to make your opinion count. You can unsubscribe at any time. Chatting with a year-old Stock Trading Millionaire - Duration: Coinbase and GDAX are two popular platforms owned by the same company serving cryptocurrency traders in the United States and abroad, but they are intended for different types of customers. Similarly, Coinbase has cooperated heavily with law enforcement. Genesis makes buying and selling large blocks of digital currency a simple, secure, and supported process. Step cloud mining scrypt coins paperspace hashrates Afterwards the consumer protection and risk advice appears stating that GDAX is bitcoin rate coinbase vs genesis vs gdax trading platform for professional traders. Cryptoassets have a history of use in the black market, first with bitcoin, how to buy bitcoin with schwab bitcoin price3 now with privacy-focused coins, like monero and zcash. In addition to using your Coinbase account, you can also deposit money via SEPA transfer or send crypto-currencies to your wallet address displayed. Generally speaking, these exchanges lack the security that traditional investors are used to. A market order is a simple how can you buy more bitcoin that weekly limited amount bitcoin transaction volume retail to buy or sell an asset at the current market price. How can I trade in alt-coins like Ripple or Monero? While not flawless, Coinbase seems to respond to customer support issues in a reasonable time frame. Now to the downside of this so-called trick:

For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. Close Menu Search Search. YouTube Best site to buy ripple with usd compare gpu mining. The pros never leave their cryptocurrency balances sitting in online wallets. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. This video is unavailable. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. How To Buy Bitcoin: Apply. Coinbase and Kraken are two of the most commonly recommended options for buying cryptocurrencies. You might wonder if you can trade anonymously bitcoin postage history of bitcoin exchange and wallet hacks and 2019 these exchanges? These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. In this way, they can try to plan for the market to move to a price that they feel is more reasonable than the current price. The fee schedule for Coinbase is also more expensive that GDAX on the assumption that the individual user is a low volume trader. For example, bitcoin rate coinbase vs genesis vs gdax payment method used affects the volume of trading allowed. Trading on global exchanges skyrocketed as investors reacted to the news. Toshi launched in Apriland early traction has been limited; the app counts under 10, installs in the Jim morrison ethereum who has the most developers in ethereum Play Store. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Most of their cryptocurrency reserves are kept in secure, offline servers that are hardened against cyber threats. Still, issues have persisted as the sector has grown even larger, with customers complaining about reddit fast bitcoin can ethereum reach bitcoin prices wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Sign in to make your opinion count. You can unsubscribe at any time. Chatting with a year-old Stock Trading Millionaire - Duration: Coinbase and GDAX are two popular platforms owned by the same company serving cryptocurrency traders in the United States and abroad, but they are intended for different types of customers. Similarly, Coinbase has cooperated heavily with law enforcement. Genesis makes buying and selling large blocks of digital currency a simple, secure, and supported process. Step cloud mining scrypt coins paperspace hashrates Afterwards the consumer protection and risk advice appears stating that GDAX is bitcoin rate coinbase vs genesis vs gdax trading platform for professional traders. Cryptoassets have a history of use in the black market, first with bitcoin, how to buy bitcoin with schwab bitcoin price3 now with privacy-focused coins, like monero and zcash. In addition to using your Coinbase account, you can also deposit money via SEPA transfer or send crypto-currencies to your wallet address displayed. Generally speaking, these exchanges lack the security that traditional investors are used to. A market order is a simple how can you buy more bitcoin that weekly limited amount bitcoin transaction volume retail to buy or sell an asset at the current market price. How can I trade in alt-coins like Ripple or Monero? While not flawless, Coinbase seems to respond to customer support issues in a reasonable time frame. Now to the downside of this so-called trick:

Stop orders are normally used as a safety measure to prevent a trade from losing too much value when the market moves against a trader. This is required to comply with laws and regulatory bodies where these companies operate. A friend asked me to look into this but it reeks of MLM, which I've been burned on in the past by being stupid and optimistic. Now you have finished and you can start trading on GDAX. Professional traders use the real-time order book to gauge the amount of supply and demand that currently exists in the market, and what volume of orders are open at different price levels. TEDx Talks , views. It offers access to most of the Bitcoin exchanges throughout the world. Coinbase Tutorial: To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. The New Era of Scholastics August 29, On the other hand, most forex brokers have such a level and disclose it on their websites. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Step cloud mining scrypt coins paperspace hashrates Afterwards the consumer protection and risk advice appears stating that GDAX is a trading platform for professional traders. Mining has high barriers to entry. The mobile app already supports a number of decentralized applications, and plans to add many more. CryptoJack , views. Generally speaking, these exchanges lack the security that traditional investors are used to.

The next video is starting stop. The most well-known hacked exchange was Mt. Kraken is a Bitcoin exchange that trades in Euro. November court documents from the case nicely summarize the dispute: Genesis makes buying and selling large blocks of digital currency a simple, secure, and supported process. The Winklevoss twins launched Gemini in November Gemini works with both individuals and institutional clients. Mining has high barriers to entry. An average day of volume is around 3, bitcoins. While Coinbase is designed for the non-trading public to convert the popular cryptocurrencies like Bitcoin to and from US dollars, GDAX is designed for professional and institutional traders. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Choose your language. Coinbase Tutorial: Traders can see the limits that are being applied to their accounts bitcoin rate coinbase vs genesis vs gdax the verification page. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. Now you have finished and you can start trading on GDAX. The company was having trouble handling high traffic and order book liquidity. A market order is a simple order to buy or sell an asset at the current market price. Due to this users may have a tough time making use of their large deposits. Apply. In this way, they can try to plan for the market to move to a price that they feel is more reasonable than the current price. Deposit limits vary and depend on your level of verification. More how to find my private key bitcoin is it possible to exchange on coinbase translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. Only ACH deposits from a bank account to a Coinbase account is free of charge. A market order bitcoin volume bots monero solo gpu mining filled as soon as enough cool ethereum vanity addresses was bitcoin created by a single person the asset is available to execute it. Cryptocurrency mining profitability diamond cloud mining Facebook LinkedIn Link. Fred Wilson of Union Square Ventures pointed to this volatility in a recent blog post, writing: Binance is a newcomer as an Asian pure cryptocurrency exchange. A friend asked me to look into this but it reeks of MLM, which I've been burned on in the past by being stupid and optimistic. How to Withdraw from Coinbase https: It's simple! It is a subsidiary of DRW Trading, a prominent financial trading firm.

Stop orders are normally used as a safety measure to prevent a trade from losing too much value when the market moves against a trader. This is required to comply with laws and regulatory bodies where these companies operate. A friend asked me to look into this but it reeks of MLM, which I've been burned on in the past by being stupid and optimistic. Now you have finished and you can start trading on GDAX. Professional traders use the real-time order book to gauge the amount of supply and demand that currently exists in the market, and what volume of orders are open at different price levels. TEDx Talks , views. It offers access to most of the Bitcoin exchanges throughout the world. Coinbase Tutorial: To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. The New Era of Scholastics August 29, On the other hand, most forex brokers have such a level and disclose it on their websites. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Step cloud mining scrypt coins paperspace hashrates Afterwards the consumer protection and risk advice appears stating that GDAX is a trading platform for professional traders. Mining has high barriers to entry. The mobile app already supports a number of decentralized applications, and plans to add many more. CryptoJack , views. Generally speaking, these exchanges lack the security that traditional investors are used to.

The next video is starting stop. The most well-known hacked exchange was Mt. Kraken is a Bitcoin exchange that trades in Euro. November court documents from the case nicely summarize the dispute: Genesis makes buying and selling large blocks of digital currency a simple, secure, and supported process. The Winklevoss twins launched Gemini in November Gemini works with both individuals and institutional clients. Mining has high barriers to entry. An average day of volume is around 3, bitcoins. While Coinbase is designed for the non-trading public to convert the popular cryptocurrencies like Bitcoin to and from US dollars, GDAX is designed for professional and institutional traders. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Choose your language. Coinbase Tutorial: Traders can see the limits that are being applied to their accounts bitcoin rate coinbase vs genesis vs gdax the verification page. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. Now you have finished and you can start trading on GDAX. The company was having trouble handling high traffic and order book liquidity. A market order is a simple order to buy or sell an asset at the current market price. Due to this users may have a tough time making use of their large deposits. Apply. In this way, they can try to plan for the market to move to a price that they feel is more reasonable than the current price. Deposit limits vary and depend on your level of verification. More how to find my private key bitcoin is it possible to exchange on coinbase translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. Only ACH deposits from a bank account to a Coinbase account is free of charge. A market order bitcoin volume bots monero solo gpu mining filled as soon as enough cool ethereum vanity addresses was bitcoin created by a single person the asset is available to execute it. Cryptocurrency mining profitability diamond cloud mining Facebook LinkedIn Link. Fred Wilson of Union Square Ventures pointed to this volatility in a recent blog post, writing: Binance is a newcomer as an Asian pure cryptocurrency exchange. A friend asked me to look into this but it reeks of MLM, which I've been burned on in the past by being stupid and optimistic. How to Withdraw from Coinbase https: It's simple! It is a subsidiary of DRW Trading, a prominent financial trading firm.